In September of 2022 Ethereum 1.0 (ETH) will finally merge with the Beacon chain and migrate to the Proof of Stake (POS) consensus mechanism, creating Ethereum 2.0.

This will be a huge event both for the blockchain industry in general and for Ethereum and Ethereum Classic (ETC) in particular, as the former will become a large Proof of Stake smart contracts financial and dapp ecosystem and the latter will become the emerging and largest Proof of Work (POW) smart contracts financial and dapp ecosystem in the world.

However, there is the possibility that a group of miners will fork Ethereum 1.0, not migrate to POS, and try to position the new forked chain as a base layer POW network. This new network will be called Ethereum Work, Ethereum POW or similar, and its cryptocurrency symbol will be ETHW.

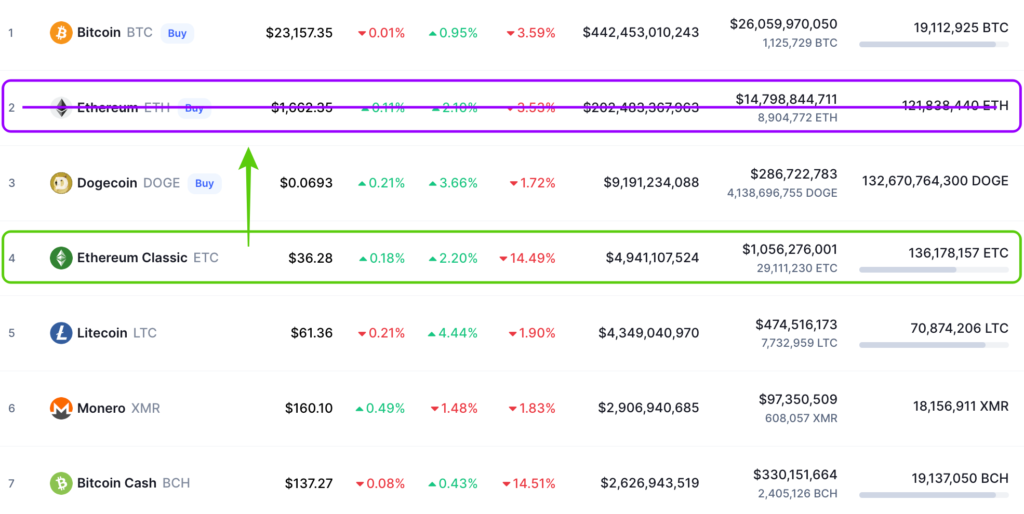

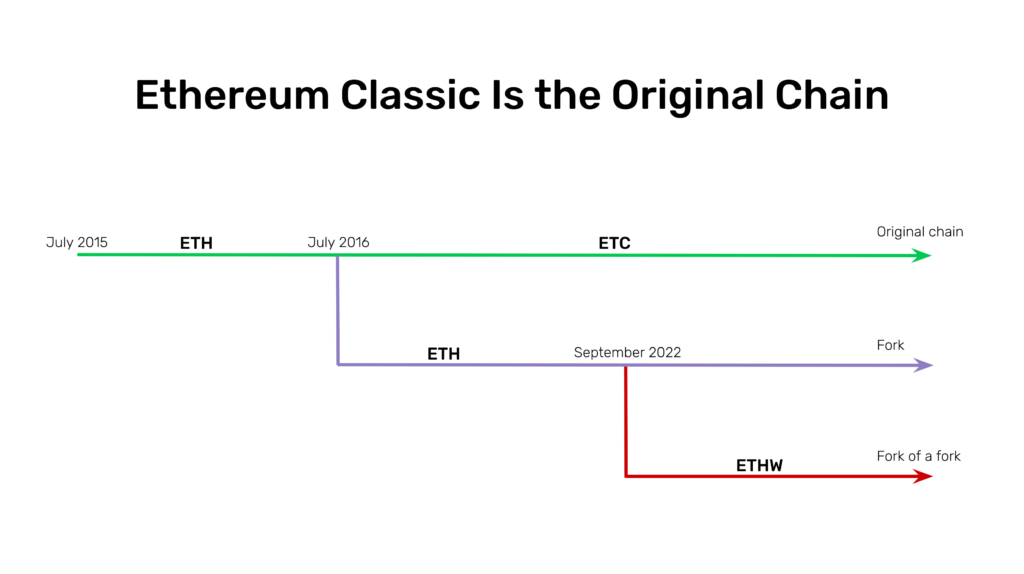

The first thing to clarify is that Ethereum is, indeed, a fork of the original blockchain and that Ethereum Classic is the original chain.

This is because Ethereum chose to reverse funds from a hacked dapp in July of 2016, and Ethereum Classic decided to honor the strong ethos of immutability and “Code Is Law” that was the original promise of unstoppable decentralized blockchains and applications.

The second thing to clarify is that Ethereum POW will be a fork of the fork.

In other word, a fork of Ethereum, which is a fork of the original Ethereum Classic, hence “fork of a fork”.

Why Will ETHW Fail?

There are several reasons I cited in the past of why any POW residue of Ethereum 1.0 would fail, this is the list that I posted in my 2019 article:

In my opinion, a marginal ETH 1.x would be, in any case, a low quality, low value residue of ETH because:

– 100% of accounts, balances and dapps will be duplicated on ETH 2.0.

– ETH 2.0 will have higher performance and scalability.

– The monetary base will also be duplicated after they split.

– ETH 1.x has no clear monetary policy.

– It would have to fork again to establish a monetary policy.

– A new monetary policy will not be credible.

– It is extremely bloated.

– It contains the precedent of an irregular state change.

– It would create a redundancy at the base layer.

However, as we have learned more about how these networks evolve in the last few years, there are more reasons that practically guarantee the failure of the new fork of a fork:

- Forks of forks, as evidenced by Bitcoin SV (BSV) and others, usually fall into obscurity, lose value, and fail.

- As they lose value, they become the target of constant 51% attacks and become unstable and insecure.

- The large stablecoin, wrapped coin, and dapp ecosystem of Ethereum is unforkable* as they largely depend on external pegged assets that are impossible to fork, therefore a considerable amount of disruption and broken dapps, including an interrupted chain of inter-dapp assets and liabilities, will be left unusable on the residue of ETHW.

- As ETHW will have to make several core changes to its protocol, including changing its monetary policy to subsidize miners, it will immediately lose any marginal Lindy effect it had and would take it years, if not decades, to recover from that sudden crash of credibility.

Summary

ETC Is the Original Chain. ETH Is a Fork. And ETHW Is a Fork of a Fork.

Ethereum POW (ETHW) will fail.

Ethereum Classic will inexorably become the largest smart contracts proof of work blockchain and ecosystem in the world.

* I wish to thank Bob Summerwill, Executive Director of the ETC Cooperative, for alerting me of the Ethereum unforkability phenomenon.

Code Is Law