Join Our Telegram channel to stay up to date on breaking news coverage

Aave price prediction shows that AAVE continues its rally as the coin spikes higher to touch the resistance level of $172.49.

Aave Price Prediction Statistics Data:

- Aave price now – $169.52

- Aave market cap – $2.52 billion

- Aave circulating supply – 14.9 million

- Aave Coinmarketcap ranking – #38

This Aave’s price has shown notable volatility, with a 24-hour range between $163.63 and $172.00. Despite its current value, the token once peaked at an all-time high of $666.86 on May 18, 2021, but is now down by 74.85%. This significant drop from its peak highlights the dynamic nature of its performance, offering potential future opportunities for those keeping a close eye on the market.

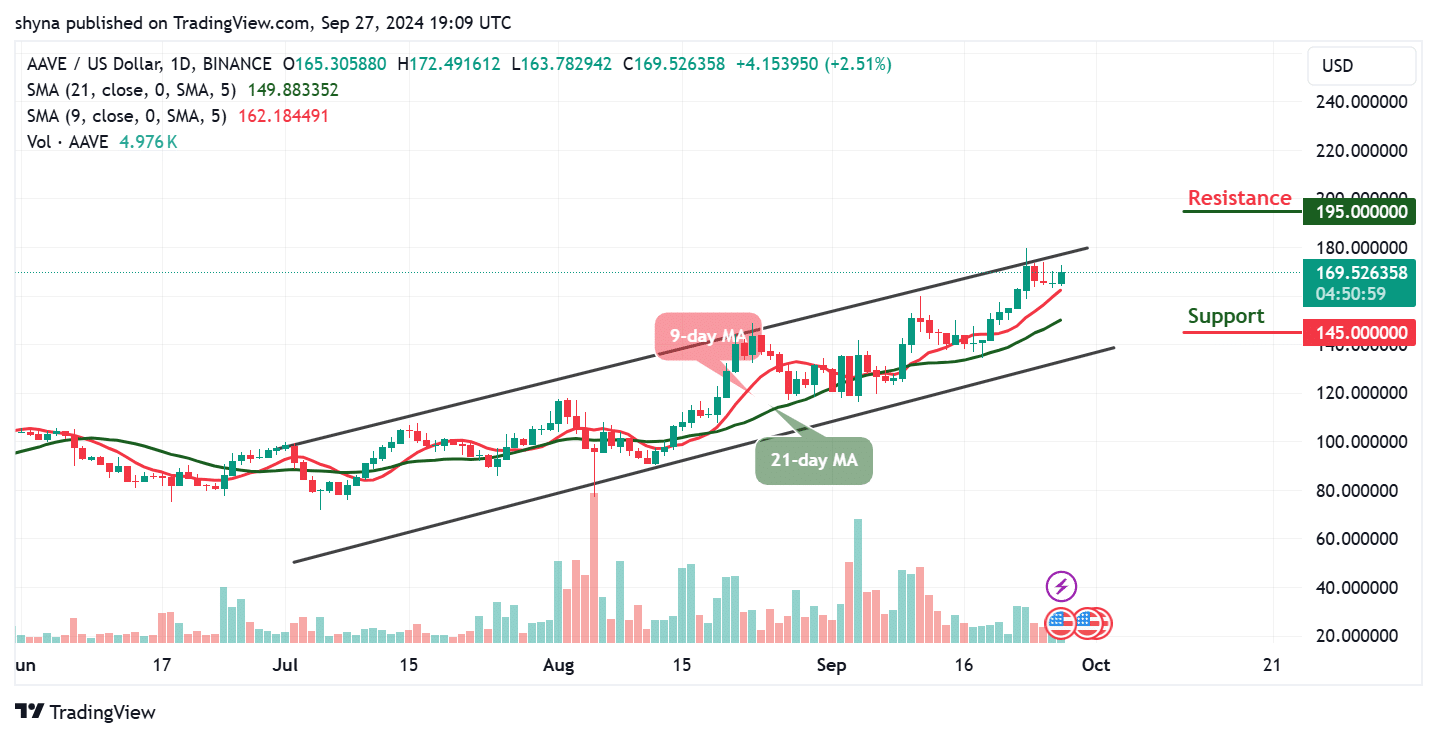

AAVE/USD Market

Key Levels:

