Ahh Ordinals Ordinals Ordinals. If you’re utterly overwhelmed at the thought of exploring an entirely new ecosystem for the jpegs, are perhaps dealing with burnout, and / or are struggling to stay on top of even 1% of what is happening on Ethereum.. this Newsletter is for you.

If you’re fascinated and excited and energized at the thought of exploring a new ecosystem but don’t know where to begin or what to look for.. this Newsletter is hopefully for you as well.

I’ve spent the last week falling deeper and deeper into the Ordinals rabbit hole and trying to formulate my own views on the ecosystem, as well as my theses for collecting and investing, and am going to share them here.

I’m still very new, so please do point out any omissions, oversights, or straight up incorrect information if you see it — I am always happy to correct.

If you haven’t read last week’s Newsletter, I highly recommend going back to do that first: On Bitcoin Ordinals (Part 1).

Alright, let’s jump in.

We’ve had NFTs on Ethereum for a long time. Ethereum has sophisticated smart contracts. Ethereum has far more functionality. Ethereum has the ability to store things on-chain, and with as much effective immutability as Bitcoin, insofar as you believe Ethereum will exist for as long as Bitcoin.

..and perhaps therein lies the detail.

An Ordinals OG and level headed thinker, Dazza, wrote this great tweet sharing his thesis. Quoting part of it here:

I think there is very little if anything that can be done on Ordinals that can’t be done on eth.

Even immutability on chain is being done by some projects on eth.

So the point of difference is the chain itself. Bitcoin being the mother chain, most decentralised, most valuable block space, first, historic. The best canvas or storehouse of collectables, and the canvas itself should enrich what is being stored. So I look for things that resonate with collectibility. Perhaps because I’m less technical.

It reminded me of this tweet from a couple of days prior by Deeze, on one of the “issues” with collecting on Tezos (in his view), effectively being that the strength of the chain was/is less than Ethereum. To quote him as well:

Given the weakness of the chains currency, it doesn’t make sense for collectors to spend a large portion of their capital in their ecosystem.

I look at my tezos NFTs fondly, but they also represent less than 2% of my art collection and likely will never be much higher than that.

Both hit home to me, and put together, make a lot of sense. It’s also a concern a lot of people have had for collecting on Cardano, Solana, Avalanche, or one of many other chains that are widely viewed as less likely to exist / be thriving in a decade or five in comparison to ETH.

We actually saw the reality of Solana’s centralization issue implode and the impact that had on the entire ecosystem after FTX’s collapse.

Chain-risk is a real thought/concern when collecting NFTs, and especially when investing in them. And you can yell at me until you’re blue in the face about collecting art for art’s sake, but the reality is the vast vast vast majority of collectors also consider the financial elements and ability to re-sell their jpegs at some point for profit, even if they’re truly okay with things going to zero. None of us have unlimited monies. And even if you do purely only care about the art, you should care about it existing and being recoverable decades from now.

SO. If the risk increases when moving from Ethereum to most other chains, would it not stand to reason that the risk reduces when moving to Bitcoin, unarguably the most decentralized, secure, and likely-to-exist chain a century from now?

This, to me, is the core thesis and WHY that collecting on Bitcoin might make sense. It is through this lens that I view Ordinals, and have since February, even if I haven’t been active in the ecosystem until recently.

Ordinals are not some holy grail solution to all of the issues in web3. Much of the power of NFTs is due to smart contracts and the interoperability possible between a decentralized web of tokens. The ability to transact at speed and scale is also an important element for a large percentage of NFTs, and neither is particularly feasible on Bitcoin (at the L1 layer at least).

Energy consumption was / is an enormous narrative around Blockchain technology and many people, companies, and governments will have a much easier time justifying transacting on Ethereum or another PoS chain vs a PoW one.

For some, Bitcoin is not “meant” to serve as a blockchain for jpegs, or any utility beyond being a digital currency. It muddies the water. The thesis and bull case for Bitcoin was/is clear without Ordinals: digital gold. Scarce, secure, decentralized. Or as Satoshi famously and eloquently put it:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.

