Join Our Telegram channel to stay up to date on breaking news coverage

JPMorgan and Goldman Sachs have raised the odds of a recession in the US, the former citing Donald Trump’s “extreme” policies as the crypto and stock market crash.

The capitalization of the digital asset market plummeted over 3% in the last 24 hours, with Bitcoin briefly tumbling below $80K.

Meanwhile, the US stock market shed more than $1.7 trillion in value after President Donald Trump declined to rule out the possibility of a recession this year.

JPMorgan Raises Recession Odds To 40%

As Trump keeps the possibility of a recession this year open, economists at JPMorgan have increased the odds of a recession to 40%, from 30% previously.

“We see a material risk that the US falls into recession this year owing to extreme US policies,” the analysts said.

Goldman Sachs analysts are also bearish, raising their probability of a recession in the next 12 months to 20% from 15% previously.

The analysts warned that the odds of a recession will likely continue unless Trump changes course.

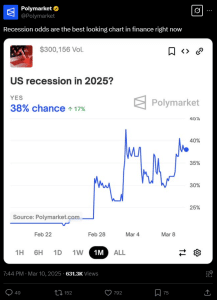

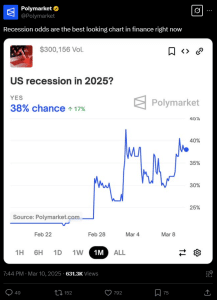

Users of the decentralized betting platform Polymarket also raised the chances of a recession in 2025. In the last month, odds for a contract on the platform have risen 18% to 38%.

Crypto Fear And Greed Index Signals ”Extreme Fear”

Crypto investor sentiment remains fearful. The Crypto Fear and Greed Index currently stands at 24, signaling “Extreme Fear.” This marks a 4-point increase in the last 24 hours. However, the index is still down 21 points compared to a month ago.

Meanwhile, Trump economic adviser Kevin Hassett said in a March 10 interview with CNBC that there are “a lot of reasons to be extremely bullish about the economy going forward.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage