beginner

As more and more people become interested in investing in cryptocurrencies, it’s important to know which exchanges are the best to use. With so many options out there, how do you determine which crypto platforms are trustworthy and secure?

Cryptocurrency exchanges are online platforms where you can buy, sell, and trade digital assets. Individuals can invest in cryptocurrencies there and potentially profit from their value fluctuations. However, conditions offered by exchanges may vary. Therefore, it’s important to do your research before choosing one to invest in cryptocurrencies.

Some platforms have higher fees, longer processing times, or lower security measures than others. To help you make an informed decision, I’ve compiled a list of the best crypto exchanges for buying, selling, and trading digital assets.

Hello, my name is Zifa. For the past three years, I’ve delved deep into the world of cryptocurrency, penning my insights and analyses. With my experience, I’ve garnered a unique perspective on crypto exchanges, and I’m eager to share my observations and thoughts on the evolving landscape.

How I Picked Top Crypto Exchanges for This List

In selecting the best crypto exchanges, I combined a detailed analysis with a rigorous methodology.

Security was paramount, for I wanted to emphasize exchanges with robust measures and minimal vulnerabilities. Regulatory compliance, a diverse range of tradable cryptos, and fee structures were also pivotal in the evaluation.

I prioritized user experience, ensuring platforms catered to both novice and seasoned traders. Liquidity, trading volume, and the availability of mobile apps were considered as indicators of reliability and convenience.

Additionally, the quality of customer support and community feedback played a significant role in the decision-making process.

The culmination is a list that represents exchanges that are not only technically sound but also user-centric and offer both functionality and trustworthiness. So, with our methodology out of the way, here are my picks for the best crypto exchanges in 2023.

Kraken: Best Crypto Exchange for Experienced Traders

Kraken is one of the oldest cryptocurrency trading exchanges: it has been in operation since 2011. The exchange has continued to grow in popularity thanks to its user-friendly platform and competitive trading fees.

One of the standout features of Kraken is its tiered fee structure on Kraken Pro. This allows high-volume traders to save significantly on trading fees as they move up through the tiers. With lower fees, traders can make more profitable trades, which can be especially beneficial for frequent traders.

Kraken Pro is Kraken’s professional-grade trading platform, which is perfect for more experienced traders. The platform offers highly customizable chart analysis tools, giving traders a detailed insight into order books. Kraken Pro boasts 13 order types and high-speed execution, ensuring that traders can execute trades quickly and efficiently.

In addition to low fees and Kraken Pro, Kraken also has margin and futures trading. This allows experienced traders to trade with leverage, increasing their profit potential. By offering these advanced trading options, Kraken has become a popular choice for professional traders looking to maximize their profitability.

Based on my expertise, Kraken seems to be an excellent choice for novice and experienced traders alike. With its low fees, tiered fee structure, customizable chart analysis tools, and margin and futures trading, Kraken has all the features a trader could want in a cryptocurrency exchange.

When it comes to cryptocurrency exchanges, Coinbase stands out as the best option for beginners. This is largely due to its user-friendly design and strong security measures.

Coinbase offers a wide range of supported cryptocurrencies, including popular options such as Bitcoin, Ethereum, and Bitcoin Cash. With its easy-to-use interface, users can quickly buy and sell these coins without the need for advanced trading tools or extensive knowledge about the market.

One can say that security is a top priority for Coinbase because the platform utilizes industry-leading measures such as two-factor authentication and cold storage for digital assets. This gives users peace of mind as they know that their cryptocurrencies are safe and secure on the platform.

Coinbase supports a variety of payment methods, including bank transfers, credit cards, and debit cards. The platform also offers custodial and non-custodial wallets, allowing users to store their digital assets either on the platform or in an external wallet.

However, it’s important to note that Coinbase’s trading fees can be higher compared to other exchanges, which may negatively impact profitability for frequent traders. Additionally, the platform has been criticized for its poor customer service. So, users who need assistance may find this fact frustrating.

From my—and not my alone, there are experts who recommend it as an ideal starting point too—perspective, Coinbase is arguably the best gateway for those venturing into the realm of cryptocurrencies. I second that its user-friendly interface is tailored for beginners, and, coupled with its robust security measures and a broad spectrum of supported coins, Coinbase has a lot going for it.

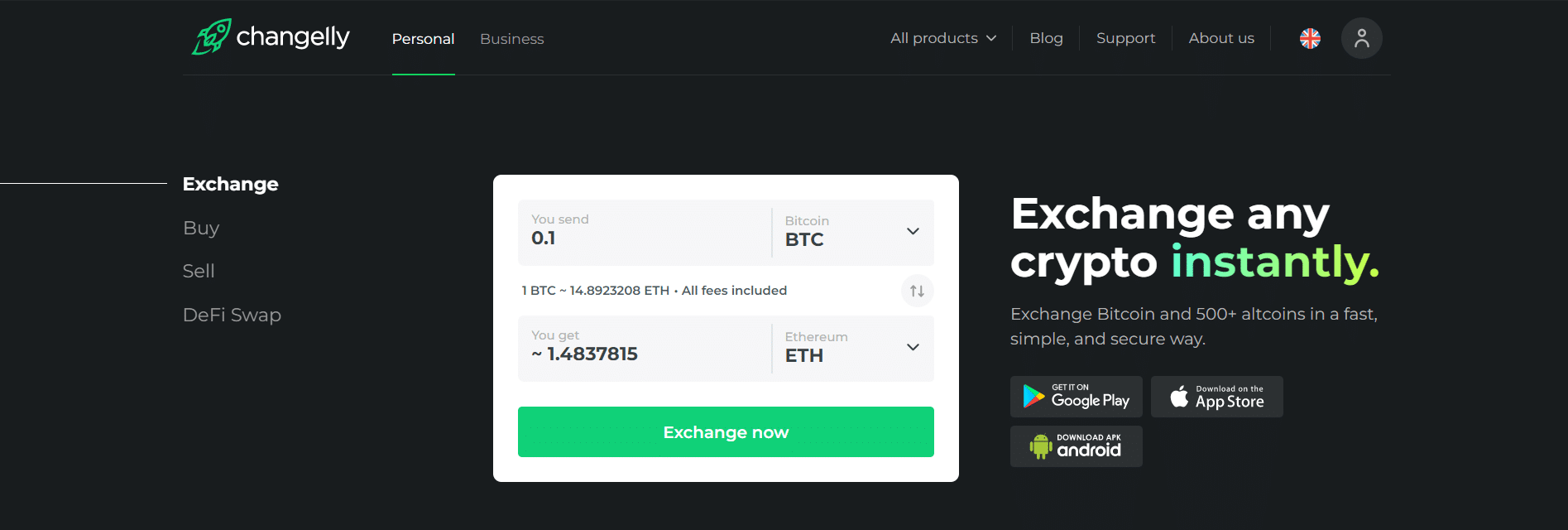

Changelly: Top Choice for Asset Variety and Speed

Changelly sets itself apart in the crypto exchange landscape by functioning as an aggregator. This means that it assembles rates and liquidity data from multiple partners, acting as an information hub. This unique feature allows users to identify and choose the most advantageous offers at any given time, making it a vital tool for savvy investors.

Housing more than 400 digital assets for purchase and exchange, Changelly boasts an impressive variety that caters to a broad range of investment interests. From major players to emerging coins, this extensive selection allows users to diversify their portfolios without having to switch between platforms.

Another strong point in favor of Changelly is its fair and transparent fee structure. The platform is known for its reasonable costs that don’t eat into your profits, making it a financially sound choice for regular users. Coupled with its speedy transaction time, it further enhances the user experience by ensuring that trades can be executed quickly.

Its convenience and range of features have made Changelly a favored platform among seasoned crypto enthusiasts. The platform’s design, which combines efficiency with ease of use, allows users to streamline their trading activities, optimizing their time and financial investments. Therefore, whether you are a seasoned investor looking for an efficient way to manage your trades or a newcomer aiming to broaden your digital asset portfolio, Changelly provides a comprehensive and user-friendly platform to meet your needs.

Crypto.com: Best Cryptocurrency Exchange with Top-Notch Mobile Application

When it comes to the best mobile app for crypto traders, Crypto.com is worthy of attention. This mobile app allows users to buy, sell, trade, and earn interest on their crypto, as well as pay with crypto.

Crypto.com provides a vast digital asset ecosystem consisting of its own blockchain, Crypto.org Chain, a native token called CRO, a crypto Visa card, yield-generating crypto products, and more. This ecosystem allows for a diverse range of functionalities weaved into a single network.

One of the biggest advantages of using Crypto.com is its vast selection of cryptocurrencies, encompassing almost 300 options. This crypto platform also supports over 20 fiat currencies, which rightly contributes to its positioning as a one-stop shop for crypto traders. Additionally, the minimum amount needed to fund an account is relatively low, which makes it accessible to individuals with lower budgets.

Crypto.com ensures quick crypto withdrawals without any complexities, which appeals to users seeking fast and hassle-free crypto transactions.

However, it’s important to mention that Crypto.com has higher fees compared to other cryptocurrency exchanges, which may impact profitability for frequent traders. Additionally, the platform has been criticized for its poor customer support.

To sum it up, Crypto.com’s mobile app is a comprehensive tool, offering functionalities like buying, selling, and even earning interest on crypto. As my observations suggest, its holistic digital asset ecosystem, which includes the Crypto.org Chain, the native CRO token, a crypto visa card, and yield-generating products, positions Crypto.com as a one-stop solution. While I acknowledge that its fees are on the higher side compared to some competitors, I think that the swift withdrawals and extensive cryptocurrency support make it a viable choice for traders across the board.

Gemini: Best Crypto Exchange for Security

Gemini is an excellent cryptocurrency exchange for those who prioritize security above all else. This platform is one of the most trusted major exchanges in the industry, courtesy of its stringent security protocols.

One of the ways Gemini ensures the protection of user assets is through their hot wallet insurance policy. This means that any assets held within the exchange’s hot wallet are insured, providing an added layer of protection for customer funds.