Debating this last point is probably beyond the scope of what I want to cover today, but it would be remiss to not at least mention it. Not all fans of Bitcoin are fans of Ordinals.

If you’re enjoying this – refer a friend! This is a new Substack feature and I’m gonna find fun and creative ways to reward those who help spread the word about this Newsletter. It’s kinda win-win-win if you think about it, so.. think of a friend who would benefit from reading this and let them know – I will greatly appreciate it!

Crypto and Vapid Cash Grabbers (VCGs), a pair that go hand-in-hand. Due to the anonymous and wild west nature of crypto, combined with the large amounts of capital, this space attracts grifter after grifter. Grifters come in many shapes and sizes, but there’s one thing they all do: follow the attention, follow the money.

When all the attention was on meme coins, the VCGs were dropping a hundred meme tokens a day. When all the attention was on ETH NFTs, the VCGs were dropping a hundred 10k collections a week. When all the attention was on ICOs, the VCGs were releasing 100 token pre-sales a week. All with the intention of parting other market participants with their hard earned (or not so hard earned) money, and little to no desire to actually build anything of substance or meaningful value.

So, naturally, they have arrived in the Ordinal space as well. It can be tricky to identify them if you haven’t been around the block (heh, pun was not intended but what a happy little accident) a time or two, and even if you have, it’s not always easy to spot.

All this to say, please do be careful when wading into this new ecosystem. The sharks are already circling.

The real point I want to make though is that I implore you not to throw the baby out with the bath water. E-mail had (and still has) infinity VCGs, it did not make the technology bad or worthless. Crypto has had infinity VCGs since day 1, it does not make all of crypto worthless. Ethereum NFTs are the same. It might be a minefield already in the Ordinals space, but I really do believe there is value and substance to explore.

To me, it is in culture. It is in art, and technology, and human input, and non-human input, and the exploration of the Bitcoin blockchain at this point in time, and the interesting things that are created and etched on-chain as a result.

What excites and interests me, personally, are the same things that drew me into being excited about Ethereum NFTs in the first place: art and collectibles.

CryptoPunks were the holy grail to me for the longest time because they signified culture; they signified a movement in crypto and cypherpunk history. They signified a pivotal moment in time for digital ownership and identity.

Chromie Squiggles and Art Blocks in general have enamored me for the longest time because they signify culture; a movement in crypto, in generative art history, and art history in general. Larva Labs lit the fuse with Punks & Autoglyphs; Art Blocks poured gasoline on that fire and lit the generative art wold alight, and there is now a thriving gen-art community and movement, with a lot of other incredible generative art platforms and non-Art Blocks artists also thriving. Would all this have existed without Art Blocks? For sure. Would gen-art be as far along, as large, thriving, and well-known as it is now without Art Blocks? You’d be hard pressed to find a soul that would answer yes.

XCOPY is XCOPY not purely because of the aesthetics of their work, but because of the role they played and journey they took in being an integral part of 1/1 crypto art history; culture.

These are the things I am looking for on Bitcoin. The things that, years from now, someone like me (or maybe even me!) will look back and go “ah, wow, yes, that piece, that artist, that collection, that was pivotal to an entire movement; that was the creation and propagation of culture”.

Do I know what they are? I have some ideas, and I don’t think it’s too difficult to identify them if you spend some time looking at the projects out there. Things like OCM Dimensions come to mind, and other projects pushing the whole space forward. Artists like Nullish come to mind. Whether their Ordinals themselves are currently over or undervalued, or will go up or down in price, in the short or long term… nobody really knows, and I am certainly not going to pretend to.

[Disclaimer: I own 1 Distortion by Nullish].

One more thing to mention — there’s another common thread between all of the above ETH projects: none of them set out with massive profit front-of-mind. Punks were free to claim. Squiggles minted for about $10. XCOPY started out trying to sell their pieces for $1. And actually, the original OnChainMonkeys collection was a free, stealth mint, too, come to think of it. I think Nullish’s early work was given out for free, too.

