On-chain data shows signs that the Bitcoin whales have been selling as the cryptocurrency has observed a surge above the $31,000 level.

The Number Of Bitcoin Whales On The Network Has Dropped Recently

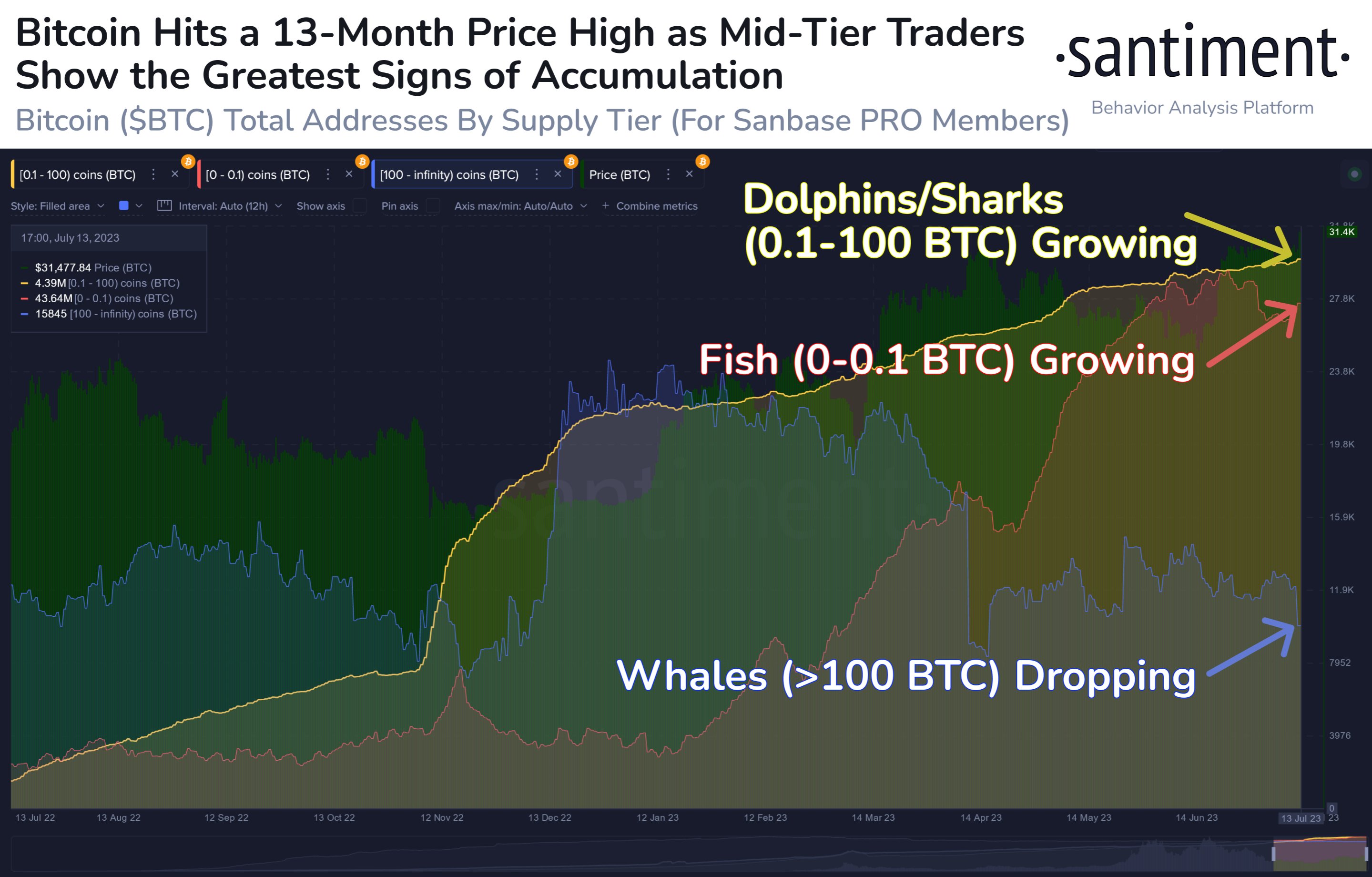

According to data from the on-chain analytics firm Santiment, while the whales have been selling, the smaller entities have been accumulating. The relevant indicator here is the “Supply Distribution,” which measures the total amount of addresses that belong to each wallet group on the network.

The addresses are divided into these wallet groups based on the total number of coins that they are holding right now. The 10-100 coins group, for example, includes all addresses carrying a balance of at least 10 BTC and at most 100 BTC.

If the Supply Distribution is applied to this particular address group, then it would add up the number of all Bitcoin addresses that satisfy this condition at the moment.

In the context of the current discussion, there are three investor groups of interest: the fish, the dolphins/sharks, and the whales. The amount that the investors belonging to them hold increases with each of them, with whales being the largest and also the most influential entities on the network.

Now, here is a chart that shows the trend in the Bitcoin Supply Distribution for these groups over the past year:

How the total number of investors belonging to these groups has changed during the past year | Source: Santiment on Twitter

As displayed in the above graph, there has been accumulation among the smaller investors on the Bitcoin network recently as both the fish (0 to 0.1 BTC) and the dolphins/sharks (0.1 to 100 BTC) have seen the total number of addresses belonging to them shoot up.

In the past day, the price of the cryptocurrency has observed a sharp surge above the $31,000 level as the cryptocurrency market as a whole has felt a bullish effect from Ripple’s victory in court.

Interestingly, even following this rally, the entities like fish and sharks have only continued to buy more, implying that these investors are optimistic about the asset.

The whales, however, appear to have taken advantage of the fresh profit-taking opportunity, as the number of investors holding more than 100 BTC on the blockchain has observed a sharp plunge.

Earlier during the past 24-hour period, Bitcoin had touched a high of $31,800. But as the whales have dumped the cryptocurrency, its price has naturally observed a bearish effect as it’s now floating in the low $31,000 level.

These prices are still an improvement over the low $30,000 levels from yesterday, but if these humongous investors continue to exit the market, these gains may be lost before long.

Naturally, the accumulation from the smaller investors is at least a positive sign for the market. Though, obviously, their accumulation is smaller in scale and thus carries a lower weight than the whales’ actions.

BTC Price

At the time of writing, Bitcoin is trading around $31,200, up 3% in the last week.

BTC has jumped during the past 24 hours | Source: BTCUSD on TradingView

Featured image from Vivek Kumar on Unsplash.com, charts from TradingView.com, Santiment.net