Bitcoin is firm, and institutions are buying even more BTC, looking at the inflows into IBIT, a spot Bitcoin ETF by BlackRock.

This week, an interesting thing happened. Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

broke above $72,000, eased past $73,000, and reversed less than $300 away from all-time highs.

The past of this expansion was undoubtedly unprecedented. No one expected the coin to rally this fast and hard.

The “Uptober” Blessings Arrive For Bitcoin ETFs

Even though “uptober” often comes with its “Bitcoin blessings“, price action over the last few weeks, especially in early September, was painful to watch.

September marked a turn for the better as Bitcoin exceeded historical performances before racing hard in October.

The digital gold is cooling off, down below $70,000 when writing.

The pullback may offer entries for the so-called permabulls to buy more at a discount.

(BTCUSDT)

If anything, institutions appear to be popping in, scooping every BTC on sight.

Indeed, the approval of spot Bitcoin ETFs in the United States early this year was a major milestone.

For the first time since BTC launched, institutions and other deep-pocketed investors can legally gain exposure by buying shares backed by the coin.

Big names are involved: From Fidelity, BlackRock, and even Grayscale, investors only have to choose a product that best aligns with their bottom line.

And, as BTC raced above $70,000, the big boys jumped in.

Spot Bitcoin ETF issuers in the United States accelerated their purchase of BTC due to client demand.

DISCOVER: How to Buy Bitcoin Anonymously in 2024 – No KYC Guide

BlackRock And IBIT Grew The Fastest Than Any Other ETF

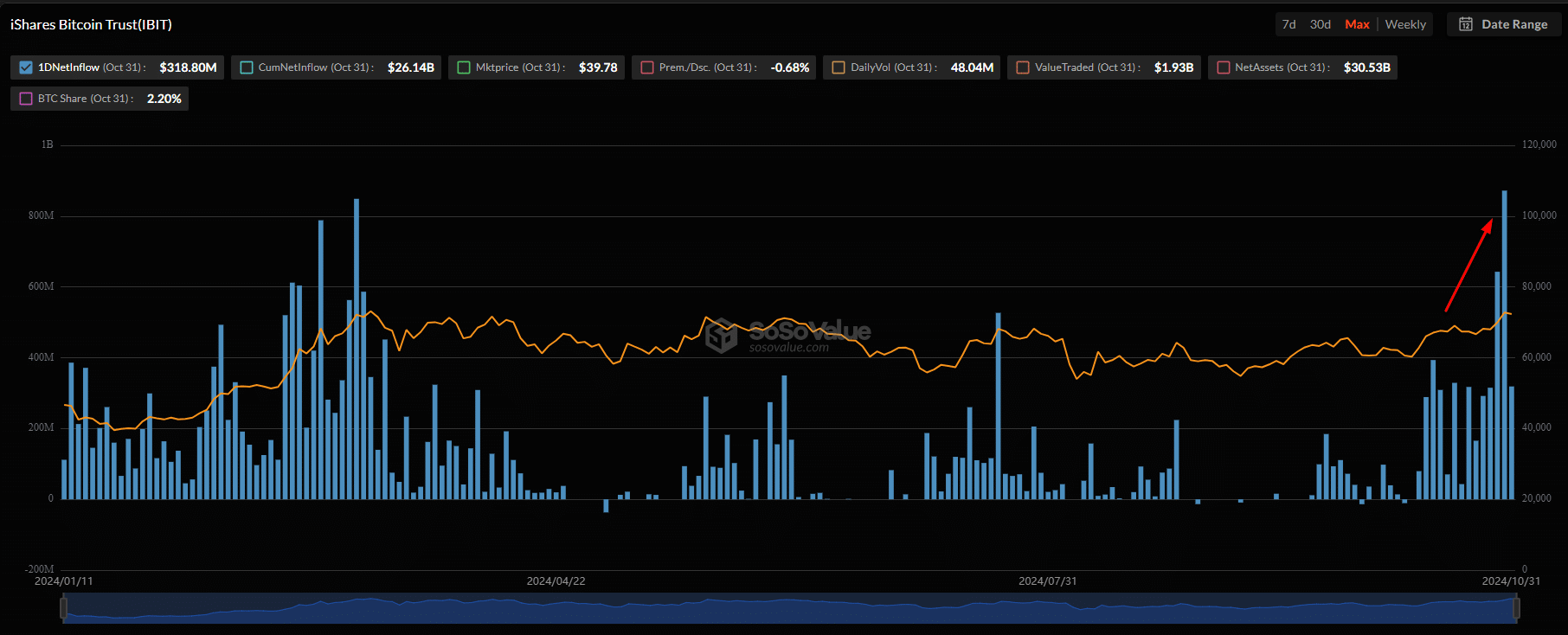

There was especially a huge uptick in BTC purchases by BlackRock through its iShares Bitcoin Trust (IBIT).

As prices soared and analysts called for the moon, institutions loosened their purse strings, splashing millions of dollars into BTC by buying IBIT shares.

