Ethereum exchange-traded funds (ETF) have been the talk of the town – and rightly so – after the United States Securities and Exchange Commission (SEC) approved the listing of the investment products during the week. Meanwhile, the Bitcoin spot ETF market continued its resurgence on one side, marked by a second consecutive week of positive inflows.

This streak of positive inflows represents a complete shift from previous weeks when investment activity was dangerously low. However, this recent turnaround reflects a rise in investor confidence over the past two weeks.

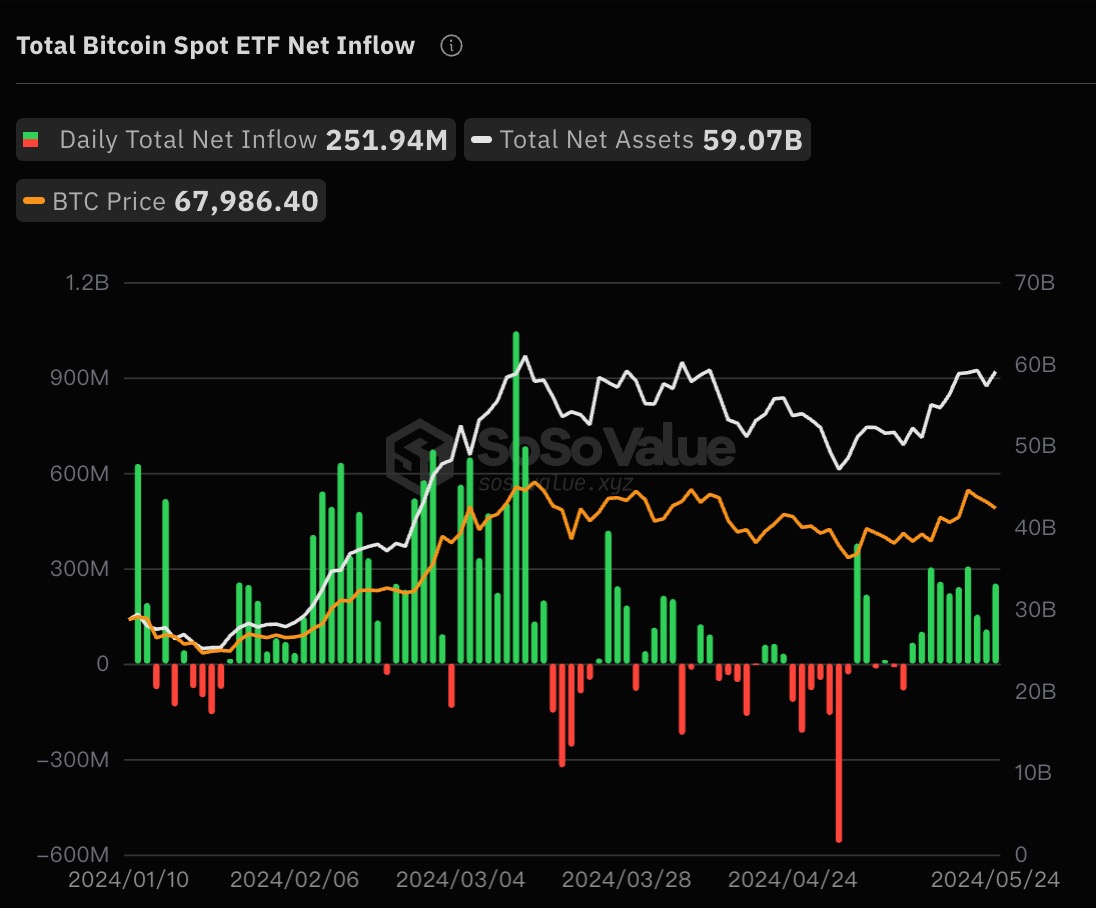

Bitcoin Spot ETF: $252 Million In Net Inflows In One Day

On Friday, May 24, the US Bitcoin spot ETF market saw another day of positive inflows, marking the 10th consecutive day of significant investment into these funds. According to data from SoSoValue, the market recorded a total net inflow of approximately $252 million to close the week.

Related Reading

Breaking this down, BlackRock amassed a substantial percentage of the total daily investment, with the IBIT ETF posting an inflow of $182 million. Grayscale Bitcoin Trust (GBTC), on the other hand, did not attract any capital on Friday, ending the week with zero daily outflows and inflow.

Other ETF issuers, such as Fidelity, Bitwise, and ARK Investment, also witnessed impressive inflows on Friday. Most notably, Fidelity’s FBTC came second to BlackRock’s fund after attracting about $43.7 million on the last day of the week.

More importantly, this positive inflow day means that the Bitcoin spot ETF market has amassed significant investment every day for the second week in a row. And after the close of Friday’s trading session, the net inflow in the past week stood at an impressive $1.06 billion.

This sustained positive trend in terms of capital inflow suggests that investor confidence in Bitcoin ETFs might be back at an all-time high. The last time there was a consistent positive capital inflow into these products, the Bitcoin price rose to a new all-time high.

With Ethereum spot ETFs on the brink of trading in the US, crypto exchange-trade products seem to be in fashion at the moment. And they might just be the catalyst that the crypto market – particularly Bitcoin – needs to resume what is left of the bull cycle.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at $68,868, reflecting a 2.5% price increase in the last 24 hours. According to data from CoinGecko, the premier cryptocurrency is up by 3% on the weekly timeframe.

Related Reading

Featured image from iStock, chart from TradingView