Bitcoin is moving sideways at press time, absorbing the wave of selling over the last week. Even though there are some optimists, the candlestick arrangement in the daily chart points to weakness.

This preview, at least from a technical angle, remains as long as prices trend below the round number of $60,000 and the liquidation level at around $66,000.

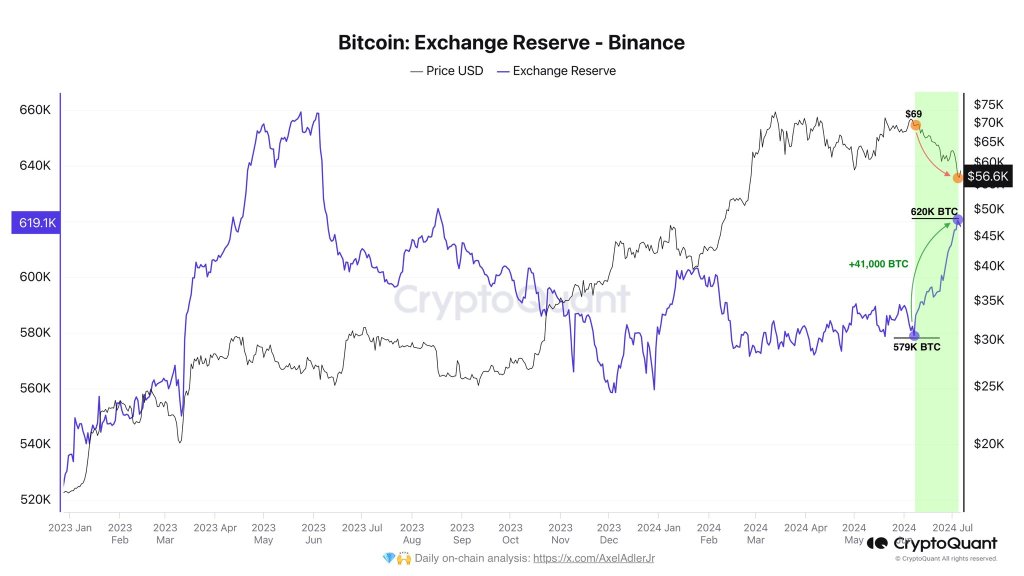

Binance Bought The Bitcoin Dip

Amid the recovery, one analyst, pointing to interesting on-chain data, observed that when prices fell last week, some unnamed exchanges were loading up the dip. It is now emerging that Binance, the world’s largest exchange by client count, was actively accumulating.

CryptoQuant data shows that Binance increased its reserves by 41,000 BTC over the last bear run when prices corrected from $72,000. Buying on dips is strategic, considering the exchange’s obligation, especially for users seeking to convert other tokens for BTC on the fly instantaneously.

Related Reading

During this time, Ki Young Ju also noted that “permanent holders,” entities who tend to HODL and not move coins, have been accumulating. These addresses, excluding spot Bitcoin exchange-traded fund (ETF) issuers, exchanges like Binance and Coinbase, or miners, added 85,000 BTC in the last month. During this time, spot Bitcoin ETF issuers decreased their holding by 16,000 BTC.

While some entities were scrambling for the exits, others saw this as an opportunity to double down, loading on every retracement. Their involvement has helped stabilize prices, improving sentiment shredded after last week’s dump to as low as $53,500.

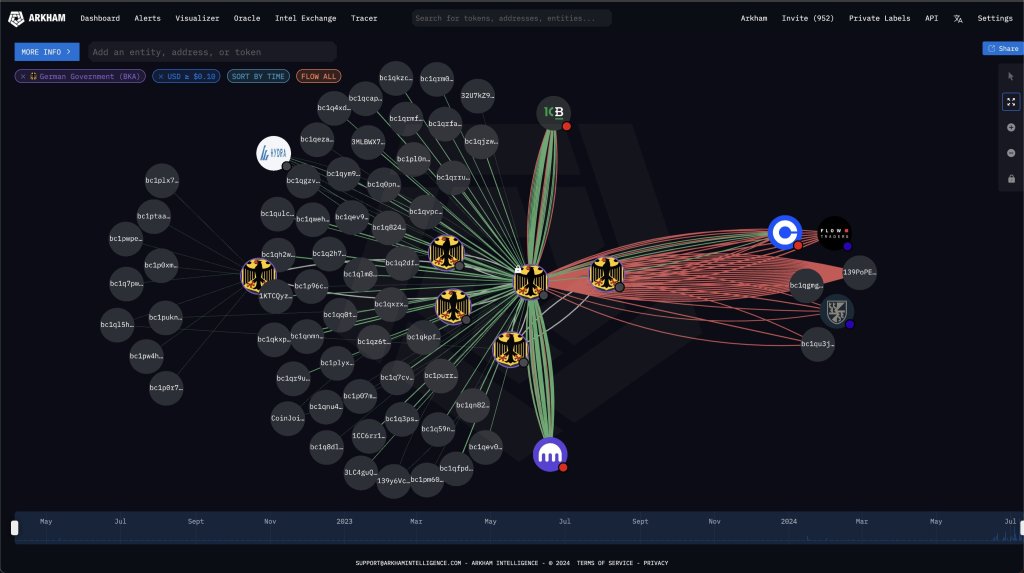

German Government Offloading More BTC

Even as the “diamond hands” buy the dip, the German government is not stopping; looking at Arkham Intelligence data. Today, on July 11, they moved another 3,250 BTC, on top of the 5,627 sent earlier, to multiple market makers and exchanges, including Bitstamp.

Their decision to sell is heaping more pressure on the coin, slowing down the uptrend. Even amid sustained outflows from the German government, a Coingecko survey shows that most respondents, especially investors, are upbeat.

Related Reading

Meanwhile, traders and speculators have mixed sentiments. While 39% of traders are upbeat, expecting prices to recover, another 33.5% of those surveyed are bearish. Most speculators, or 42.4% of those surveyed, are bearish, expecting prices to continue tanking.

Feature image from DALLE, chart from TradingView