With the broader market swing suggesting that most cryptocurrencies are in a bull run, Uniswap has continued its upward trajectory, capturing some of the momentum of the broader market. According to CoinGecko, the token is up nearly 12% since last week despite the market dipping slightly yesterday, August 21st.

Related Reading

Uniswap’s position within the crypto community is largely untouched, especially after its recent on-chain development that shows exceptional growth as a market. However, there are some aspects where the platform is seeing some weakness, putting UNI’s position into question in the long term.

Uniswap Sees Exponential Increase In Uniswap v2 Trading Pairs

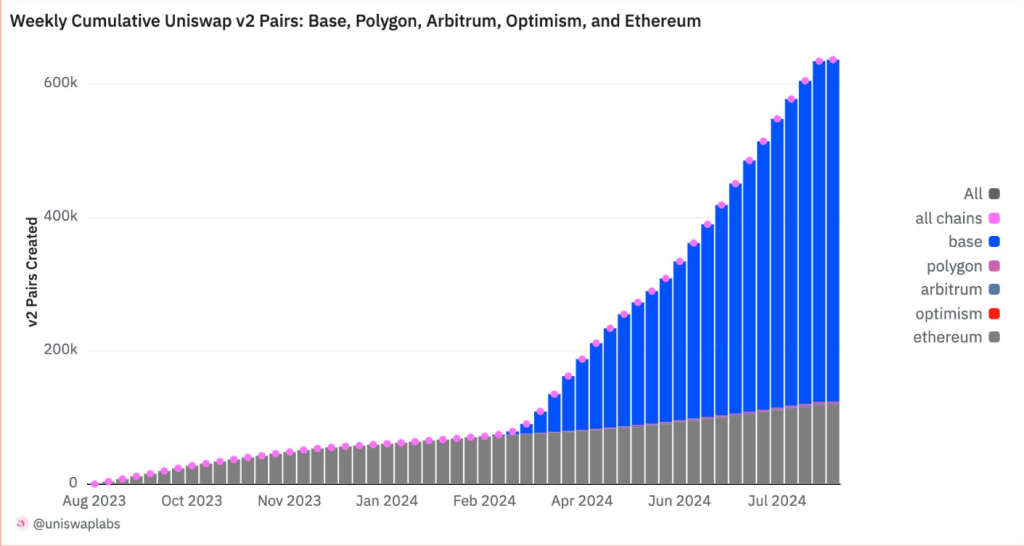

In a recent X post, Uniswap shared a Dune query made by Austin Adams, a research fellow on the platform. It revealed that ever since Uniswap v2 was launched on the platform’s major partner blockchains, trading pairs on the latter have skyrocketed by a significant degree.

Weekly number of pools being created on Uniswap v2

Optimism: 342

Arbitrum: 1,866

Polygon: 2,989

Ethereum: 118,820…and Base: 512,545 🔵 pic.twitter.com/VkBPaY4qMq

— Uniswap Labs 🦄 (@Uniswap) August 19, 2024

From its initial figure of 79,277 back in February, it soared to over 636,562 as of August 19th; a whopping 703% increase since it was first deployed.

The largest share of the bunch was Base, CoinBase’s in-house Ethereum layer-2, with over 512,545 pairs alone on its Uniswap v2 deployment. The trust built within this period between Uniswap and a major market player like CoinBase will help the ecosystem in the long term.

However, criticisms arose as to how the data was translated and what it represented.

this is a bit odd / surprising — seems like an extreme long-tail distribution of liquidity that results in many pools being insufficient

am i thinking about this correctly?

— brady 🌴 (@bmgentile) August 19, 2024

CEO of Bonzo Finance Labs, Brady Gentile, stated that the data was odd and surprising for him, leading to the conclusion that the data represents that a lot of the pools included in the 636,562 figure don’t have sufficient liquidity, thus finding the need for multiple liquidity pools for the same pair.

The sentiment has been echoed by the majority of the comments on the post. This air of suspicion with how the data is shown and with little to no chance of it being addressed by Uniswap may affect the overall view of the platform.

Breakthrough On $6.8 In The Short Term

With the slight drama surrounding how data was represented on the platform, the broader sentiment flipped from bullish to bearish as the bears tackled the breakthrough on the $6.8 ceiling.

Related Reading

With exchange reserves of the token reaching monthly highs, UNI bulls are exhausted and overburdened by strong market pressure in the short term which will inevitably lead to losses. UNI may retrace to $5.8 in the short term before stabilizing on the $5.8-$6.8 in the medium term before another attempt in the long term.

However, this can only happen if the market itself is bullish, but with the recent up-and-down swings it has been experiencing, caution should be exercised to prevent further losses.

Featured image from FineProxy, chart from TradingView