Gemini is also SOC 2-certified, meaning that it meets a set of strict security and operational standards set by the American Institute of CPAs. This certification is only awarded to companies that demonstrate a high level of security and compliance.

To further safeguard user assets, Gemini encourages users to utilize two-factor authentication and device approval. Furthermore, the exchange employs advanced cold storage techniques to store user assets offline, preventing unauthorized access.

In terms of crypto exchange fees, Gemini charges an industry-standard 0.35% fee of 0.35% for trades under $200 and lower fees for higher-volume trading. While this may seem steep compared to other global crypto exchanges, the added security measures and insurance policy make it worth the extra cost for security-conscious users.

Gemini also supports over 100 digital currencies and tokens, providing users with a wide range of options to trade and invest in.

If ensuring top-notch security is your main concern in cryptocurrency trading, then I’d highly recommend Gemini. I think that its hot wallet insurance policy, coupled with the SOC 2 certification, two-factor authentication, device approval, and state-of-the-art cold storage techniques, showcases its commitment to safeguarding user assets.

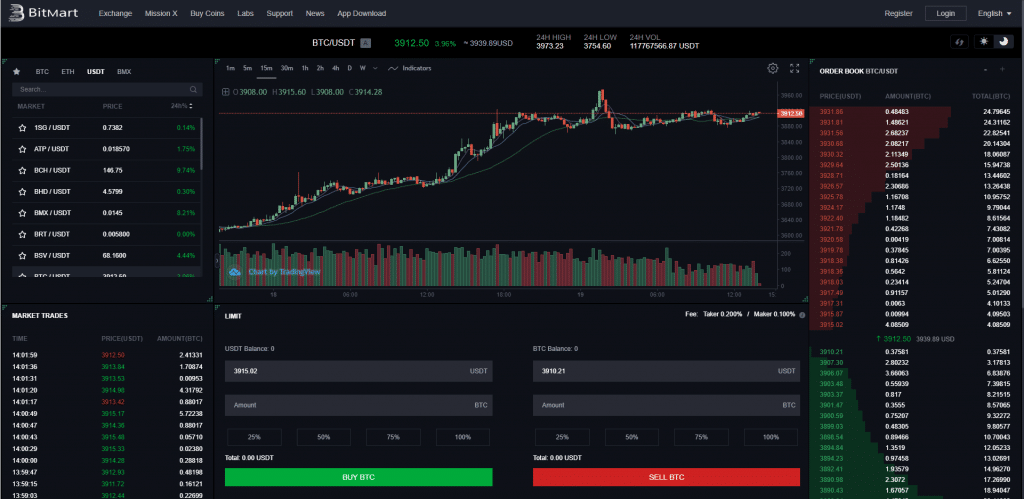

BitMart Exchange: Best for Altcoins

BitMart Exchange is a great option for traders looking to invest in altcoins. The platform offers a range of features that make it an ideal choice for anyone seeking to diversify their portfolio with cryptocurrencies beyond well-known assets.

One of the main advantages of BitMart is its wide range of altcoins available for trading. Currently, the platform supports over 400 cryptocurrencies and provides access to more than 800 trading pairs. This extensive range ensures that crypto traders can invest in a diverse portfolio of altcoins to meet their needs.

Another key feature of BitMart is its Earn tool which enables users to earn interest on their crypto assets. This feature is a welcome addition for users who want to hold long-term positions in their cryptocurrencies and earn passive income from their holdings.

Despite its advantages, BitMart is not without its drawbacks. In 2021, the platform suffered a hack that affected several users and left them exposed to potential security risks. Besides, customer feedback has not always been positive: some users were dissatisfied with the platform’s support team.

One way that BitMart seeks to address these issues is through its native token, BMX. Users who trade BMX and hold it can enjoy discounted trading fees. That’s why frequent traders who wish to save on transaction costs may find this asset valuable.

Based on my expertise, BitMart Exchange stands out for those keen on diving into the altcoin market. Its vast array of cryptocurrencies, trading pairs, and the enticing opportunity to accrue interest on crypto assets make it a compelling choice for enthusiasts in decentralized finance. However, I’d advise exercising caution and being aware of the 2021 hack incident to ensure informed trading decisions.

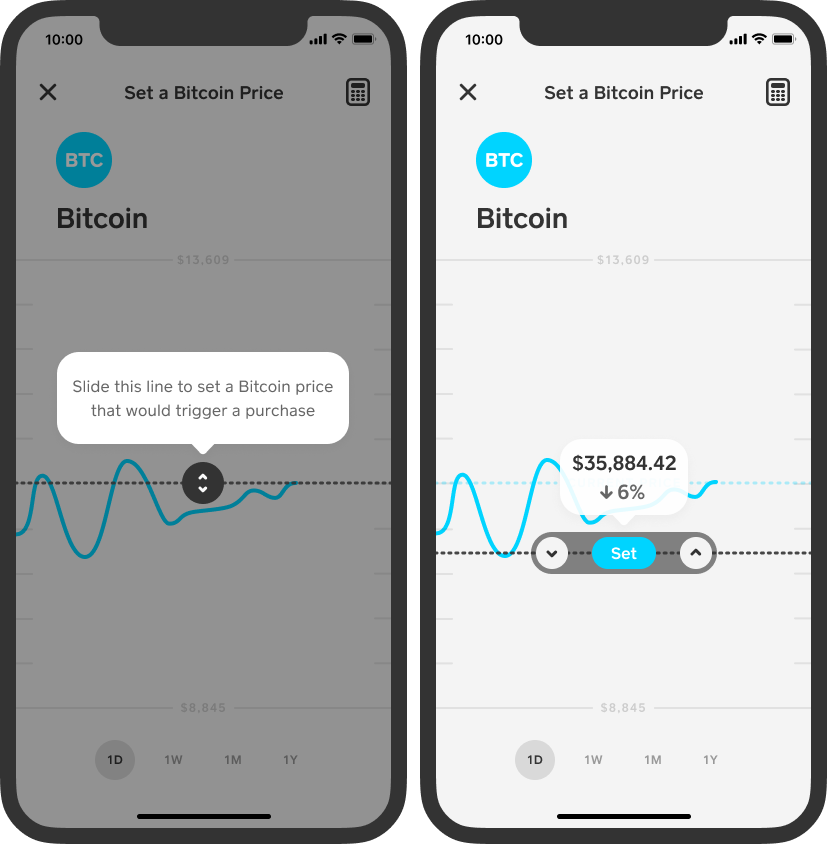

Cash App: Best Platform to Trade Bitcoin

Cash App is the top choice for those who appreciate a user-friendly interface and look to buy, sell, and store Bitcoin. Being a mobile banking app, it is geared towards peer-to-peer payments with an investment component, allowing users to invest in stocks, ETFs, and Bitcoin.

One of the significant advantages of Cash App is its straightforward process of buying and selling Bitcoin. Users can easily deposit funds into their Cash App account and convert them into Bitcoin. Additionally, users can withdraw Bitcoin to external wallets. This feature gives them full control over their assets.

Cash App also supports the Bitcoin Lightning Network, ensuring speedy and low-cost transactions for users.

However, since it is a custodial wallet, users must trust Cash App to hold their Bitcoin on their behalf. Cash App’s cryptocurrency options are limited beyond Bitcoin. Therefore, those users who’d rather diversify their portfolio may consider it unsuitable.

To sum it up, for those primarily focused on Bitcoin investments and craving a streamlined experience complemented by mobile banking features, I’d say Cash App is your best bet.

