Aptos crypto is surging amid APT price growth, but the Network is spending aggressively on financial incentives. Will this be sustainable for APT crypto in 2025?

If you are new to crypto, there are multiple options to use or launch from. Solana and Ethereum are for those searching for activity, and Algorand and Cardano are for decentralization fans.

Those keen on performance can opt for Aptos. It is one of the few blockchains that supports parallel transaction execution without sacrificing decentralization and security.

Built using Move, a programming language, Aptos has a thriving ecosystem and has drawn activity and users since launching.

‘@Aptos $APT is showing strong growth:

– 3M daily transactions

– 15M monthly active addresses

– Over $1B Total Value Locked (TVL)

– 180 weekly active developers pic.twitter.com/ZXSZ6EePXL— Immortal

(@BitImmortal) November 25, 2024

While Aptos has made significant strides over the years, it appears that it is spending too much on incentives to attract activity and secure the network.

Aptos Crypto Spent $494 Million As Incentivizes In 2024

Taking to X, one analyst notes that Aptos spent a whopping $494 million in 2024 alone, only to generate just $1.38 million as revenue from gas fees.

This translates to a cost of $358 spent for every $1 fee earned, a stark and worrying contrast to the economic efficiency of other blockchain networks.

Understandably, new platforms like Aptos must spend a fortune to prevent “cold start” problems. Aptos can attract developers, projects, and validators by dangling financial incentives.

The more users there are, the more transaction fees are earned. Additionally, more validators lead to a more secure platform, and increased users accelerates adoption.

However, for investors who poured billions into ensuring Aptos operates according to their whitepaper, it is only natural to ask: How did the team spend $494 million?

Understanding the operational framework of Aptos is essential to answer this question.

