Join Our Telegram channel to stay up to date on breaking news coverage

- What Trading on centralized exchanges (CEXs) grew 5.9% in the 2nd quarter of 2023

- Why Investors are becoming more savvy about investing and more resilient to external forces

- What next Binance is likely to remain the dominant force in the industry for some time to come

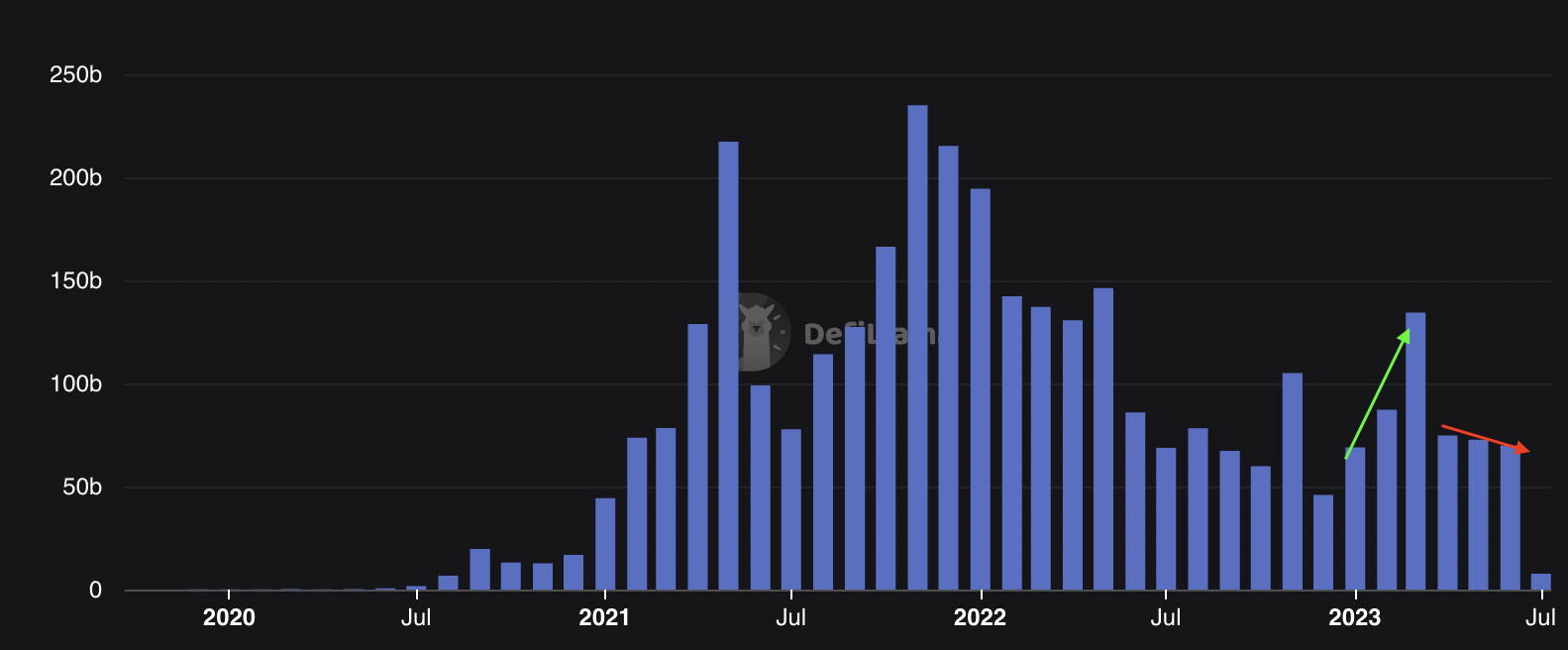

Centralized exchanges like Binance and Coinbase have experienced a 5.9% growth in total volume traded in Q2, according to data from CoinMarketCap.

More data from The Block shows that trading volume on CEXs increased by 11.1% month-on-month, from $440.06 billion in May to $489.24 billion in June.

This increase has come despite the US Securities and Exchange Commission (SEC) lawsuits against Binance and Coinbase, two of the largest crypto exchanges in the world by trading volume.

Centralized Exchanges Outperform DeFi Platforms

Trading volume on Binance increased from $209.06 billion in May to $239.63 billion in June. Similarly, the volume traded on Coinbase increased by approximately $4.2 billion over the same period.

Dr. Lucas Whittaker, Cryptocurrency Analyst from LuxCrypto, said:

“This upward trend reflects the adaptability and determination of market participants to navigate the regulatory challenges and seize opportunities in the evolving landscape.

Traders have become increasingly knowledgeable about the legal complexities surrounding cryptocurrencies, allowing them to make informed decisions and adjust their strategies accordingly. Moreover, the growing acceptance of digital assets in mainstream finance has attracted a broader investor base, contributing to the heightened trading activity.

This surge in trading volumes is a testament to the resilience and long-term potential of the crypto market, reinforcing its position as a transformative force in the financial world.”

Binance still held a 73% dominance of the overall volume traded between April and June, with Coinbase controlling 9.5%.

C

.

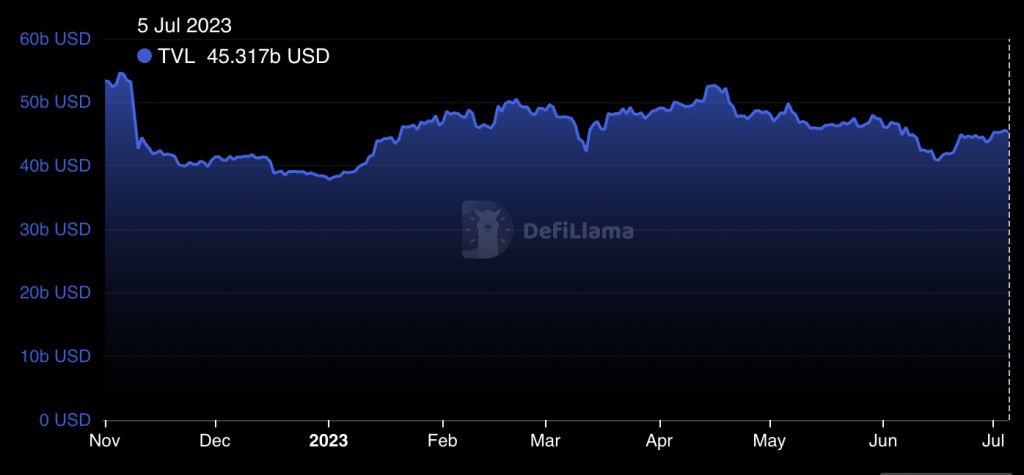

Total Value Locked On DEXs

“Total Value Locked (TVL) is a measure of the total value of digital assets that are locked or staked in a particular DeFi platform and is used to show the perceived trust investors have in the platform.”

Related News

Wall Street Memes – Next Big Crypto

- Early Access Presale Live Now

- Established Community of Stocks & Crypto Traders

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection – Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage