Chainlink (LINK) is currently experiencing significant momentum in the cryptocurrency market, leading to speculation that its value may increase to $30 in the near future.

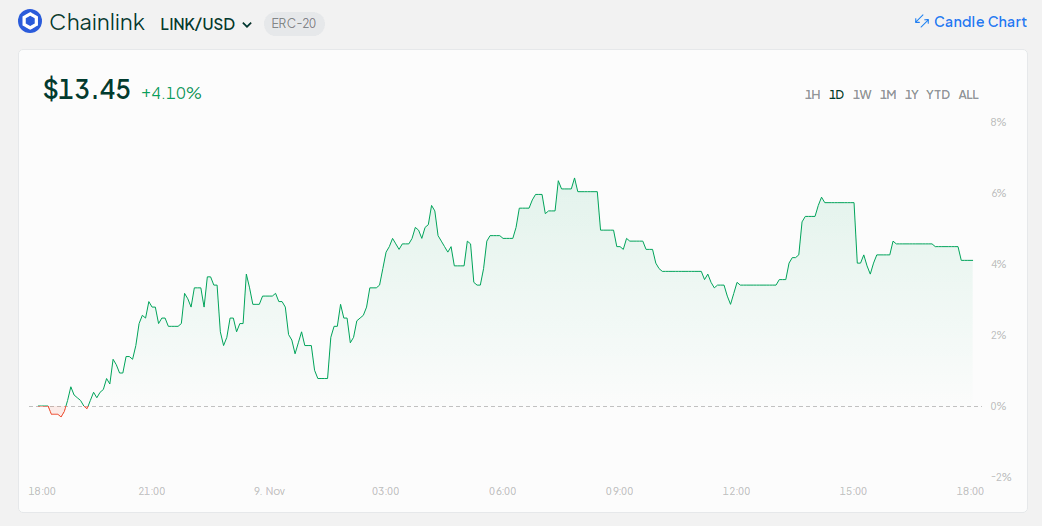

LINK, which is currently trading at approximately $13.45, has recently experienced a surge in price momentum, which is attributed to a number of critical factors that indicate additional upside potential.

Related Reading

Analysts especially find great interest in the technical framework of the token, whale activity, and more general market movements.

Whale buildup, lower exchange supply, increased on-chain activity, and bullish derivatives data favor Chainlink. If the bullish flag pattern breaks, World of Charts predicts LINK price might challenge $30 in the following weeks.

LINK breaching the $30 threshold would cause the crypto currency to surge 125%.

Whale Accumulation, Incentive For Optimistic Sentiment?

Increased whale activity is one of the primary factors contributing to the recent price movement of LINK. Over the past seven weeks, significant holders of the token, with balances varying from 100,000 to 10 million LINK, have amassed a staggering $370 million in LINK.

This marks the highest accumulation in three months, amounting to an 8.2% increase in holdings. Whale accumulation is frequently perceived as an indication of optimism regarding the health status of a token, as these investors are inclined to maintain their positions for an extended period.

More whale action is likely to have an effect on how people feel about the market as a whole. As moneyed individuals buy more LINK, regular buyers may do the same, which will raise its value even more. Since the price recently broke above $13.30 it has already sparked more interest in buying. In the event that LINK stays above this level, it might help the price rise toward $30.

Getting Ready For A Price Increase

One more thing that might make the price of LINK go up is that there is less pressure to sell on platforms. According to CryptoQuant data, LINK has seen a big rise in withdrawals from exchanges. On November 8, it hit a 30-day high.

Token removal from exchanges usually suggests that holders are not expected to be making any quick trades, thereby suggesting that the market is undergoing tightness. Given few tokens on exchanges, the price may climb quickly in reaction to any demand surge.

The declining sale pressure and the higher whale activity prepare the surroundings for a price explosion. If more investors start seeing LINK as a long-term investment—especially if demand keeps surpassing supply—the token may appreciate even more.

🧑💻 Here are crypto’s top Real World Assets (RWA’s) by development. Directional indicators represent each project’s ranking rise or fall since last month:

➡️ 1) @chainlink $LINK 🥇

➡️2) @synthetix_io $SNX 🥈

➡️3) @duskfoundation $DUSK 🥉

➡️4) @oraichain $ORAI

📈5) @skyecosystem… pic.twitter.com/t5nnyIWV0g— Santiment (@santimentfeed) November 5, 2024

Chainlink Development Activity Conducive To Long-Term Expansion

Apart from price behavior, Chainlink’s continuous expansion is another crucial factor inspiring individuals. The network’s creators have greatly stepped up their work; development activity in only the past month has surged by an astounding 4,000%.

Related Reading

Meanwhile, the partnership with financial giants like Swift, Euroclear, or UBS could only prove that Chainlink is a relatively new ally for aiding the financial sector in dealing with data fragmentation.

Chainlink’s real-time validation through the oracles of data might find it at the forefront of decentralized finance based on AI and blockchain. The more institutions begin to use Chainlink technology, the greater the utility and value, which can help back up sustained prices on the token.

Chainlink does look rather well-positioned for a potential rally in the near term, especially if ongoing development and whale accumulation continue to take place, combined with very strong technical indicators.

Featured image from Pexels, chart from TradingView