Long-term Bitcoin holders are showing signs of growing greed as the price of BTC steadily approaches the $100,000 mark. A crypto analyst has underscored the significance of this market trend, highlighting that a possible Bitcoin market top could be incoming in the next few months.

Long-Term Holders Stay Greedy

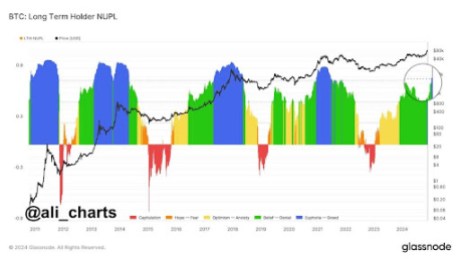

On-chain data from Glassnode reveal that long-term Bitcoin holders are showing a significant level of greed, which continues to intensify as the price of BTC maintains its bullish trajectory. While the flagship cryptocurrency inches closer to the anticipated $100,000 milestone, these long-term holders, or HODLers, stay relentless, showing no signs of selling their holdings despite rising prices and increasing profits.

Related Reading

Data from the market intelligence platform IntoTheBlock indicates that 98% of Bitcoin holders are making profits at the current market price. This underscores Bitcoin’s remarkable performance this month, as most long-term holders acquired their holdings at prices lower than BTC’s current market valuation.

Popular crypto analyst Ali Martinez noted in an X (formerly Twitter) post that historically, a growing increase in Bitcoin long-term holders’ greed suggests the potential for an imminent price leap to new highs. He revealed that when holders’ greed showed elevated levels in previous bull cycles, it took 8-11 months for Bitcoin to reach a new market top.

The analyst has predicted that if this trend holds true, the market should expect Bitcoin to hit a potential price peak between June and September 2025. Based on his price chart, Bitcoin long-term holders showed extreme levels of greed during the previous bull markets that followed the cyclic halving events.

The steady increase in long-term holders’ greed can be taken as a good sign, as this suggests that fewer coins are in circulation or available for trading, ultimately creating scarcity. With demand for Bitcoin rising amidst bullish market trends, the cryptocurrency price could eventually hit the coveted $100,000 price mark.

While the broader market and numerous crypto analysts anticipate a breakthrough to $100,000, many Bitcoin holders are demonstrating firm resolve by holding onto their assets. This unwavering courage in Bitcoin’s potential discourages panic selling during the current bull market, as the market remains optimistic about further price surges in the cryptocurrency.

Related Reading

Bitcoin Price Could Hit $100,000 Today

In a more recent X post, Martinez revealed that today could be the day Bitcoin finally reaches its $100,000 all-time high. The analyst revealed that the SuperTrend indicator on the Bitcoin hourly chart has flipped bullish, indicating that prices have broken through a resistance trend line and the Relative Strength Index (RSI).

The price of Bitcoin is currently trading at $98,288, reflecting a 7.16% increase over the past week. To reach the $100,000 milestone, the cryptocurrency needs to rise by $1,712, requiring only a 1.74% increase from its current price.

Featured image created with Dall.E, chart from Tradingview.com