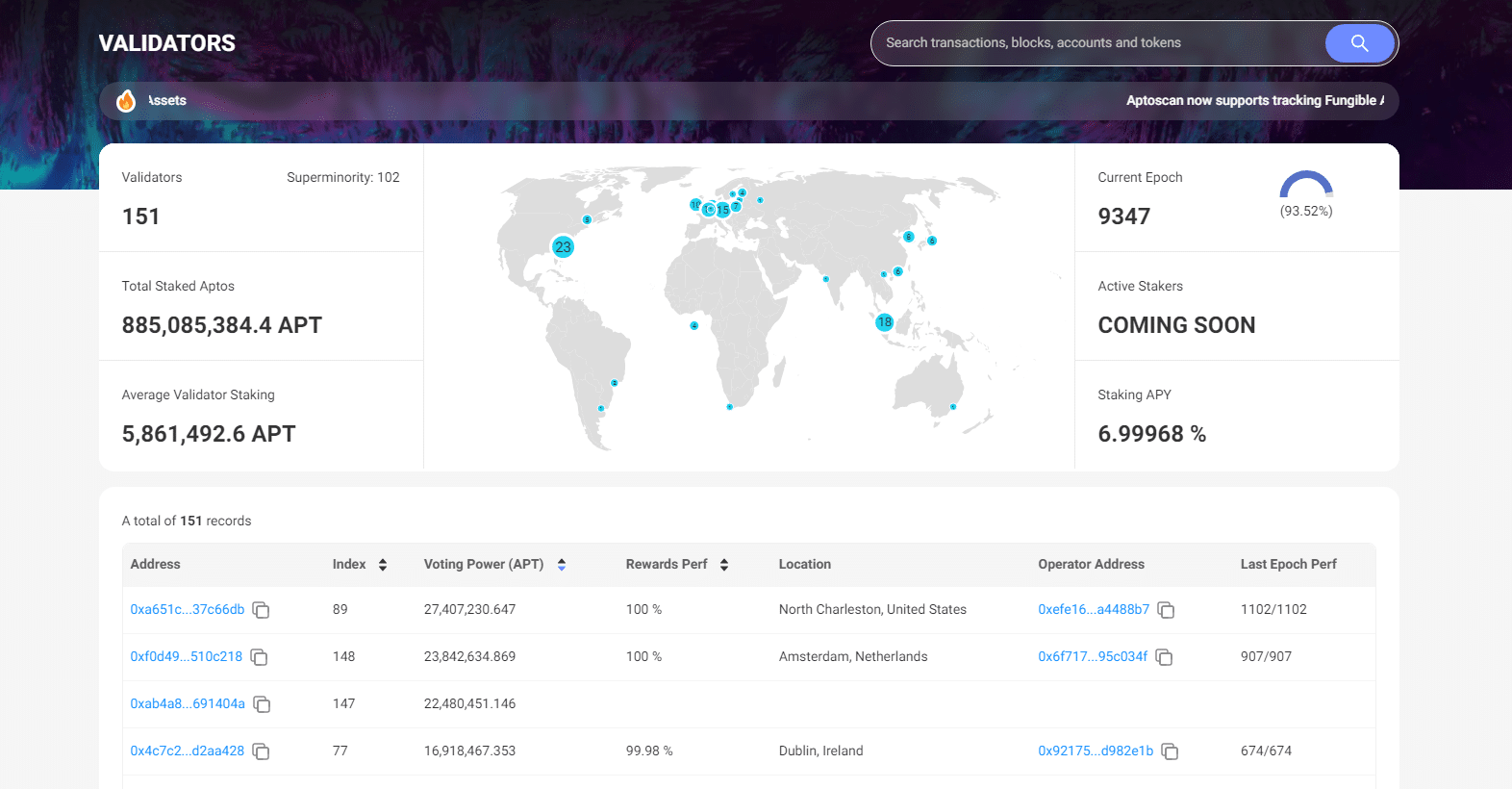

Since Aptos crypto relies on validators for transaction processing and decentralization, the team spent $3.27 million per validator distributed among the 151 nodes.

(Source)

This incentive is necessary and critical. Validators, as mentioned, are necessary for transaction validation, block creation, and overall network security.

With $3.27 million spent by each validator, it is clear that Aptos is spending a premium to ensure each node is functional and reliable, all while ensuring the network is sufficiently decentralized.

While attractive for supported validators, will this model be sustainable? Will Aptos eventually transit so that validators are sufficiently compensated from gas fees as primary revenue in the long run?

