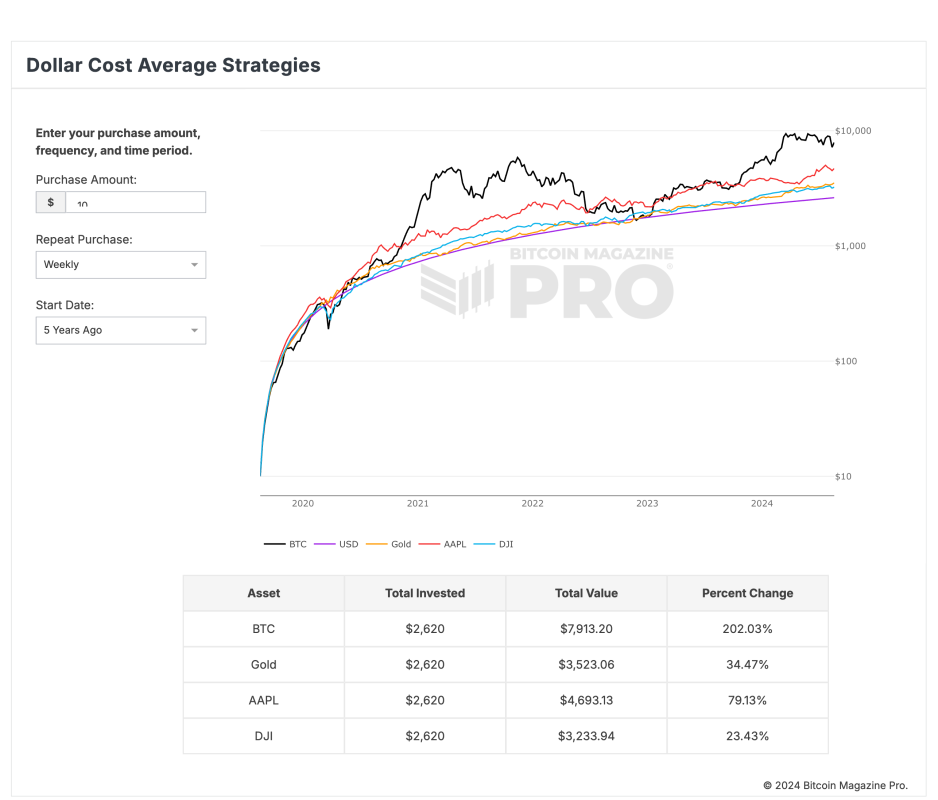

A recent analysis from Bitcoin Magazine Pro showcases the power of dollar-cost averaging (DCA) in Bitcoin compared to traditional assets like gold, Apple stock, and the Dow Jones Industrial Average (DJI). The data reveals that consistently investing $10 weekly into Bitcoin over the last five years would have grown a total investment of $2,620 into $7,913.20, reflecting a remarkable 202.03% return.

In contrast, the same $10 weekly investment in gold yielded a return of 34.47%, growing the initial $2,620 to $3,523.06. Apple stock also performed well, with a 79.13% return, turning the $2,620 investment into $4,693.13. Meanwhile, the Dow Jones provided the least return, with a 23.43% increase, growing the investment to $3,233.94.

This data underscores Bitcoin’s potential to be one of the best assets, if not the best asset, for investors to incorporate into their long-term investment strategies. The principle behind dollar-cost averaging—regularly investing a fixed amount of money regardless of price fluctuations—has proven particularly effective with Bitcoin, allowing investors to accumulate wealth over time.

Saving $10 a week into Bitcoin through Dollar Cost Averaging (DCA) offers an affordable and accessible way for newcomers to start investing in Bitcoin. This strategy is especially appealing for those who may be hesitant to invest large sums upfront or are still learning about the volatile nature of the Bitcoin market. By investing a small, fixed amount regularly, individuals can gradually build their Bitcoin holdings, reducing the impact of market fluctuations and making it easier to adopt a long-term investment mindset. This approach allows for consistent growth over time, without the pressure of trying to time the market perfectly.

The Dollar Cost Average Strategies tool from Bitcoin Magazine Pro allows users to explore various investment strategies, optimizing their Bitcoin investments across different time horizons. The tool compares Bitcoin’s performance against other assets like the US dollar, gold, Apple stock, and the Dow Jones, illustrating Bitcoin’s potential as a superior store of value in a well-rounded investment portfolio.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro’s data and analytics, visit the official website here.