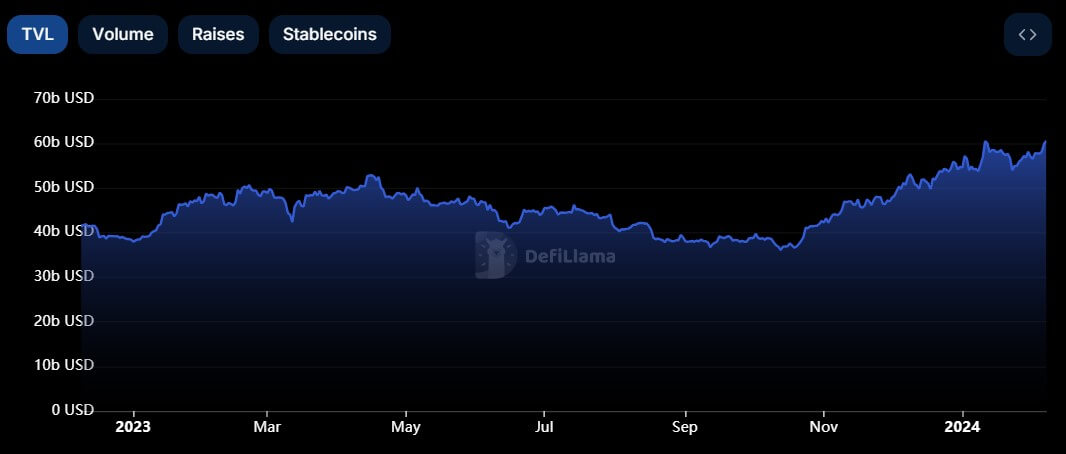

The decentralized finance (DeFi) ecosystem has hit a significant milestone as the total value of assets locked (TVL) surpassed $60 billion, marking a return to levels last seen in August 2022.

According to data from DeFiLlama, the sector surged by an impressive 68% to $60.72 billion from November 2023, when the TVL stood at around $36 billion.

The upward trajectory of a TVL signals robust investor confidence, with more users entrusting their assets to partake in decentralized financial activities.

Market analysts attribute this growth to the recent surge in crypto asset prices, fueled by buzz surrounding Bitcoin exchange-traded funds (ETFs). This rally, capturing the interest of both retail and institutional investors, propelled Bitcoin to nearly $50,000 and Ethereum, the leading DeFi blockchain network, above $2,000.

Ethereum leads

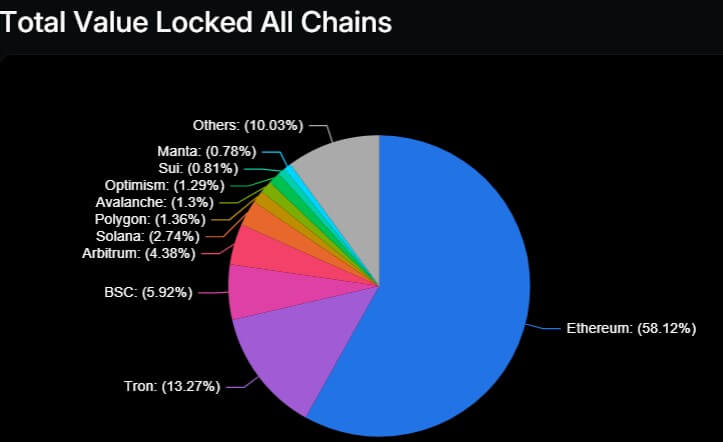

Ethereum remains the dominant force in DeFi, claiming over 58% of the market share across blockchains, boasting a TVL of $35.3 billion. Tron blockchain is second, commanding a 13% market share with a TVL of $8 billion.

Beyond Ethereum and Tron, other blockchain networks such as Solana, Binance Smart Chain, Polygon, and Arbitrum also wield considerable influence, hosting many projects and boasting substantial TVL figures.

Meanwhile, the emergence of the Sui blockchain is noteworthy as it has rapidly ascended the ranks in the DeFi space, securing a spot among the top 10 in TVL and surpassing well-established competitors like Cardano and Bitcoin.

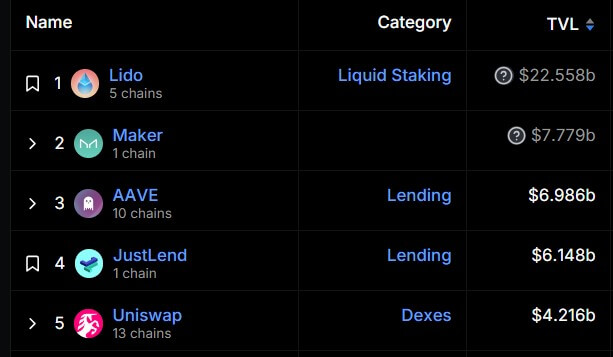

Lido dominate protocols

Lido Finance, a leading liquid staking protocol, commands a significant 37% market share, boasting a TVL of $22.58 billion.

Lido is poised to exceed 10 million ETH staked through its platform, operating across prominent blockchain networks such as Ethereum, Solana, Moonbeam, and Moonriver.

The other top five protocols include notable entities like the DAI stablecoin issuer Maker, lending platforms Aave and Justlend, and the decentralized exchange Uniswap. These protocols collectively hold TVLs of $7.7 billion, $6.98 billion, $6.14 billion, and $4.21 billion, respectively.

Trading resurgence

Concurrently, decentralized exchanges (DEXs) have experienced a surge in daily trading volumes, witnessing a 3.29% increase over the past week alone, facilitating trades worth approximately $22 billion, according to DeFillama data.

Furthermore, a Dune Analytics dashboard curated by rchen8 shows a resurgence in the sector’s user base, with more than 3 million users returning to previous highs. Over the past two months, the ecosystem has welcomed 3.6 million new addresses, pushing its total user count close to 50 million.