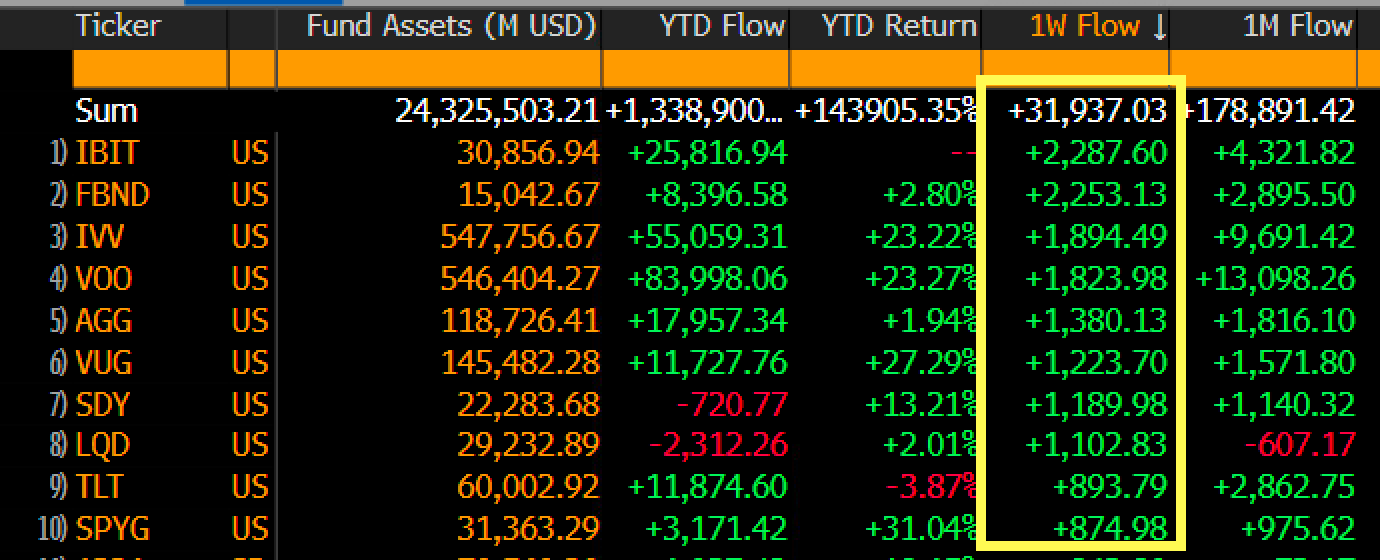

This remarkable development meant that IBIT scooped the most money of all ETFs in the world.

(Source)

Investors bought over $315 million of shares on Monday before adding $642 million of IBIT shares on Tuesday.

A day later, on Wednesday, a record $872 million of shares.

(Source)

The number fell to $318 million on Thursday but within range of their average purchases from mid-October.

If you consider that there are 13,227 ETFs worldwide, including Vanguard’s tracking the S&P 500 or several others tracking the United States bond market, the cash splash is huge for BTC.

What’s more?

BlackRock’s IBIT is breaking records and is barely a year old.

This endorses Bitcoin as an asset and reveals a growing appetite for crypto exposure on Wall Street.

The big boys are willing to dive in, aware that Bitcoin is more volatile than traditional assets backing VOO or IVV ETFs, for example.

For the neutrals, what happened this week is nothing but a paradigm shift where traditional equity and bond ETFs are increasingly facing stiff competition from the more “lucrative” crypto-backed assets.

DON’T MISS: The Hottest ICOs to Sccop in November 2024

Will Wall Street Create A Supply Crisis?

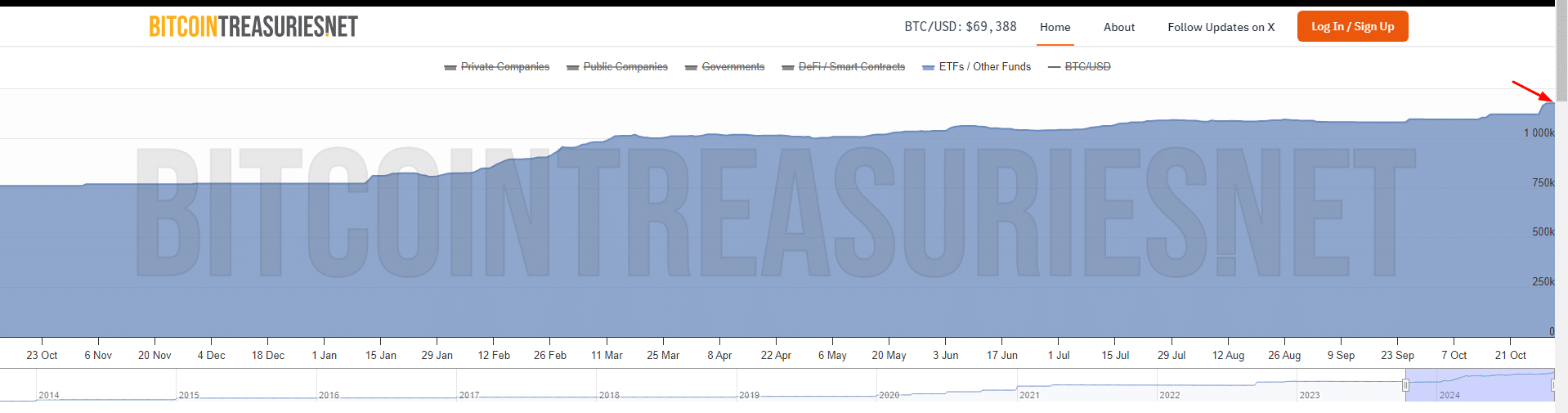

Altogether, all spot Bitcoin ETFs in the United States added $2.2 billion worth of BTC, pushing assets under management to over $70 billion.

