Avalanche has experienced an impressive 25% surge since Wednesday, driven by the Federal Reserve’s announcement of a 50 bps interest rate cut. This has pushed AVAX to a critical resistance level, which will likely shape its price action in the coming weeks. Currently trading near $28, the token is testing a key supply zone that has analysts and investors paying close attention to its next move.

Related Reading

Many market participants are optimistic, projecting that a break above this resistance could pave the way for an aggressive rise in AVAX’s price. This would likely push AVAX into a new uptrend, potentially leading to fresh highs and even a 50% surge for the token. However, if Avalanche fails to break through this level, it risks a pullback that could see prices retest previous support levels.

Analysts are highlighting this moment as crucial for determining AVAX’s market direction, as broader crypto sentiment has turned more bullish following the Federal Reserve’s recent decision. With increasing trading volume and investor interest, the next few days will be key in establishing whether Avalanche can sustain its momentum or face a short-term correction.

Avalanche Testing Key Supply Levels

Avalanche has been one of the top-performing altcoins in recent days, showing impressive strength amid a broader market surge. This recent momentum could be just the beginning of a more significant move for AVAX, as analysts and investors are projecting even larger gains if the token continues to break through key supply levels.

One of the most respected figures in the crypto space, Carl Runefelt, shared a bullish technical analysis of Avalanche on X, stating that AVAX has broken out of a falling wedge pattern, a classic indicator of bullish price action.

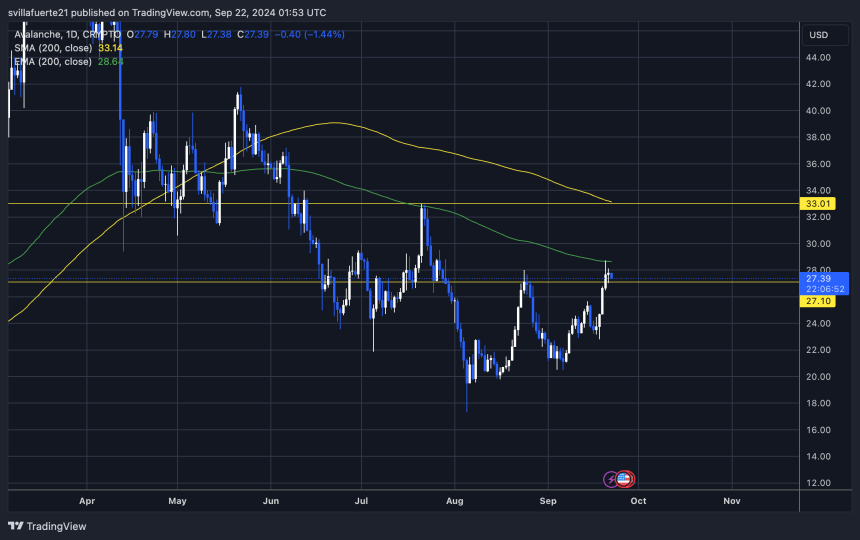

According to his analysis, AVAX successfully retested the wedge and is now targeting medium-term price levels. Runefelt’s price targets for AVAX are $28, $33, $41.30, and $54, each representing crucial supply zones that the token needs to surpass to continue its upward trajectory. If AVAX hits $41.30, it will reflect a 50% surge from its current price, marking significant progress.

Related Reading

Currently, Avalanche has formed a new high, confirming its strength. While the price may consolidate before making its next move, many investors believe that this consolidation could be a stepping stone toward a larger surge.

With broader market sentiment turning positive after the recent Federal Reserve interest rate cut, AVAX is well-positioned to continue climbing, especially as more investors look to capitalize on its strong technical setup.

If AVAX can maintain this momentum, it could potentially lead to significant gains in the medium term.

Price Levels To Watch

AVAX is currently trading at $27.39 after testing the daily 200 exponential moving average (EMA) at $28.66. The token has experienced an impressive 40% surge since early September, pushing it closer to crucial supply levels that will likely shape the price action in the coming weeks.

For bulls to maintain momentum and extend the rally, AVAX needs to break through the $28 resistance and reclaim the 1D 200 EMA as support. Doing so would signal a more sustained uptrend and position AVAX for further gains.

Related Reading

However, if the price struggles to hold above the $25 mark, a deeper correction could follow, bringing short-term bearish pressure. Despite this risk, there remains a possibility for AVAX to consolidate between $25 and $28, giving the token room to gather strength for a more significant surge in the near future. Investors are closely watching these levels as the market seeks direction.

Featured image from Dall-E, chart from TradingView