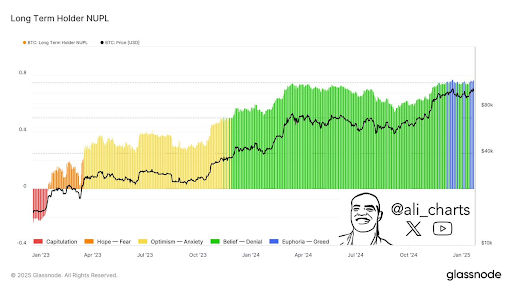

In a recent development, crypto analyst Ali Martinez revealed that Bitcoin long-term holders have officially entered greed territory. This could benefit the price in the short term, although the long-term consequences could be severe. The greed phase suggests that long-term Bitcoin holders are now excessively optimistic about BTC’s future trajectory.

Bitcoin Long-Term Holders Officially Enter Into Greed Territory

In an X post, Martinez stated that long-term Bitcoin holders, having experienced every phase of the market cycle, are now letting greed take over. In terms of market sentiment, these holders have moved from capitulation to hope, optimism, and then belief and are now in the greed phase.

Related Reading

This excessive optimism typically leads these investors to accumulate more BTC impulsively without considering rational analyses. In the short term, this greed phase is bullish for the Bitcoin price since this market sentiment could spark more buying pressure and drive the flagship crypto higher.

This buying pressure for Bitcoin already looks to be evident as on-chain analytics platform Santiment revealed that the number of wallets holding 100 to 1,000 BTC has broken an all-time high (ATH), rising to 15,777 wallets. The platform also mentioned that Bitcoin whales peaked up steam this week with the US inauguration and a new BTC ATH as transactions exceeding $100,00 surged to their highest level in six weeks.

This greed phase is good for the BTC price, as it could continue to send the flagship crypto to new highs. However, in the long term, this excessive optimism could put BTC in overbought territory, eventually sparking a massive wave of sell-offs that would send the Bitcoin price tumbling.

This greed phase among Bitcoin long-term holders looks to be sparked by optimism around Donald Trump’s pro-crypto administration and the strategic BTC reserve especially. This still poses a risk for the Bitcoin price since the flagship crypto could be trading well above its actual value if the BTC reserve isn’t eventually created.

What Needs To Happen For BTC To Stay Bullish

In another X post, Ali Martinez warned that the Bitcoin price needs to stay above $97,530 to remain bullish. According to him, this price level is the key support level to watch for BTC, as holding above it is crucial to maintaining the current bullish momentum. Bitcoin is currently consolidating around this range after hitting a new ATH of $109,000 earlier this week.

Related Reading

Meanwhile, crypto analyst Crypto Rover highlighted the $102,000 support area as the most important for the BTC price right now. His accompanying chart showed that the flagship crypto could drop to as low as $98,000 if it drops below this support level.

At the time of writing, the Bitcoin price is trading at around $104,900, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com