Bitcoin’s upside momentum is holding firm, reaching a new all-time high and showcasing potential for more price growth towards critical resistance levels. While the recent move has triggered a wave of optimism about its future performance, pessimism still lingers among many individuals.

Skeptics Remains Unchanged By Bitcoin’s Upward Strength

Seasoned macro researcher and author at the on-chain platform CryptoQuant Axel Adler Jr. has shed light on investors’ upholding sentiments on Bitcoin’s foundation. The expert shared his perspective in a recent post on the X (formerly Twitter) platform, capturing investors’ attention.

This insightful prognosis comes amid Bitcoin’s surge to a new all-time high, marking another significant milestone in its trajectory. BTC might be displaying substantial price growth, but Axel Adler underlined that certain investors’ moods may never change.

According to the macro researcher, critics and skeptics remain present in spite of record-breaking price levels. Specifically, this indicates constant skepticism regarding the rally’s sustainability and raises questions about whether Bitcoin’s growth is truly based on sound foundations.

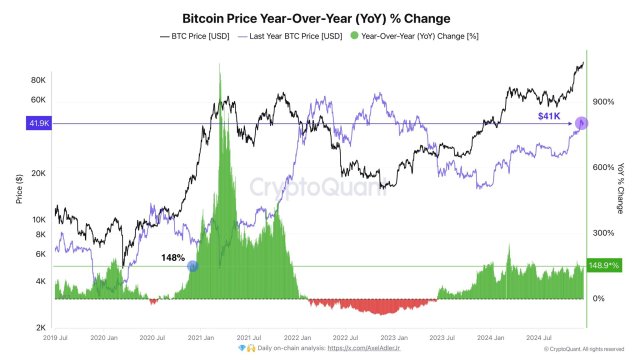

When Bitcoin was worth about $41,000 a year ago, Adler noted that many people were skeptical. Even now that the flagship asset has risen to the $106,000 level, people are still pessimistic about its sustainability.

Considering the persistent skepticism despite significant growth, it appears this could be a never-ending cycle for Bitcoin. This is because the bulls and bears, doubters, and die-hard believers will always exist.

Furthermore, there will always be 1% of those who purchase the crypto asset at the lowest price and sell at the highest value. Lastly, there will always be those who buy Bitcoin near the peak of the market only to sell at a loss or wait three years. “That’s just how Bitcoin works, and it seems unlikely to ever change,” Adler added.

New BTC Investors’ Demand Draws Closer To Past Cycle Peaks

Even though skepticism lingers, market sentiment has proven to be more optimistic lately, as evidenced by a rise in demand from new BTC investors. Adler reported that the demand from new investors is currently 4% higher than in March this year when BTC hit the $70,000 mark.

Drawing attention to the past two cycles, Adler highlighted that demand peaked at 205% and 133%, respectively. Meanwhile, the metric in this current cycle is situated at 70%, with anticipation of surpassing the last cycle.

The rise in demand from new investors signals a fresh wave of robust confidence and interest in BTC‘s short-term and long-term capability as it sustains its bullish momentum. In the event that the trend continues, it could serve as a key springboard for future price movements on the upside.

At the time of writing, Bitcoin was trading at $104,137, demonstrating a nearly 3% decline in the last 24 hours. However, in the past week and month, the crypto asset has risen by about 6% and 13% respectively.

Featured image from Unsplash, chart from Tradingview.com