Data shows that Bitcoin investors have again assumed a sentiment of greed after BTC’s surge of $64,000. Here’s what this could mean.

Bitcoin Fear & Greed Index Is Now Pointing At ‘Greed’

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the sentiment currently present among the investors of Bitcoin and other large cryptocurrencies.

The metric uses data from five factors to determine the net market mentality: volatility, trading volume, social media sentiment, market cap dominance, and Google Trends.

The index uses a scale from zero to a hundred to represent this sentiment. All values above the 53 mark correspond to the presence of greed among the investors, while those below 47 imply fear in the market. Naturally, values between these two cutoffs suggest a net-neutral mentality.

Now, here is what the Bitcoin Fear & Greed Index is looking like right now:

The value of the metric appears to be 55 at the moment | Source: Alternative

As is visible above, the indicator has a value of 55, meaning that the investors are just sharing a sentiment of greed right now. This greedy mentality is a new change for the market compared to the recent trend.

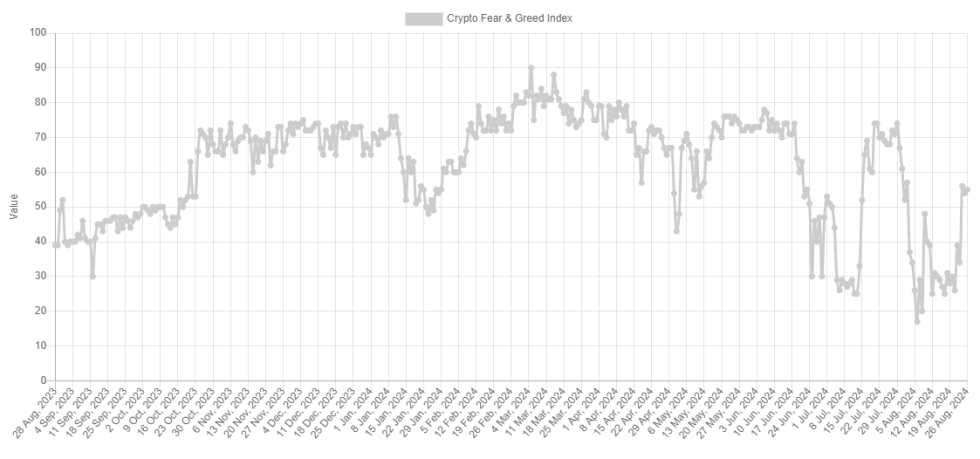

The chart below shows how the value of the index has changed over the past year.

Looks like the value of the indicator has shot up in recent days | Source: Alternative

The graph shows that the Bitcoin Fear & Greed Index had relatively low values just last week. More particularly, the indicator had been deep inside the fear region and quite close to a special zone called the extreme fear.

Extreme fear occurs when the index registers a value of 25 or lower. The metric has made several visits into this territory during the past month, with perhaps the most notable instance being the low that occurred alongside the price bottom on August 5th.

Historically, Bitcoin has seen many cases of such a pattern, where dips into the extreme fear region have led toward some bottom for the cryptocurrency’s price.

A similar but opposite pattern has also been witnessed for the extreme greed zone, which starts from 75 on the Fear & Greed Index. The price all-time high (ATH) earlier in the year also formed when the sentiment spiked into this territory.

Thus, it would appear that Bitcoin tends to move in the direction opposite to what the masses are expecting. The extreme sentiments represent the periods where this expectation is the strongest, so it makes sense that a reversal would also be the most likely to happen during them.

With the sentiment improving from fear to greed recently, investors have started becoming bullish again. As the hype is only mild for now, Bitcoin shouldn’t feel a negative effect.

The index can be watched in the coming days, though, as any spikes towards extreme greed could serve as a warning that things are getting too hot for the asset.

BTC Price

Bitcoin had gone as high as $65,000 yesterday, but the asset appears to have seen a pullback to $63,600 since then.

The price of the coin appears to have gone stale after its recent rally | Source: BTCUSD on TradingView

Featured image from Dall-E, Alternative.net, chart from TradingView.com