Parallel data from Bitcoin Treasuries reveal that all Bitcoin ETFs now control over 1.1 million BTC.

(Source)

This is more than coins the founder Satoshi Nakamoto held, standing at 1 million BTC.

As institutions flow back, it could be time for retail to consider “getting this share” before soaring demand constrains supply.

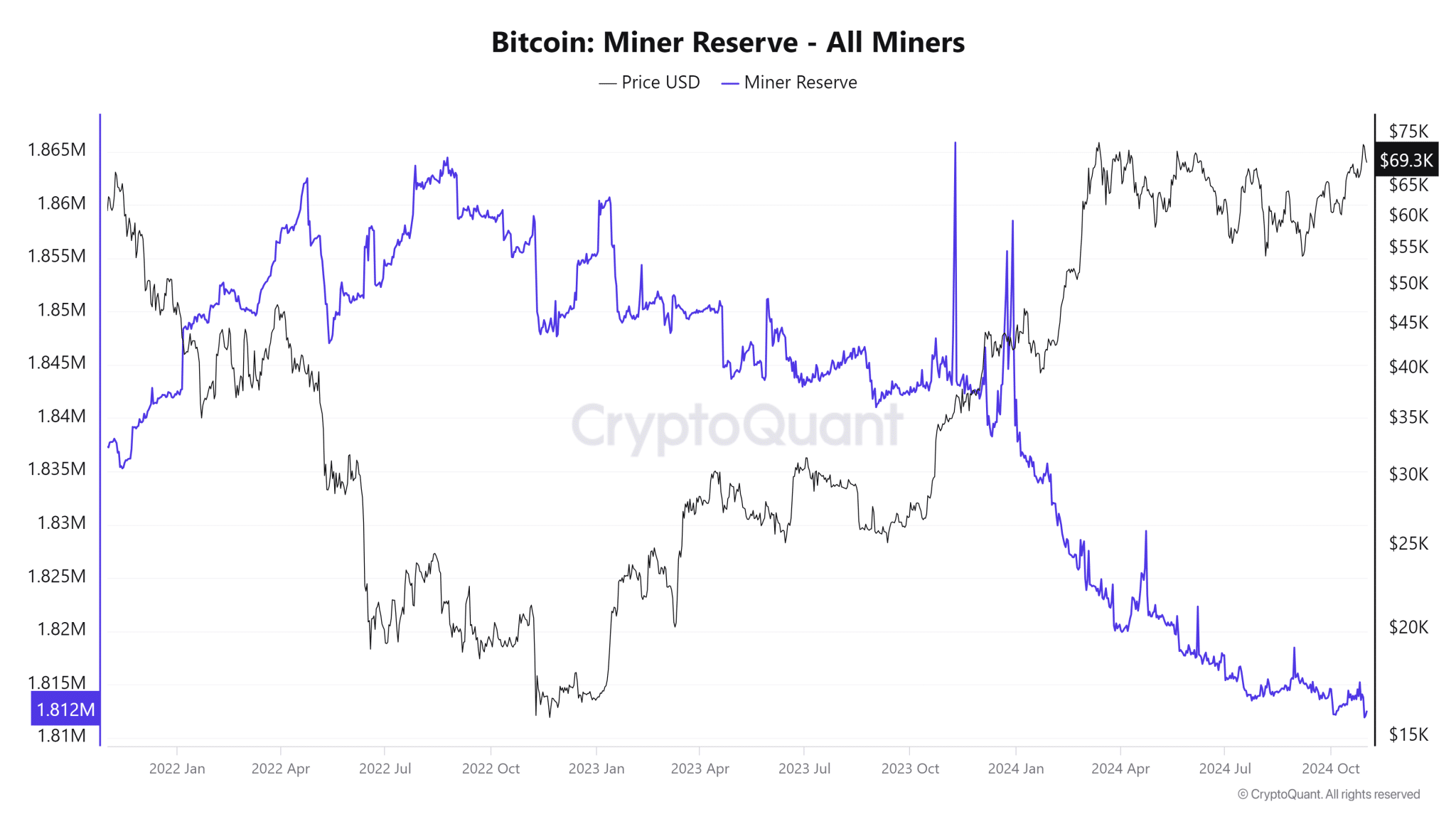

Miners have been holding in the past few weeks and are mining even fewer coins after the Halving on April 20.

EXPLORE: Crypto PACs Are Here to Stay: Coinbase is Already Positioning For 2026 US Mid-Terms

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Bitcoin Milestone: BlackRock and IBIT Took in More Cash than Any Other ETF in the World appeared first on .