Despite heightened expectations for the Bitcoin price to hit the $100,000 milestone, a crypto analyst has surmised that this key target could present psychological resistance for the pioneer cryptocurrency. Amidst this bearish warning, the coin’s price’s continued upward movement towards the elusive $100,000 mark has become the center of attention in the crypto community.

Related Reading

$100,000 Bitcoin Price As A Psychological Resistance

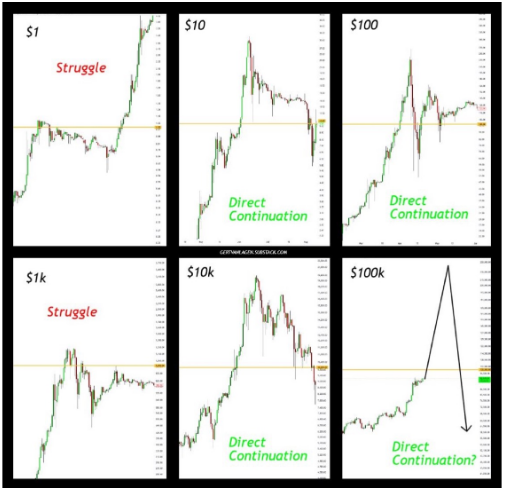

Crypto analyst Gert van Lagen recently took to X (formerly Twitter) to announce to his 108,000 followers that the Bitcoin price is approaching the $100,000 all time high. The analyst has suggested that its climb to $100,000 would be like hitting major price levels of $10, $100, and $10,000 for the first time.

According to Lagen, the $100,000 milestone is set to present a psychological resistance for Bitcoin, potentially leading to short-term price volatility. Based on the analyst’s statements, this psychological resistance could temporarily stall the crypto’s rally above $100,000.

While sharing this bearish warning, Lagen also issued a bullish forecast for Bitcoin, highlighting that a surge to the target zone of $220,000 to $320,000 was likely before the global recession set in. While this prediction could be well received by BTC if it continues on its bullish momentum, the analyst has asserted that the timeline to reach these heights may be limited.

In preparation for the projected Bitcoin psychological barrier, Lagen has advised crypto investors to short their BTC at the $100,000 mark. Traders who leverage this strategy will have to bet on the possibility of a price correction in Bitcoin before it experiences any significant breakout to the upside.

With Bitcoin approaching the $100,000 price level, the stakes are getting higher, as analysts believe that this key milestone could serve as a launch pad to propel the cryptocurrency to a price top. For now, the price is trading at $98,560, marking a 7.63% increase in the last seven days as bullish sentiment and momentum continue to grow.

Massive Liquidation To Follow If BTC Hits $100,000

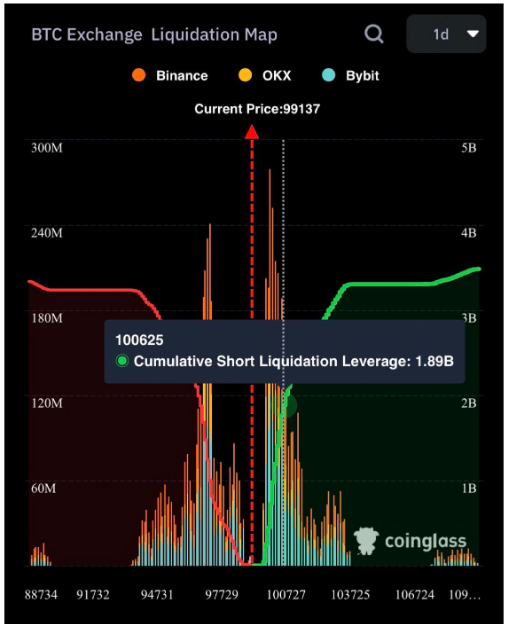

Although the crypto market is anticipating Bitcoin’s price rise to $100,000, a prominent analyst has revealed that massive liquidation could be triggered once BTC reaches this fundamental level. According to Ali Martinez, $1.89 billion is set to be liquidated if Bitcoin jumps to the $100,625 level.

Based on the analyst’s chart, this Bitcoin liquidation represents its “cumulative short liquidation leverage.” This analysis follows reports of a large-scale Bitcoin liquidation, as Martinez recently revealed that a whopping 65,000 BTC, valued at $6.37 billion, was withdrawn from exchanges.

Related Reading

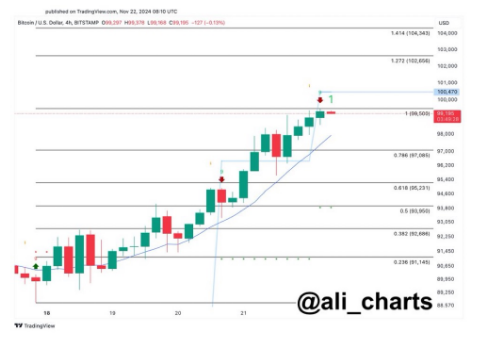

Martinez has also revealed that Bitcoin’s TD Sequential is flashing a sell signal on its 4-hour chart. Given this, the analyst has predicted a significant correction to the $97,085 mark. On the flip side, the analyst has disclosed that if Bitcoin can hold a candlestick above $100,470, it would invalidate the bearish formation and potentially propel its price towards $102,656 or $104,343.

Featured image from Pexels, chart from TradingView