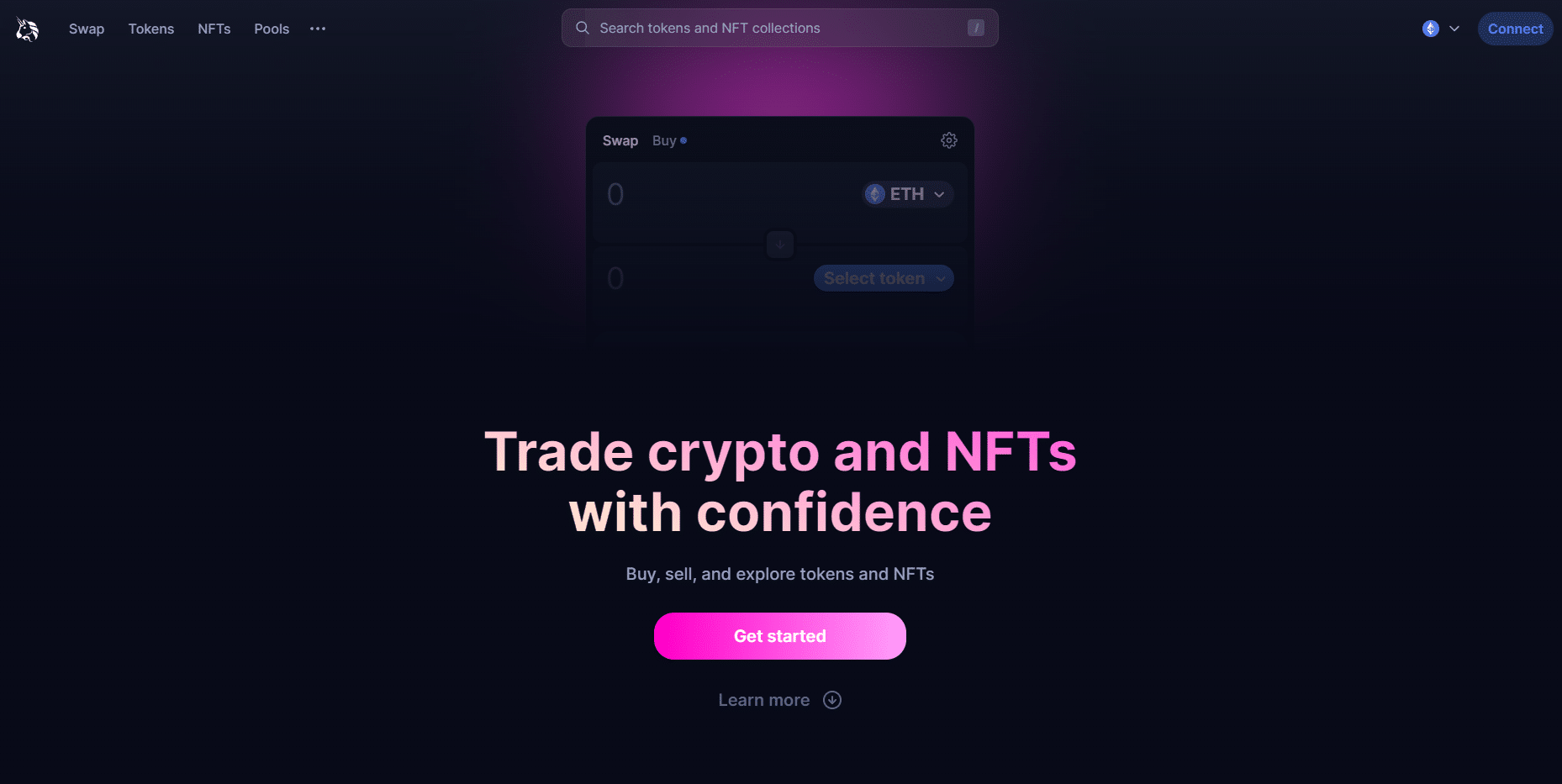

Uniswap: Best Decentralized Exchange

If you’re a cryptocurrency trader, you might want to take notice of Uniswap. Uniswap, a decentralized exchange that runs on the Ethereum blockchain, is quickly gaining popularity in the crypto world. Decentralized exchanges enable direct trading between buyers and sellers without intermediaries, functioning as a peer-to-peer marketplace. Uniswap uses an automated market-making system. This means that assets (specifically, ERC-20 tokens) are exchanged via smart contracts instead of the order book.

One of the key benefits of Uniswap for traders is its open liquidity pools, which ensure high liquidity for the assets traded on the platform. Additionally, compared to centralized exchanges, Uniswap’s fees are often significantly lower, making it a cost-effective option for traders. Moreover, there are minimal barriers to entry for anyone with an Ethereum wallet, which means that the exchange is accessible to a wide range of users.

Uniswap is also popular among traders who value independence and decentralization. It allows for seamless token swaps without the need for a trusted third party. This means that Uniswap users can retain control of their digital assets without relying on intermediaries or centralized authorities.

I think we all agree that Uniswap has impressively ascended to the pinnacle of decentralized exchanges, largely due to its innovative take on automated market-making, competitive fees, and impressive liquidity. If, like me, you cherish the principles of independence and decentralization, I’d suggest giving Uniswap a whirl. It not only offers a plethora of ERC-20 tokens but also ensures a smooth and user-friendly journey for anyone equipped with an Ethereum wallet.

Guide for Choosing the Best Crypto Exchange

Cryptocurrencies have become popular financial assets, and with their increasing popularity comes a higher demand for reliable and trustworthy cryptocurrency exchanges. Choosing a cryptocurrency exchange might seem like an easy task, but it requires careful consideration of several important factors, such as security, fees, and available cryptocurrencies. In this guide for choosing the best crypto exchanges, we’ll take a closer look at these aspects and provide details on some of the best exchanges in the market.

Regulation

The regulatory landscape for cryptocurrency exchanges is constantly evolving. Yet, it is important for investors to understand the regulations that affect the selection process. Considering that the popularity of digital assets and cryptocurrencies is on the rise, governments are seeking to regulate the industry to protect consumers and prevent illegal activities such as money laundering and terrorism financing.

Several regulatory licenses are available for crypto exchanges, each of them important for maintaining security and customer service standards. One of the most common licenses is a money transmitter license, which allows exchanges to operate within a specific state or country. Another weighty license is the digital asset exchange license, which regulates the trading of digital assets.

Currently, there are several countries that regulate crypto assets with laws and regulations that apply to exchanges. In the United States, for example, digital assets are regulated by the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN). Japan has also established a regulatory framework for digital assets, and the Financial Services Agency oversees crypto exchanges.

Investors should be wary of unregulated crypto exchanges, as they pose greater risks. These exchanges operate without government oversight, and their security and customer service standards may be subpar. Additionally, investors may be at risk of losing their digital assets if the exchange is hacked or goes bankrupt.

In summary, regulatory licenses play an important role in the security and customer service standards maintained by cryptocurrency exchanges. Countries are increasingly regulating crypto assets, allowing investors to have greater confidence in the industry. However, the lack of regulations for unregulated crypto exchanges poses greater risks for investors. It is important for investors to do their research and only choose exchanges that are properly regulated to minimize risk.

Tradable Cryptos

Since the assortment of available cryptos is crucial for effective portfolio management and diversification, one should not disregard this aspect when choosing a cryptocurrency exchange.

Two of the top exchanges in this regard are OKX and eToro. OKX offers more than 370 different cryptos for trading, including major coins such as Bitcoin, Ethereum, and Bitcoin Cash, as well as a wide range of altcoins. This allows for significant diversification and the ability to take advantage of different market trends.

eToro, on the other hand, offers up to 20 different cryptos, including Bitcoin, Ethereum, Ripple, and Litecoin. While the cryptocurrency selection is smaller than on OKX, eToro is known for its user-friendly platform and social trading features.

Other exchanges may have a more limited selection of cryptos, so it’s important to carefully consider this factor before choosing an exchange. By selecting an exchange with a wide range of tradable cryptos, investors can effectively diversify their portfolios and take advantage of different market opportunities.

Fees

Fees are yet another thing worthy of careful consideration, especially if you plan to make frequent trades or deposits. Actually, exchanges charge several types of fees, including deposit fees, trading commissions, and transaction fees.

Some exchanges charge flat deposit fees, while others charge percentage-based fees that vary depending on the payment method. For instance, Coinbase charges a flat fee of $10 for wire transfers, whereas their fee for credit and debit card purchases equals 3.99%. Binance, on the other hand, imposes no deposit fees for bank transfers, yet they charge a 1.4% fee for credit and debit card deposits.

In terms of trading commissions, exchanges often charge a percentage-based fee on each trade. To illustrate this point, let’s turn to Kraken: they charge a fee of 0.16% for maker trades and 0.26% for taker trades. In contrast, Coinbase charges a flat fee of $0.99 and 1.49% for trades under $10 and above $10, respectively.

Some exchanges offer reduced trading fees for high-volume traders or for those who pay fees in the exchange’s native token. Binance, for instance, has a tiered fee structure with reduced commissions for users with high trading volumes. Additionally, Binance offers a 25% discount on trading fees for users who pay them in Binance Coin (BNB).

However, centralized exchanges often have high transaction fees due to their heavy use of on-chain transactions. For instance, Coinbase charges a transaction fee of $2.99 for transactions under $200 and a fee of 1.49% for transactions over $200. This can make frequent trading and small transactions quite expensive.

Overall, when choosing a cryptocurrency exchange, it is important to consider the deposit and trading fees and factors that may potentially reduce them. Additionally, it is important to remember that centralized exchanges may charge higher transaction fees.

Crypto Wallet

In the world of cryptocurrency exchanges, digital wallets play a crucial role. In simple terms, wallets are digital containers that hold the keys to accessing your cryptocurrencies. Without a wallet, it is impossible to store tokens and conduct transactions on an exchange.

While some exchanges provide a proprietary wallet for their users, others do not. This means that traders must use a private wallet to store their tokens. Private wallets offer more security and control over your tokens since the users hold their private keys. However, using a private wallet can also be more complicated, and users must ensure that they keep their private keys safe.

In contrast, exchanges like eToro offer a native wallet app that makes it easy for users to store and manage their tokens. The eToro wallet app provides a simple and secure method of storing, sending, and receiving cryptocurrencies.

In contrast, exchanges like eToro offer a native wallet app that makes it easy for users to store and manage their tokens. The eToro wallet app provides a simple and secure method of storing, sending, and receiving virtual currencies.

In conclusion, wallets are an essential aspect of cryptocurrency exchanges. Whether you choose to use a proprietary wallet, a native wallet app, or a private wallet, it is crucial to ensure the safe storage of your tokens. With the right wallet, traders can enjoy a seamless and secure trading experience on a variety of exchanges.

Tools & Features

Cryptocurrency exchanges offer more than just a platform for trading digital assets. Many exchanges now provide their users with a range of tools and features that aim to enhance their trading experience. These tools provide investors with the necessary resources to make informed decisions while offering extra income opportunities.

Copy trading is a feature found on eToro, allowing beginners to copy the trades of experienced investors. This feature enables new investors to learn the ins and outs of trading. When executed correctly, copy trading can be a profitable strategy. Additionally, eToro’s native wallet app allows users to store and manage their tokens easily.

Passive income is a popular tool among investors because it allows them to generate income without actively managing their investments. This is where OKX’s crypto savings account comes in handy. Investors can earn interest on their unused tokens. This is undoubtedly an attractive option for those who want to make additional income with minimal effort. Furthermore, OKX’s non-custodial wallet provides users with full control over their private keys, ensuring extra security.

For advanced traders, Binance offers an extensive range of crypto derivatives, such as futures and options. These derivatives let traders invest in the performance of cryptocurrencies using leverage, which can result in high returns. Binance’s platform also provides users with advanced trading tools, such as margin trading, allowing investors to execute complex trading strategies.

In conclusion, investors should consider the tools and features available when selecting a cryptocurrency exchange. These extra resources can make a significant difference when it comes to investment success. From copy trading for beginners to crypto derivatives and advanced trading tools for experienced investors, the top exchanges offer a wide range of options to cater to every investor’s needs.

Payment Methods

Access to a variety of payment methods is a must when engaging in crypto purchases and sales. Top cryptocurrency exchanges offer a range of options, including debit/credit cards, e-wallets like PayPal and Neteller, and local bank transfers like ACH and SEPA.

Debit and credit card payments are popular among many traders due to their convenience and accessibility. They are an easy way to fund your exchange account in real-time. However, they come with higher transaction fees compared to other payment methods. These fees can range from 3% to 5% for every transaction.

E-wallets like PayPal and Neteller, commonly accepted by various crypto exchanges, are great options for traders who prioritize speed and security. However, there are fees associated with these payment methods too: some exchanges charge around 2% of the total transaction.