Resistance levels: $195, $200, $205

Support levels: $145, $140, $135

AAVE/USD trades near significant resistance levels above the 9-day and 21-day moving averages. On the daily chart, Aave is approaching the upper boundary of a long-term ascending channel, a level that has previously acted as resistance multiple times. The price action suggests AAVE/USD may face a potential rejection, but its proximity to the resistance warrants close observation. Meanwhile, on the daily chart, the price has been moving near the resistance level for two consecutive days, with a recent candlestick showing rejection. Although, AAVE remains close to the threshold.

Aave Price Prediction: What to Expect from Aave

In the last few days, Aave has moved from $160 to $172 and could make a bullish cross above the upper boundary of the channel if the buyers increase the pressure. However, a significant technical development is the breakout above the moving averages. This breakout is considered a bullish signal and indicates a potential shift in AAVE’s trend direction. Meanwhile, traders are closely watching to see if a break above the channel could translate into a successful move beyond the current resistance levels.

Nonetheless, if the bulls put more effort, it could hit additional resistance levels at $195, $200, and $205 respectively. On the contrary, a bearish drop may roll the market back below the 21-day moving average and to the initial support level of $163. Whereas, the critical support levels could be found at $145, $140, and $135. Therefore, as the trading volume increases, the technical indicator 9-day MA is seen above the 21-day MA as this could still supply more bullish signals into the market.

