Chainlink is the leading middleware, linking on-chain dapps with external data securely. While the platform is critical in many crypto sectors, especially DeFi, LINK has recently struggled for momentum.

LINK Holders Moving Tokens From Exchanges: Are They Accumulating?

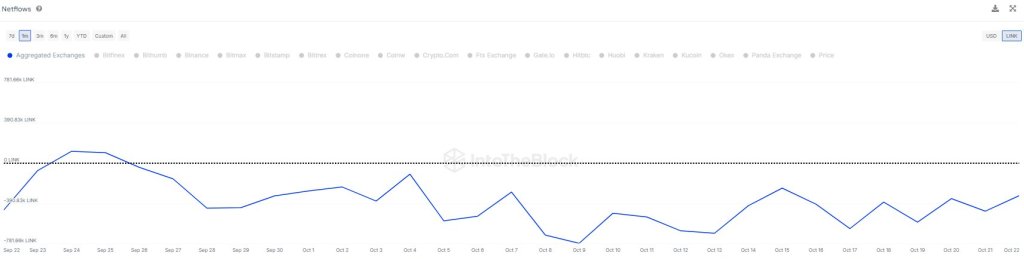

However, on-chain streams from IntoTheBlock reveal that more holders are moving tokens from top exchanges like Binance and Coinbase. In a post on X, the analytics platform observes that exchange flow over the past month has been negative, signaling sustained withdrawals.

Usually, whenever tokens are moved from exchanges, it could indicate that owners are confident of what lies ahead. Since LINK, the ERC-20 token, is supported by many DeFi protocols, it could suggest that holders are interested in engaging with these dapps, possibly earning passive income.

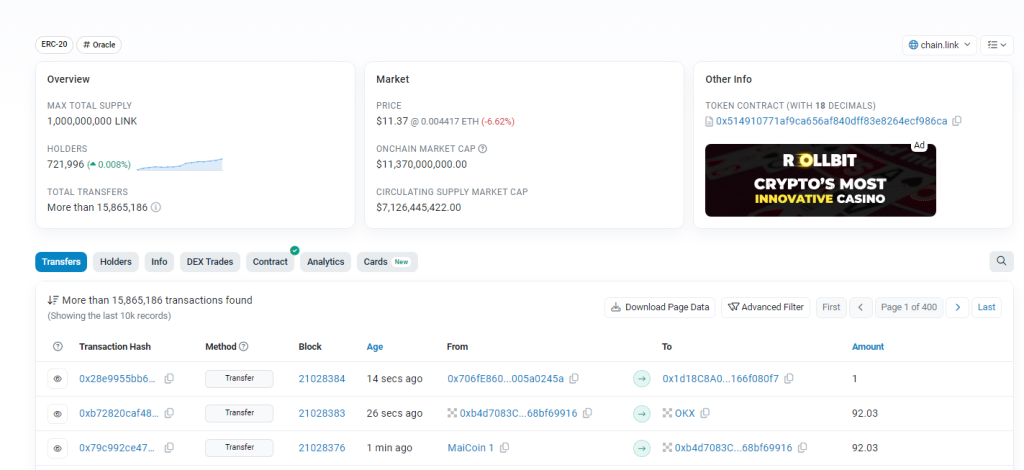

The more transfers from centralized ramps, the higher the likelihood of prices expanding in tandem, which is a net positive for LINK bulls. According to Etherscan, Chainlink has a top supply of 1 billion LINK distributed to 721,996 unique addresses when writing on October 23.

These holders have, in turn, moved LINK over 15.8 million times. A level deeper, onchain data reveals that Binance controls more than 4.2% of the total supply. LINK under their control exceeds $479 million at spot rates.

Chainlink Building: Will Price Break Above $20?

With IntoTheBlock data pointing to net outflows from exchanges, there is a chance that LINK will find support and resume the uptrend of the past few trading days. LINK has resistance at $12.3, and a double bar bear formation is printing out following the dip of early today.

However, even if prices break higher, rejecting bears, bulls must decisively expand above the double top at around $13. The eventual spike will open the door for LINK bulls to create a solid base for a rally to $20.

The pace of this growth depends on how top altcoins, including Ethereum, perform. If Ethereum prices recover, soaring above $3,000, it could reinvigorate DeFi and NFT demand, lifting LINK.

Beyond this, price drivers will include the team’s progress. Yesterday, October 22, Chainlink Labs launched the Cross-Chain Interoperability Protocol (CCIP) Private Transactions. This feature enables data privacy without violating existing laws guarding cross-chain transactions.

The solution uses the middleware’s Blockchain Privacy Manager. This way, partner banks and other financial players can securely connect private chains with other ledgers whenever they share sensitive information.