Local bank transfers like ACH and SEPA are ideal for traders who seek lower fees and don’t mind waiting for the payment to be processed. These payment methods usually have lower transaction fees compared to credit/debit cards, but they can take longer to complete. The fees for local bank transfers usually range from 0% to 2%.

eToro, one of the leading crypto exchange platforms, offers its users a no-fee deposit option in US dollars — a great option to save more on transaction fees. However, certain exchanges may charge higher transaction fees for larger volume trades, which can add significant costs in the long run.

In summary, the best payment method for a trader depends on their priorities, be it convenience, speed, or cost-effectiveness. It’s essential to evaluate each payment method’s associated fees and examine the exchange’s overall fee structure to ensure that there are no hidden costs.

Customer Service

Customer service is a crucial factor to consider when choosing the best exchange for your needs. With the increasing popularity of cryptocurrencies and the rapid growth of the industry, it is inevitable that users will need assistance from time to time, whether it be for crypto exchange account issues, technical difficulties, or general inquiries.

Having access to reliable customer service is essential for a positive user experience. This is especially important for beginners who may need assistance navigating the platform and understanding the features. A responsive and knowledgeable support team can help users feel confident in their trading decisions and enhance their overall experience with the exchange.

Cryptocurrency markets are notoriously volatile and operate around the clock. As a result, users may need assistance at any time, including outside of regular business hours. Exchanges that offer 24/7 support are better able to meet the needs of their users and provide a more comprehensive service.

Live chat support allows users to quickly and easily get in touch with a support representative and get their questions answered in real time. This can be especially helpful for users who need immediate assistance or have urgent issues.

There are several exchanges in the industry that are known for having good customer support. Coinbase, for example, offers phone support and 24/7 email support, as well as a comprehensive knowledge base and community forums. Binance also offers 24/7 support via live chat. Besides, they have email and social media channels.

It is important to note that customer service is just one aspect of the user experience with an exchange. A well-designed platform with clear and intuitive features can also enhance the user’s overall experience and reduce the need for support in the first place.

Mobile App

Mobile apps have become an essential part of the cryptocurrency market, offering users the ability to quickly and easily access crypto trading platforms from their smartphones. In the highly volatile crypto markets, having an easily accessible trading platform is crucial for investors looking to make informed trades in real time.

Here’s a breakdown of some of the best mobile exchange apps available:

1. eToro

This social trading platform offers a user-friendly experience and allows investors to easily monitor their portfolios and track market trends. eToro also offers a noncustodial wallet for users to store their digital assets and a broad range of cryptocurrencies to choose from. However, eToro’s high trading fees and limited coin offerings may be a downside for some users.

2. OKX

This mobile app offers a broad range of tradable cryptocurrencies and a user-friendly experience for investors. OKX’s noncustodial wallet provides users with extra security and control over their digital assets. However, customer support can be slow to respond to user inquiries.

3. Crypto.com

This mobile exchange app allows users to buy, sell, and trade a broad range of cryptocurrencies, as well as earn interest on their holdings. Crypto.com’s noncustodial wallet and user-friendly experience make it a popular option among mobile users. However, the trading fees on Crypto.com can be high compared to other mobile exchange apps.

4. Cash App

Launched by Square, Inc., Cash App has been gaining popularity among crypto users for its simple and easy-to-use platform. Cash App allows users to buy and sell Bitcoin in small amounts and provides a noncustodial wallet for users to store their digital assets. However, Cash App’s limited coin offerings and lack of advanced trading features may not appeal to experienced traders.

In conclusion, mobile exchange apps have become an essential tool for crypto investors looking to make informed trades in the highly volatile crypto markets. Each of the above-listed mobile apps has its own standout features along with its downsides. It is important to evaluate these key features and weaknesses before deciding which app is best suited for your investment needs.

Final Verdict: Where to Buy Crypto?

Choosing the right cryptocurrency exchange can make all the difference in your investing journey. Throughout this article, I have reviewed several important factors, such as safety, security, fees, and advanced features, one should consider when selecting an exchange.

In summary, the top five cryptocurrency exchanges that stand out for their diverse offerings, low fees, and high transaction volumes are Binance, Coinbase, Kraken, Gemini, and Bitfinex.

For beginners or those looking for a hassle-free experience, Coinbase and Gemini offer a user-friendly platform with strict security measures. On the other hand, experienced traders and active traders may prefer Binance and Kraken, which provide advanced features such as margin trading, a wide range of cryptocurrencies, and low fees.

Bitfinex is a great option for those looking for high liquidity and a wide variety of order types to facilitate trading strategies. All of the exchanges on this list offer insured cold storage, external wallets, educational resources, and responsive customer support.

In conclusion, whether you are a beginner or an experienced trader, safety, security, and low fees are crucial factors to consider when selecting an exchange. Be sure to choose an exchange that fits your needs and risk tolerance. With the above-mentioned top exchanges, you can make an informed decision and start your cryptocurrency investing journey with confidence.

Searching for Best Crypto Exchange: FAQ

How many cryptocurrency exchanges are there?

