The price of Bitcoin has not shown any serious momentum so far in 2025 besides briefly surpassing the $108,000 level in mid-January. On the contrary, the flagship cryptocurrency has suffered some significant corrections over the past few weeks.

The most recent pullback saw the BTC price heavily slump toward $92,000 after US President Donald Trump introduced new trade tariffs on Canada, Mexico, and China earlier this week. While the Bitcoin price quickly recovered above $100,000, it has since struggled to sustain any bullish momentum — currently trading around $96,500.

HTX And BitMEX Users Load Their Bitcoin Bags — What We Know

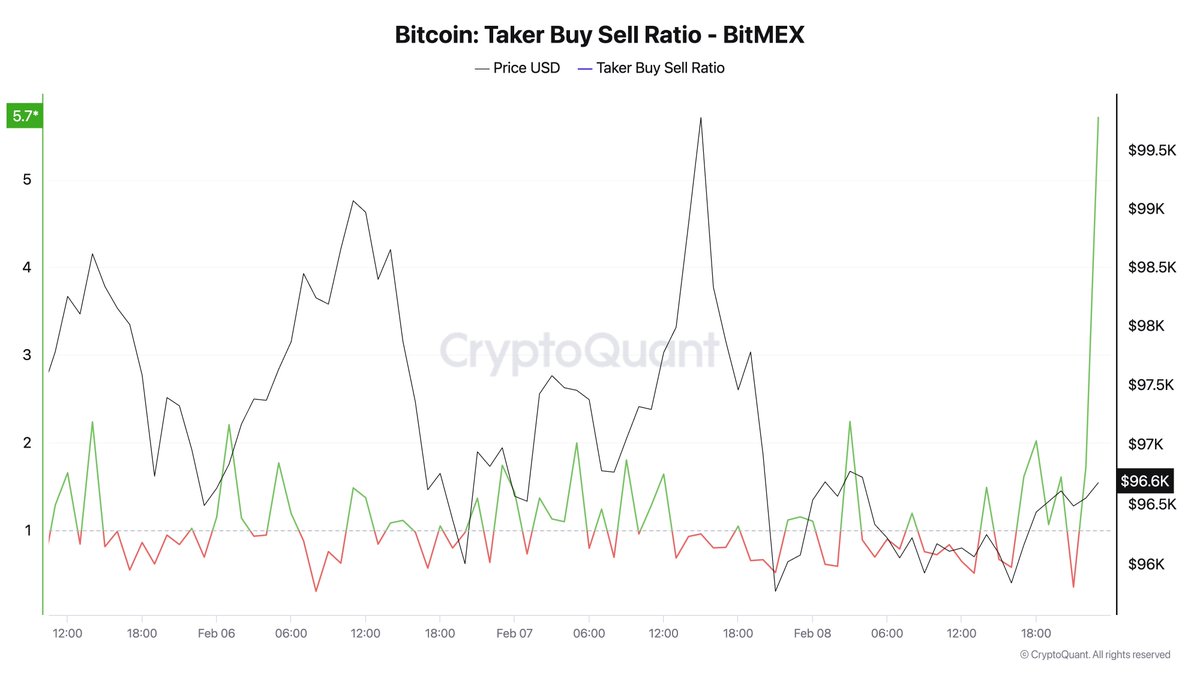

Prominent crypto analyst Ali Martinez took to the X platform to share that certain centralized exchanges have witnessed increased buying activity. This on-chain observation is based on changes in the “taker buy/sell ratio,” which measures the taker buy and taker sell volumes for a particular asset (Bitcoin, in this case).

For clarity, the taker buy volume is higher than the taker sell volume when the value of the taker buy/sell ratio is greater than one. Typically, this scenario is considered bullish, as it suggests the willingness of investors to pay a higher price for a specific cryptocurrency (Bitcoin).

Contrastingly, a less-than-one value for the taker buy/sell ratio indicates that more sellers are willing to part with their assets at a lower price. This phenomenon implies that the sellers are overtaking the buyers, signaling a bearish investor sentiment in a particular crypto market.

According to Martinez’s post on X, the Bitcoin taker buy/sell ratio on the HTX and BitMEX exchanges experienced a notable upswing on Saturday, February 8. CryptoQuant data shows that the metric rose to around 5.7 on the BitMEX platform in the late hours of the day.

Similarly, the Bitcoin taker buy/sell ratio climbed to as high as 16 on the HTX exchange on Saturday before later crashing down toward 0.4. Nonetheless, this piece of on-chain data indicates a spike in buying activity on the centralized trading platforms.

Fresh buying activity on crypto exchanges could be bullish for the Bitcoin price, which has lacked the bite needed to sustain any upward movement. As of this writing, the premier cryptocurrency is valued at around $96,700, reflecting no significant price change in the past 24 hours.

Is It Time To Buy BTC?

In a separate post on X, Martinez suggested that it might be time for investors to dabble back into the BTC market. The rationale behind this suggestion is based on how the crypto crowd is feeling at the moment.

Recent on-chain data shows that the crowd sentiment toward Bitcoin is negative right now. However, prices have been known to move in the crowd’s opposite direction several times in the past.