As Bitcoin (BTC) inches closer to $70,000, its dominance in the wider crypto market has risen to a cycle high of 58.9%.

Bitcoin Dominance Rises, Are Altcoins In Trouble?

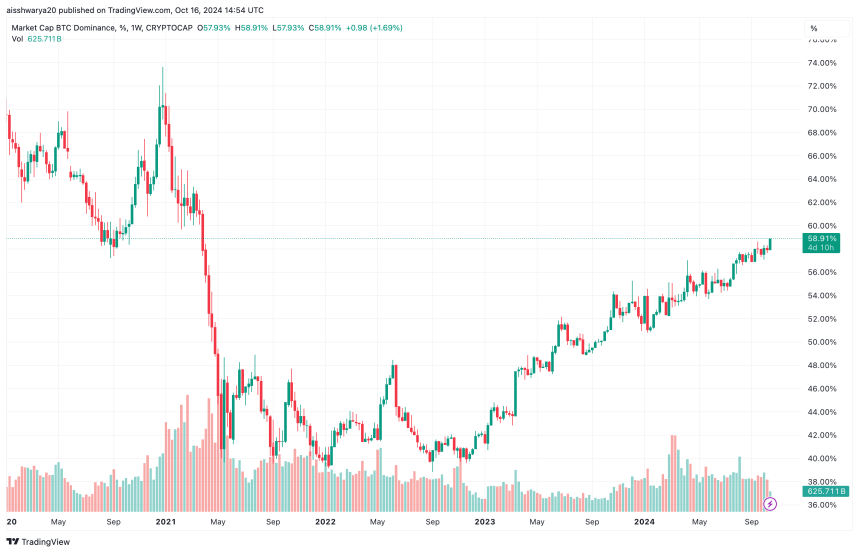

Bitcoin dominance (BTC.D), a metric that measures the proportion of the total cryptocurrency market cap commanded by the leading digital asset, has hit a new cycle high of 58.9%. The last time the crypto market witnessed this level of BTC.D was in April 2021.

After a slight pullback following Iran’s attack on Israel earlier this month, Bitcoin has risen by almost 10% in the past week, trading at $67,769 at the time of writing.

Related Reading

Concurrently, the total crypto market cap has surged from $2.26 trillion on October 8, to $2.41 trillion on October 16, according to data from CoinGecko. However, the rise in the total crypto market cap is largely buoyed by the upward movement in BTC price.

At the start of October, BTC.D hovered around 57.1%. Since then, it has risen by approximately 1.8%, showcasing Bitcoin’s strong performance relative to altcoins such as Ethereum (ETH), Solana (SOL), Binance Coin (BNB), and others.

The current level of BTC.D has cast doubt on the prospects for the much-anticipated “altseason,” typically characterized by parabolic price increases in altcoins and a decline in BTC.D. Notably, BTC.D peaked at 70% during the post-COVID bull market in 2020-21 before dropping to 40% by mid-2021.

In late 2022, BTC.D bottomed out at around 39% amid the collapse of FTX, which halted operations due to fraud charges against its leadership. Since then, BTC.D has been on a gradual rise, as shown in the chart below.

ETH/BTC Ratio Must Rebound For A Potential Altseason

As BTC.D continues to rise, it is important to consider the ETH/BTC trading pair. For the uninitiated, the ETH/BTC trading pair – colloquially known as the ETH/BTC ratio – tracks Ethereum’s (ETH) performance against BTC.

Related Reading

At press time, ETH/BTC trading pair stands at 0.0385, a level last seen in April 2021. The chart below shows that Ethereum has failed to establish a higher high against Bitcoin since at least November 2022, reflecting weak ETH price action over the past two years.

A strong ETH performance against BTC often precedes an altseason, but there are no clear signs of a meaningful trend reversal.

Further, the total value locked (TVL) in decentralized finance (DeFi) protocols across all blockchains has slid from almost $110 billion in June 2024 to $88 billion, indicating weak demand for altcoins among crypto investors.

However, some crypto analysts and technical indicators still suggest a potential altseason may be on the horizon.

For example, earlier this month, the altcoin market cap surpassed its 200-day exponential moving average (EMA), a key resistance level that signals strong altcoin performance in recent days.

Similarly, Steno Research recently remarked that ETH is set for a comeback following the US Federal Reserve (Fed) interest rate cuts. BTC trades at $67,769 at press time, up 2.5% in the past 24 hours.

Featured image from Unsplash, Charts from Tradingview.com