The market behavior of Bitcoin has undergone a dramatic change as its volatility has fallen to an all-time low. This change is a sign that the market is maturing and attracting more institutional investors, who had previously avoided its volatile price fluctuations.

Bitcoin 3-Month Volatility Down To New Lows

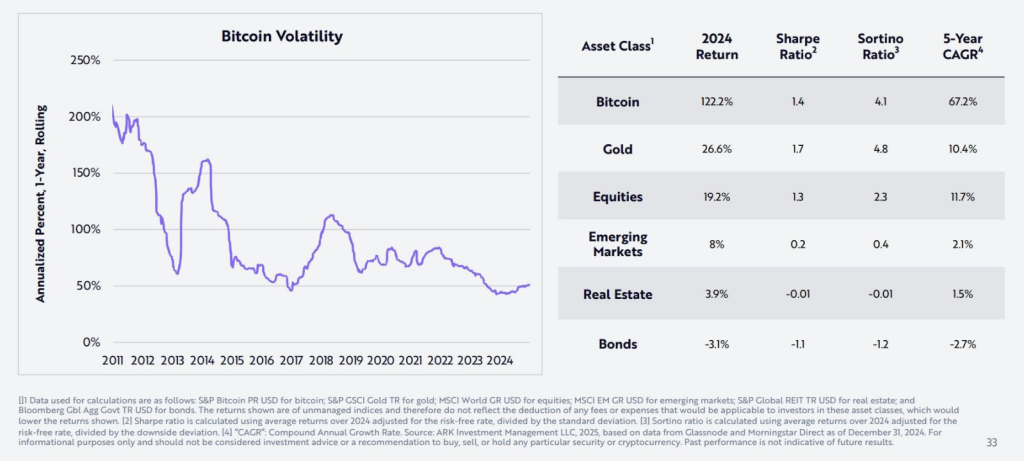

According to the most recent data from Glassnode, the cryptocurrency’s three-month realized volatility has fallen to all-time lows. The days of jaw-dropping 80–100% price swings are over. With volatility staying below 50%, Bitcoin is still moving in a fairly stable direction today. This newfound stability isn’t just a fleeting moment – it’s reshaping the entire market landscape.

Institutional Powerhouses Step Up

With a solid $40 billion in net inflows, the introduction of US spot Bitcoin ETFs has completely transformed the market. In addition to countries making calculated investments in Bitcoin, BlackRock’s iShares Bitcoin Trust (IBIT) is spearheading this institutional push.

The market’s reaction has been intriguing: rather than the typical peaks and troughs, Bitcoin now exhibits a “stair-stepping” development pattern, with price surges interspersed with consolidation periods.

The Impact Of Whales On Market Dynamics

An interesting trend can be seen in a recent data: Over a hundred new wallets containing at least 100 BTC units were added in February, whereas nearly 138,000 smaller ones suffered a decline in holdings.

This development provides important insight into the mood of the market. While newer traders who joined within the last six months are selling due to short-term market swings, large investors, commonly referred to as “whales,” are discreetly accumulating Bitcoin during price falls.

A New Era In Crypto Investing

For long-term investors, the current state of Bitcoin offers an engaging story. Even if the flagship digital asset’s price dropped by 0.10% in a day to $97,547, its risk-adjusted returns still beat those of the majority of other asset classes, latest data shows.

Bitcoin’s annual volatility fell to an all-time low, while its risk-adjusted returns remained superior to most major asset classes pic.twitter.com/pbPaSCBCzV

— unfolded. (@cryptounfolded) February 5, 2025

Analytics company Unfolded says that Bitcoin is still doing well, even though its yearly price swings have reached their lowest point ever. The mix of strong profits and lower risk makes it great for institutions to invest in, and it could lead to the next phase of Bitcoin’s growth in the financial sector.

A key change in the cryptocurrency world is how Bitcoin has transformed from a highly unpredictable investment to a more dependable option. Bitcoin might be starting to become a reliable financial asset if big investors keep putting money in and large holders continue to buy more.

Featured image from DALL-E, chart from TradingView