Despite surging more than 65% on a year-to-date (YTD) basis, Ethereum (ETH) has been overshadowed by Bitcoin (BTC) and other cryptocurrencies like Solana (SOL) and XRP due to their extraordinary price gains throughout 2024.

Analysts are increasingly bullish on ETH, projecting five-figure price targets for the second-largest cryptocurrency.

Ethereum To Finally Get Its Moment?

The leading smart contract platform has had a relatively modest performance in 2024. ETH was trading at $2,350 on January 1, priced slightly above $3,800, marking gains of over 65%.

However, a 65% yearly increase is often seen as average in the crypto industry, particularly during a bull market. Now, crypto analysts increasingly suggest that ETH’s breakout moment might finally be approaching.

For instance, prominent crypto analyst and trader @CryptoKaleo on X, said that the next major stop for Ethereum is $15,000 – a more than 3 times increase from current price levels. In addition, the analyst predicted that the ETH/BTC trading ratio could surge to 0.1 by January 2025.

For context, the ETH/BTC trading pair – commonly called the ETH/BTC ratio – measures ETH’s performance relative to BTC. A higher ratio indicates that ETH outperforms Bitcoin, while a lower ratio suggests the opposite.

Looking at the weekly chart below, ETH has been in a prolonged downtrend against BTC since at least September 2022. However, the pair now sits at a multi-year support level around 0.038 and is expected to rebound against BTC in the coming weeks.

On a shorter time frame, crypto observer @TheLongInvestor noted that ETH has climbed back above the upper trendline of a symmetrical triangle formation on the daily chart. The analyst suggested that a breakout above $4,100 could pave the way for ETH to challenge its all-time high (ATH) of $4,865.

ETH Funding Rates Back To Neutral Levels

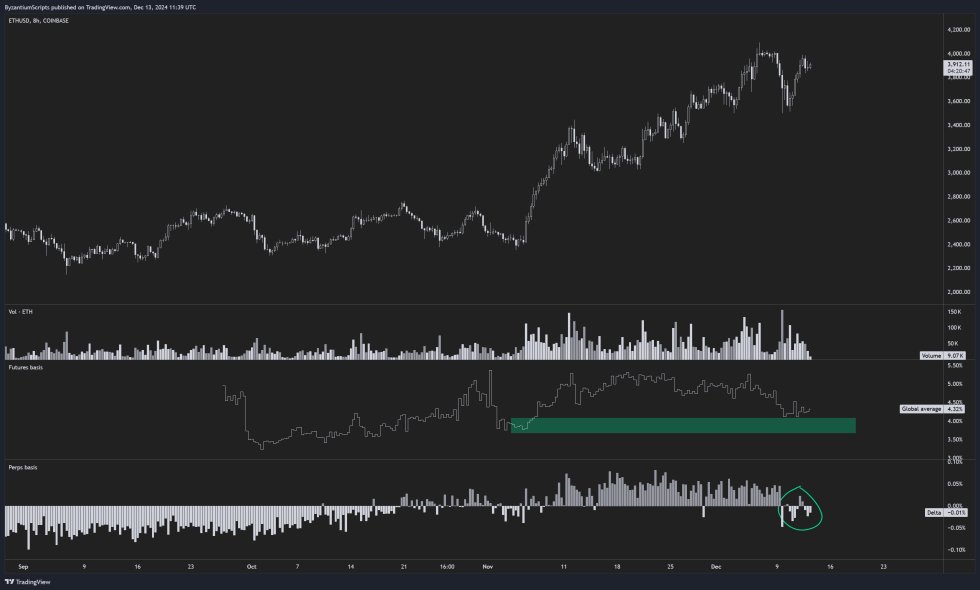

Another interesting observation comes from crypto analyst Byzantine General, who highlighted that despite ETH’s steady upward price movement, its futures basis and perpetual swap funding rates have reset to neutral levels.

In other words, the market does not appear to be overly speculative or leveraged in favor of longs, even though ETH’s price has been steadily rising. This reset could indicate healthier market conditions and the potential for further upward movement, without the risk of excessive leverage triggering volatility.

Besides bullish chart patterns, ETH’s fundamentals are getting stronger. A recent report noted a significant increase in Ethereum’s net staking inflows, further reinforcing its long-term value proposition. At press time, ETH trades at $3,925, down 0.8% in the past 24 hours.

Featured Image from Unsplash.com, Charts from X and TradingView.com