Ethereum’s price went through a frustrating correction at the start of the week. However, things could change soon, and a rebound might occur in the coming weeks.

Technical Analysis

By Edris Derakhshi (TradingRage)

The Daily Chart

On the daily chart, the asset has been making lower highs and lows since getting rejected from the $4,000 resistance level. The $3,500 level has also been lost and has turned into resistance.

At the moment, the market is testing the key $3,000 support level and the 200-day moving average, located around the same price mark. This is a significantly strong and critical level that could initiate a rebound for ETH. Yet, note that a breakdown could lead to catastrophic results, as it would indicate a complete bearish reversal.

The 4-Hour Chart

The 4-hour chart demonstrates an interesting picture of the recent ETH price action. During the recent decline, the asset has created a falling wedge pattern, which can be a bullish reversal pattern if it gets broken to the upside.

With the price seemingly rebounding from the $3,000 level at the moment, if a bullish breakout occurs, the market could officially begin a new rally by rising back toward the $4,000 area in the short term.

Sentiment Analysis

By Edris Derakhshi (TradingRage)

Ethereum Open Interest

While Bitcoin’s price is at a key level that could create a bottom for the entire market, relying solely on technical analysis would not necessarily yield reliable insights. As a result, analyzing the futures market sentiment could add some beneficial information about the underlying dynamics and lead to better conclusions.

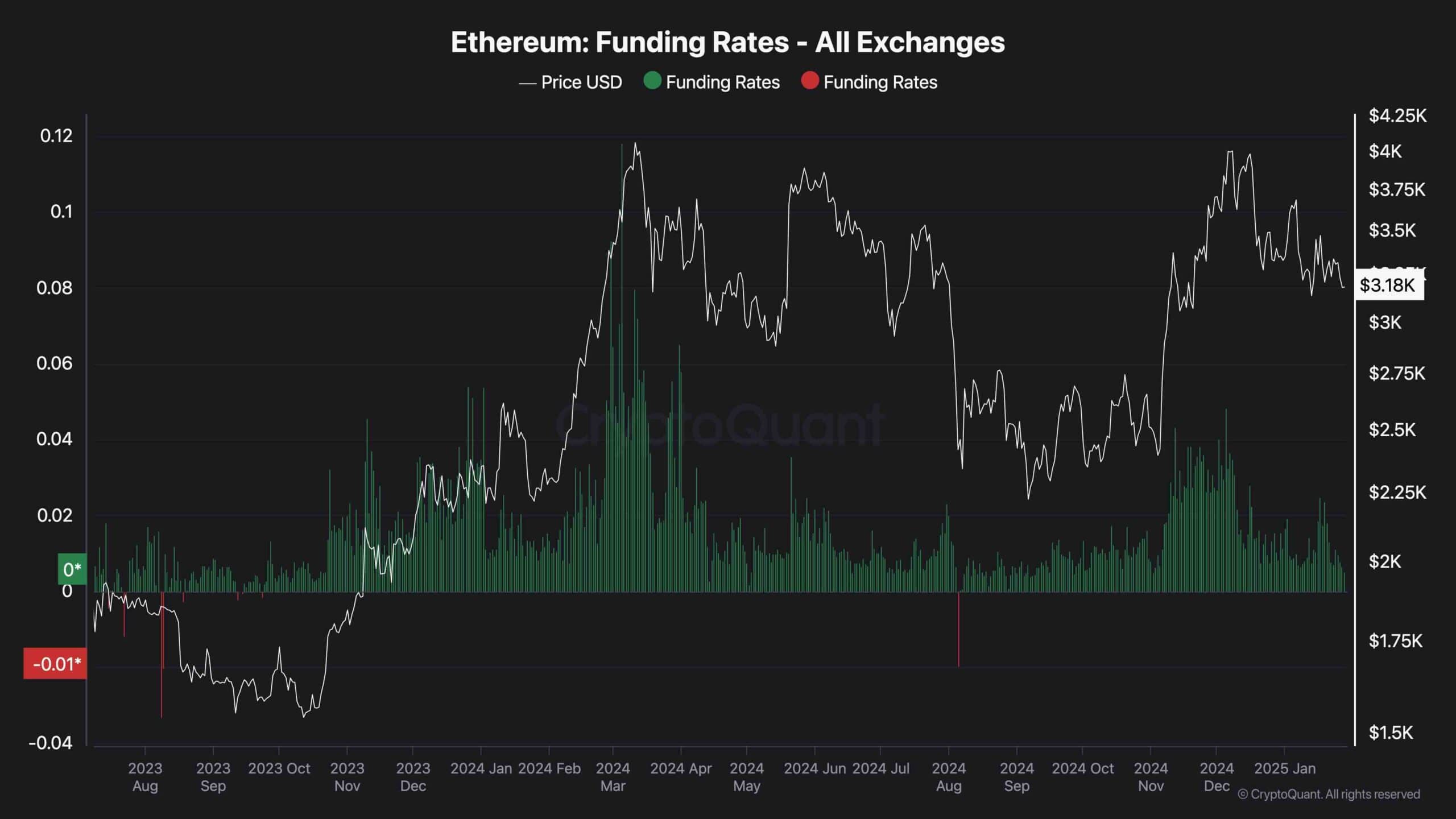

This chart presents the Ethereum funding rate metric, which measures whether the buyers or the sellers are more aggressively executing their orders on aggregate overall exchanges. Positive funding rates indicate bullish sentiment and vice versa.

It is evident that while ETH’s price has been on a gradual decline recently, the funding rates metric has also been dropping and is now far from the significantly high values seen over the last few months. This indicates that the futures market is no longer overheated, and with enough spot demand, the price can once again rally higher in the coming weeks.

The post Ethereum Price Analysis: Can ETH Finally Break Out of its Corrective Phase? appeared first on CryptoPotato.