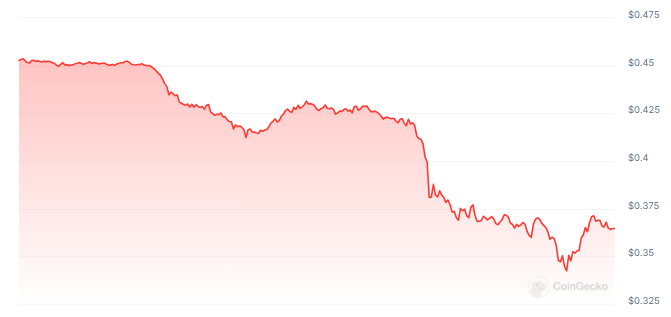

MATIC bulls fumbled the bag after the market panic that turned the correction phase into a nosedive. The latest market data shows MATIC took a beating with a 33% wipe in value since last week. Hostile market environment and macroeconomic fears continue to plague the broader financial world.

Related Reading

The crypto market was not spared. The whole market depreciated by almost 17% in the past 24 hours, marking a period of strong bearish pressure. Despite the overwhelming downward trajectory the market has taken, on-chain developments continue that might slow the bearish wave, but it will take time before the price mediates back to realistic levels.

More Developments

Polygon’s position continues to solidify as it marks several developments that improve user experience on the platform. Messari, an independent crypto research platform, recently released its report, providing an overview of the Polygon ecosystem.

In summary, the report notes several developments in the platform that occurred within the 2nd quarter of the year. Primarily, the community has reached a consensus on upgrades that will positively affect the network’s usability and performance. One of these will be the switch from MATIC to POL, which is scheduled to occur on September 4th.

To attract devs to Polygon, the platform created a $1 billion Community Grants Program (CGP), supporting devs and builders of Polygon financially. According to a June blogpost, Season 1 of the CGP will feature a 35 million MATIC pool which is roughly equivalent to $12.9 million using today’s prices.

Uniswap has also launched its Uniswap v3 campaign on Polygon with other $250k in rewards on Oku, a crypto trading platform. This will boost investor confidence in the platform as it shows that despite hostile market conditions, Polygon remains a major player in the DeFi space.

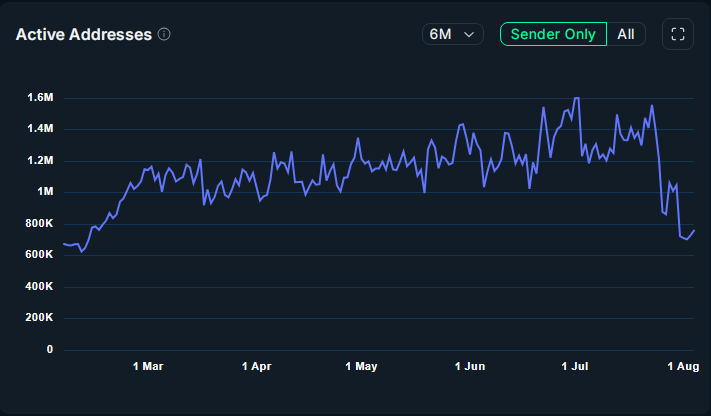

This is seen in the current metrics the platform is running on. Nansen’s data shows an increase in active addresses and transactions in the past 24 hours, a great indicator of growth activity if it wasn’t for the air of bearishness surrounding the market.

DefiLlama, on the other hand, shows the other side of the coin with major outflows on all chains under the Polygon ecosystem.

MATIC: More Pain On The Way For Investors?

As the market continues its painful descent, investors are poised to let go of their MATIC holdings. Recent market data shows that investors are rushing to exchanges to sell rather than hold and ride the bearish wave.

This can be seen in MATIC’s price which continues to test the $0.339 support level.

Related Reading

The market overreaction caused by cascading fears within the broader financial spectrum remains to threaten any future bullish action. As of the moment, MATIC is down to March 2021 levels, a new low after 2024’s early bull runs led by major cryptocurrencies like Bitcoin and Ethereum.

Investors and traders should evaluate their positions to remain in the green. If possible, they can try to take advantage of the situation by shorting the token.

Featured image from Pexels, chart from TradingView