There is absolutely nothing wrong with making money, or for commanding a higher mint/purchase price, of course. More power to the creators that are able to create, and sell, whatever, at whatever price. As a collector + investor though, I am always just a little bit weary of hyped allowlists and high mint prices where a large % of the people minting are hoping to flip for a profit in the short term, is all.

An Ordinal is created when data is inscribed onto an individual satoshi. Because of the nature of ordinal theory, we have the ability to track and transfer individual satoshis – all the way back to the original block they were mined from. As a reminder, there are 100,000,000 satoshis in every bitcoin (and, currently, 6.25 BTC are mined per block).

This has opened up a pretty cool world known as “sat hunting”, where people effectively churn through bitcoin (usually transferring to/from centralized exchanges) trying to find “rare” satoshis. What constitutes a rare satoshi, you say?

Well… a satoshi that is rare, or scarce, or that there are relatively few of. There are an infinite ways to define rarity — the 12th satoshi from every block is technically rare. But is it valuable? Ah, therein lies the question. What people really want to know is what satoshis are rare and valuable. At a certain point, somewhat arbitrary decisions must be made.

This has happened. I would not say it’s entirely arbitrary; it’s a conjunction of natural community/culture evolving as sat hunters spend time + effort (+money) trying to find certain specific satoshis, as well as certain people making statements about what they think should be rare and sharing those ideas, and then having them propagate throughout the community for one reason or another.

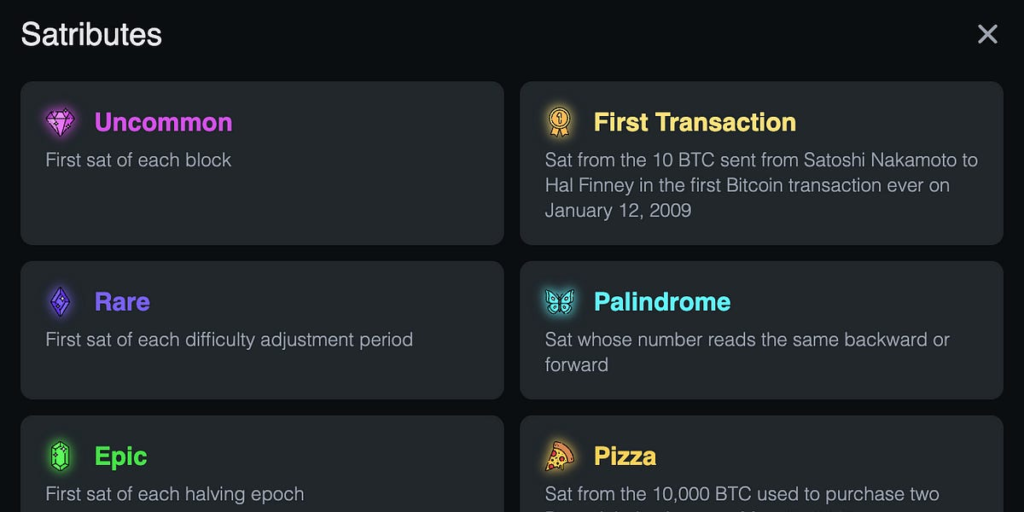

The mot widely disseminated list and generally well-agreed upon way to view rarity for satoshis is this list (taken from https://www.ord.io):

While there’s no doubt that these are rare (in that, they make up a very small percentage when compared to all satoshis in existence), personally, I find it a bit of a stretch to ascribe value to a lot of them. But, the market will do what the market will do. For the most part, right now, the market does seem to ascribe quite a bit of value to some of these categories. I do think it’s pretty freaking cool if nothing else to be able to track, inscribe, and own a satoshi that you can trace back to Satoshi, or Hal Finney.

There is a self-fulfilling prophecy element to keep in mind: if enough people ascribe value to these things for a long enough period of time, there’s a reasonable chance that they will be thought of as valuable forever. The collective delusion phenomenon.

