With the general crypto market still facing heightened volatility, Ethereum has once again failed to reclaim the pivotal $3,000 price level. Bearish pressure continues to linger in its price action, leading to speculations about its potential in the short term. Although ETH has failed to experience a major surge, analysts believe the altcoin could see a turnaround towards the upside shortly.

Ethereum Gearing Up For A Bullish Run?

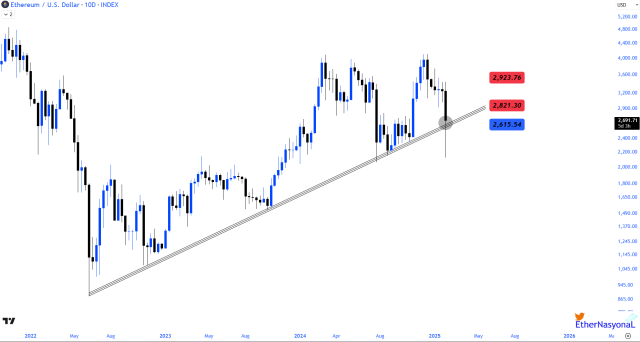

Ethereum may have seen a notable decline in the last few days, but Ether Naysonal, a market expert and trader is unshaken about the heightened volatility. According to the technical expert, “ETH is still in its major uptrend,” indicating resilience amid broader market volatility.

Despite occasional pullbacks, the expert cites that ETH continues to hold key support levels, reinforcing optimistic sentiment among investors. With the altcoin maintaining its uptrend, it could pave the way for a potential breakout toward higher levels in the upcoming weeks.

Ether Naysonal highlighted alongside maintaining its major uptrend, ETH has also consistently held the $2,615 support level, which is good for its price action. However, for Ethereum to make a quick recovery, it must at least close above the $2,820 mark for one day.

A close above the $2,820 level would likely reignite bullish momentum for the altcoin again. Meanwhile. the much-anticipated pump will be triggered if the candle closes above $2,923.

Ethereum has experienced remarkable adoption and interest in spite of occasional price corrections. This growing institutional interest coupled with rising on-activity might serve as key factors bolstering the expected upside move.

Ether Naysonal has questioned the actions of individuals presently offloading their ETH holdings despite institutional investors accumulating ETH at a huge scale. Major companies are currently seen acquiring ETH in current market conditions.

Financial behemoth and asset manager firm Blackrock has purchased over 100,535 ETH, valued at $284 million. Furthermore, asset management company Fidelity has also acquired about 9,552 ETH, worth around $26.39 million.

While the biggest global investment institutions are still purchasing, the analyst asserts it is completely illogical for individual investors to sell after being exposed to misleading waves within a short period.

A Surge To New All-Time High Imminent

Several bullish structures have emerged on ETH’s chart, suggesting a possible rebound in the short term. With upside momentum building for ETH, the asset may be set for a rally toward a new all-time high.

After examining Ethereum’s price action, market expert Jonathan Carter highlighted that the asset is still trading within a Symmetrical Triangle pattern in the weekly time frame. Carter noted that liquidity was collected below support by recent downward wicks before returning to the pattern.

Once ETH breaks out of the ascending triangle, Carter anticipates a push towards higher targets such as $3,100, $4,000, $4,850, $6,000, and $7,500 in the long term.

Featured image from Unsplash, chart from Tradingview.com