DON’T MISS: Best New Cryptocurrencies to Invest in 2024

Comparing Aptos Crypto with Avalanche, Ethereum, and Avalanche

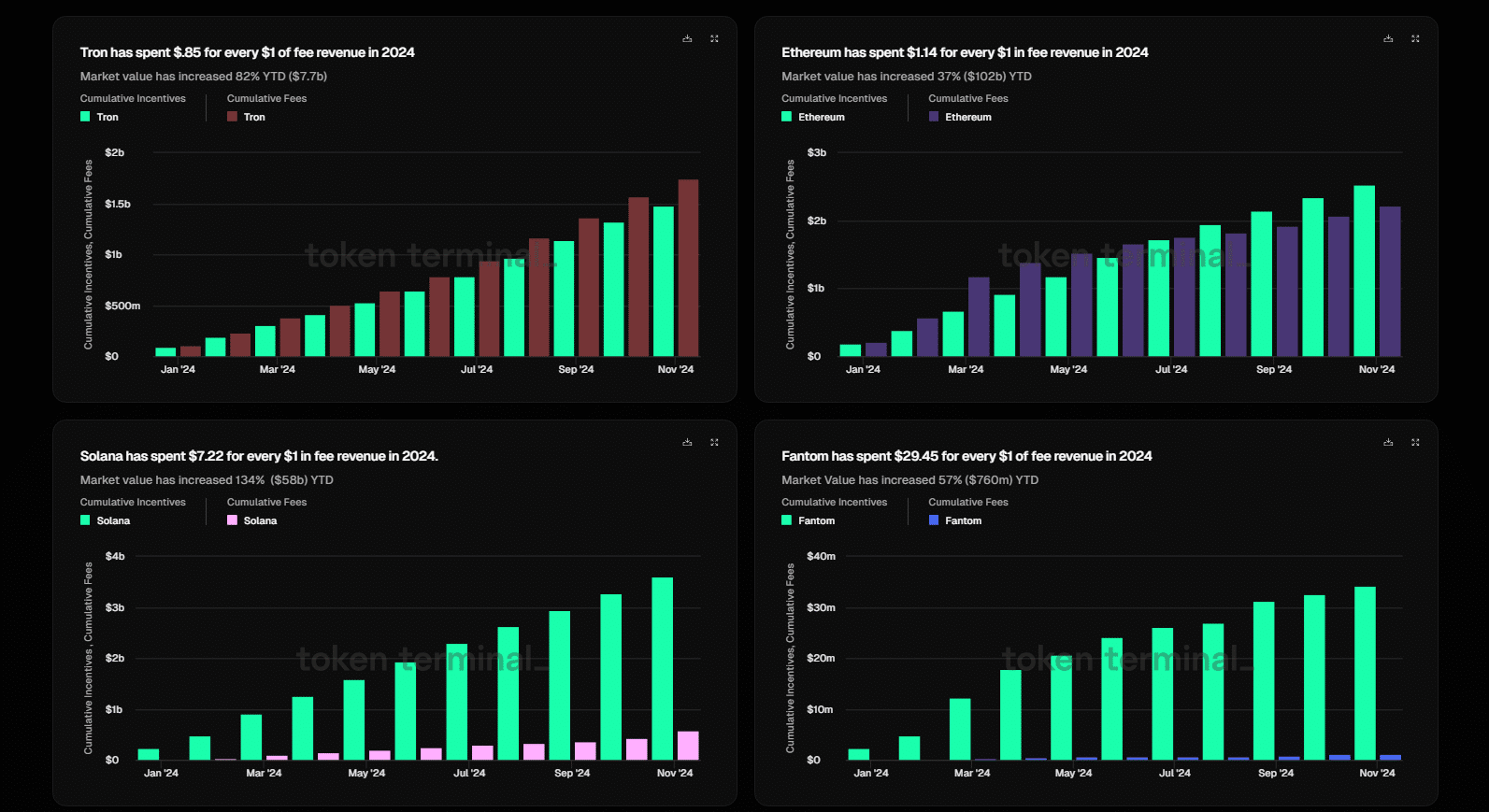

Considering how other public ledgers perform, the $358 spent for every $1 network fee generated is high.

The ultra-low fees and relatively low network activity could be to blame, but the incentive fee is astronomical.

For every $1 of network fees generated, Solana, a modern and highly scalable platform, spent $7.22.

Another relatively new network, Avalanche, spent $63 for every $1 fee generated. Though high, this is still far more efficient than Aptos spends on validators.

(Source)

Meanwhile, Ethereum, considering its relatively high gas fees on the mainnet and a web of layer-2s, spent $1.14 for every $1 of fees.

Going forward, it will be interesting to watch how Aptos evolve.

The analyst observed that Ethereum, Avalanche, and Solana printed historic peaks in the last bull cycle, reaching $4,900, $144, and $260, respectively.

Although APT prices are recovering after plunging to as low as $3 on December 22, they have yet to retest their all-time highs of around $20, which were printed in early 2023.

(APTUSDT)

As APT prices rise, the dollar value for fees generated will increase, justifying the $3.27 million spent on each validator.

At the same time, with APT at fresh all-time highs above $20, it is likely that more users will choose Aptos, pushing activity to new levels.

EXPLORE: BONK Flips WIF Targets DOGE Crown: Some Traders Are Now Storing Profits In BONK Rather Than SOL

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Aptos Spent $494 Million On Incentives: Is This Sustainable? Revenue Is Worryingly Low appeared first on .