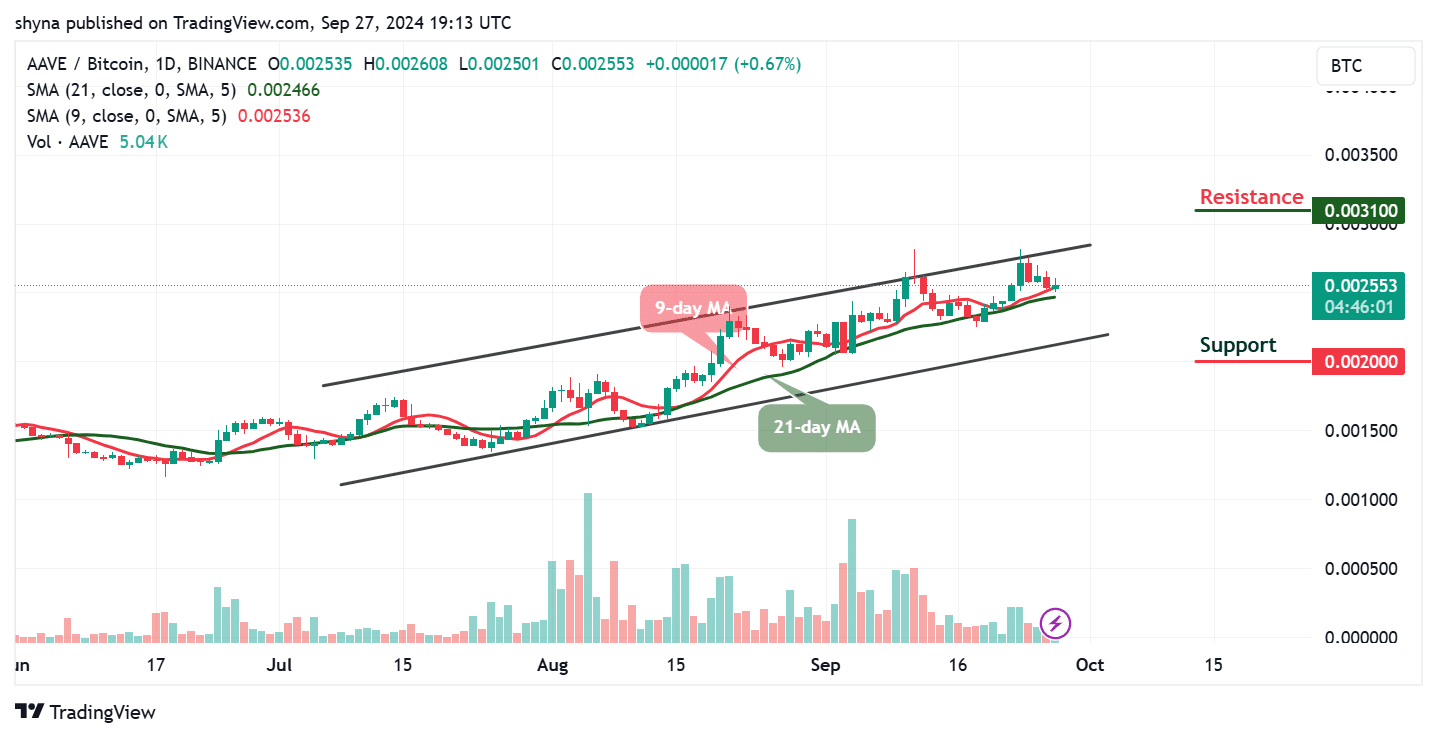

AAVE/BTC Maintains the Bullish Movement

Against Bitcoin, the Aave price is still trading near the upper boundary of the channel above the 9-day and 21-day moving averages. The price changes hands at 2553 SAT as the technical indicator’s 9-day moving average remains above the 21-day moving average. Meanwhile, the daily chart reveals that buyers may continue to dominate the market as the market price seems to break above the channel.

Positively, the resistance levels to be reached are 3100 SAT and above. In other words, if the bears return to the market, a lower sustainable move may cancel the bullish pattern and could attract new sellers to the market with the next focus on 2000 SAT and below.

Meanwhile, @SatsDoji, who has over 12,000 followers on X (formerly Twitter), shared an analysis indicating that $AAVE remains highly bullish. According to him, the token appears to have broken out of its accumulation phase and shows signs of expansion. A retest of this accumulation zone would provide a strong opportunity to add more, in his opinion. Notably, $AAVE has been in accumulation for over two years, and @SatsDoji speculates that the market maker may have finished accumulating, signaling the potential for a significant move ahead.

Still very bullish on this one.

Looks like it broke the accumulation phase and is trying to expand as we speak.

Any sort of retest of that accumulation phase would be great to add more imo.

For the record, it has been in accumulation for over 2 years now.

Wouldn’t… pic.twitter.com/oqmYDFAMfm

— Doji 🧠 (@SatsDoji) September 26, 2024

Alternatives to Aave

As indicated by its daily chart, Aave (AAVE) is at a critical juncture, with the price testing significant resistance levels above key moving averages. If AAVE/USD successfully surpasses this resistance within its long-term ascending channel, it could aim for a technical target near $180, with a potential extended target of $190. On the other hand, the Pepe blockchain, also known as “Pepe Unchained,” is making waves in the meme coin space. It has attracted widespread interest, raising over $15.7 million, and allows users to stake tokens and earn passive income.

THE PEPE BLOCKCHAIN IS EXPLODING. GET READY FOR $PEPU

Pepe Unchained is rapidly emerging as the next big thing in meme coins, with over $15 million raised and incredible opportunities for early investors. Built as a layer-2 blockchain, it offers unmatched speed, low fees, and seamless bridging with Ethereum, making it a game-changer in crypto. The presale is still ongoing, but prices will increase as the project progresses, so the earlier you get in, the more you stand to gain. With staking rewards as high as 139% APY, this is the perfect moment to maximize your passive income and be part of a revolutionary project. Don’t miss your chance to invest in the future of meme coins – Pepe Unchained.

Related News

Most Searched Crypto Launch – Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards – pepeunchained.com

- $10+ Million Raised at ICO – Ends Soon

Join Our Telegram channel to stay up to date on breaking news coverage