There are nearly 600 cryptocurrency exchanges worldwide, around 300 of them accessible globally. Some experts argue that there are well over 1,500 exchanges to choose from. However, this number is in a state of flux, with new exchanges continually launching and others either closing down or merging. It’s worth noting that the exact count can vary depending on how one defines and categorizes an “exchange,” such as distinguishing between centralized and decentralized platforms or between spot and derivatives exchanges.

What is the best crypto exchange for USA users?

For U.S. residents interested in cryptocurrency, Coinbase and Kraken emerge as premier choices. Coinbase is lauded for its user-friendly interface and diverse cryptocurrency range, making it ideal for newcomers. Meanwhile, Kraken, known for its security and extensive crypto offerings, caters to both beginners and experienced traders. Both platforms adhere to U.S. regulations, ensuring a secure trading environment.To learn more about the best USA crypto exchanges, read this article.

Which cryptocurrency exchange is best?

The best cryptocurrency exchange ultimately depends on individual needs, which may include factors such as fee structures, security measures, or the range of available cryptocurrencies.

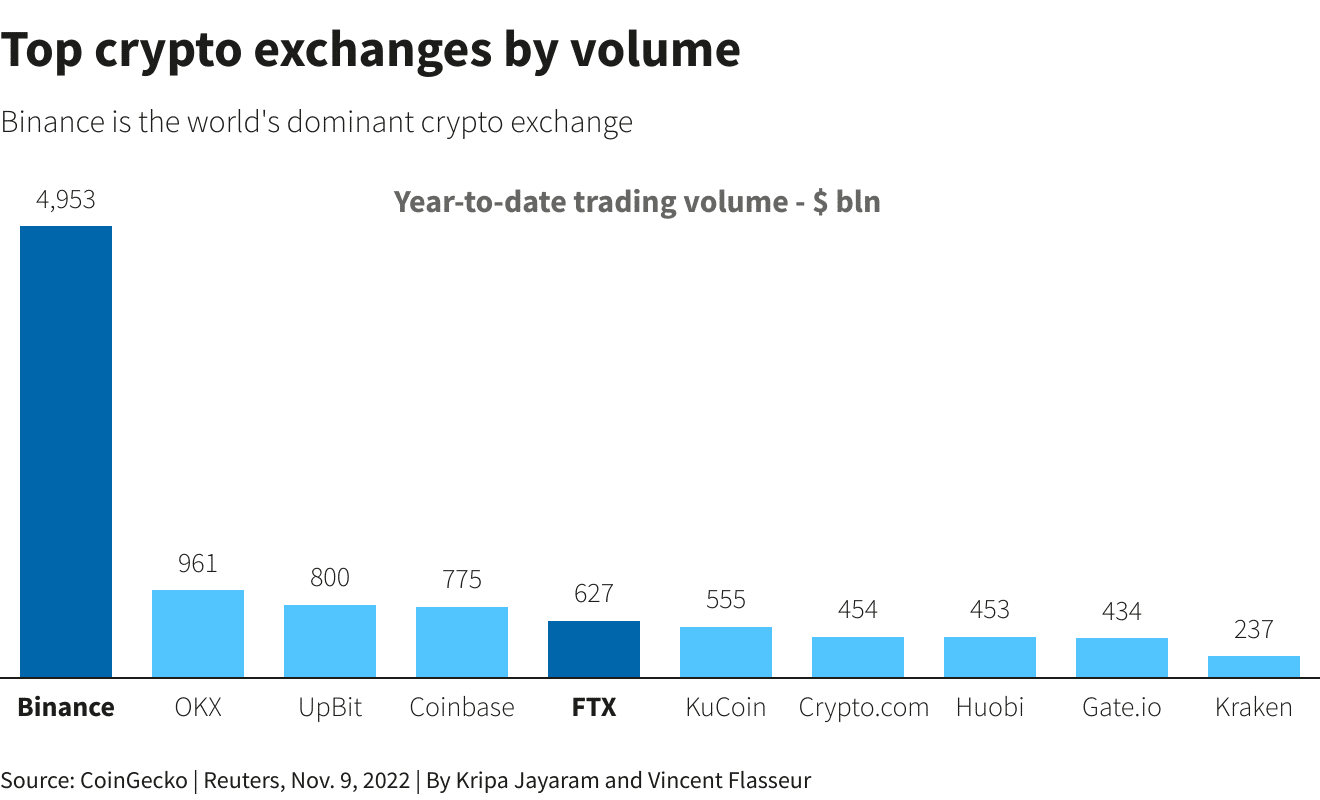

What is the leading crypto exchange?

Binance holds the title of the largest cryptocurrency exchange company, dominating the market with its vast user base and extensive range of cryptocurrencies for trade.

What is the #1 traded cryptocurrency?

Bitcoin, being not only the pioneer but also the most recognized cryptocurrency, maintains its position as the number one traded cryptocurrency in terms of volume and market capitalization.

What is the safest crypto exchange?

When it comes to safety, both Kraken and Gemini stand out. They have established robust security measures, including high-end encryption and two-factor authentication, providing users with secure platforms for their crypto trading needs.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.