When you combine the effort and art of sat hunting with interesting art, the entire journey/process to me seems fascinating, culturally relevant, and worth exploring. Nullish is a digital artist & sat hunter that is particularly worth paying attention to. They have turned sat hunting into an art form in and of itself, and by all accounts were doing it for the love and passion of it first and foremost.

I recommend reading this medium article of theirs, from March 9th, about their journey. It reads a bit to me like the formation of culture.

And now, since I promised, the answers to all the questions I left at the end of last week..

From what I can tell, the answer is largely yes. There are exceptions but by and large, an enormous part of the volume is from people coming from a background of trading NFTs on ETH, Sol, Cardano, etc. We’re not at a point where we’re seeing a significant inflow of “new blood” from either Bitcoiners who were never into NFTs (again, there are ofc some exceptions), or retail.

Yes. The same rule as ETH NFTs applies: over 99.99% are going to zero.

You spend time. You come up with a thesis that makes sense to you, follow people on Twitter, and hang out in Discord servers (our ZenAcademy server has a thriving Ordinals section – pick up your free Student ID and join us)! Talking with others and getting to know the builders and artists and collectors will help you identify projects that you like and make sense to you.

Much in the same way as they do on ETH. A combination of being “early” in Discords, getting lucky by winning giveaways, jumping through hoops by various social media engagement strategies, or good old fashioned nepotism. There was a phase on ETH when practically any allowlist spot = an opportunity to profitably flip. I don’t know if that time ever existed on Ordinals, but I think we’re already past it, with an abundance of projects offering spots, most of which I don’t think will trade above mint price on secondary (unless there’s some sort of seismic shift in the market).

We do. You. Me. Us. The Market. A lot of people have a lot of thoughts and opinions, and bag bias, and there are many voices attempting to prescribe value and rarity to different things. Some of it might stick, most of it probably won’t. At the end of the day, we the people, the market, will ultimately dictate the value of everything (even if it might take a long time to realize it). What is valuable and rare now might not be considered valuable and rare in a year, let alone a decade (same can be said for ETH NFTs fwiw).

No, it’s just mostly all a ponzi. Same as ETH NFTs, again. It might seem like a hollow victory or subtle distinction but the devil truly is in the details. Just because some people use a technology for nefarious purposes, does not make the technology in and of itself bad or evil. Nor does it mean there aren’t also people using it with pure intentions. If you’re still reading this Newsletter in the depths of the bear, you probably know how ponzi-like the entire crypto market can get. The value and beauty is in the exceptions, not the norm.

No, although it’s undeniable that there are elements of the 2021 excitement and fervor. I tend to think that market cycles speed up as they repeat (because people learn), and I think this is no different. Macro is also widely different right now compared to 2021, so it is dangerous to think or expect events to unfold similarly now as they did then. So while it might feel like 2021, the reality is different. Unironically, it wouldn’t surprise me if Ordinals has their 2021 moment in a year or two or three. Don’t buy things hoping for a quick flip or get-rich-quick idea; buy things you think have longevity, that you like, and can afford to stomach if they go to zero forever.

This tweet from trevor.btc kinda nails the vibes:

I’m actually gonna not fill out this section. I was half through writing up my responses but then I didn’t want to leave people/projects out, or influence people to think that only the projects I listed were worth paying attention to. I will at least share this tweet I put out a few days ago which has a lot of great responses.

At the end of the day, there are a lot of cool projects, great builders, and amazing artists with amazing art. I mentioned a couple already in this post but my overarching goal with writing is to educating and help people formulate their own thoughts and views. Teach people how to fish, not which fish to buy, etc. Again, come hang out in our Discord server to chat about Ordinals – we’re having a blast exploring the ecosystem as a community and learning together.

I hope you found this useful – if you did – tell a friend! My goal with writing is to provide level-headed analysis on interesting things happening in crypto. The best way you can support me (for now 👀) is to refer a friend to subscribe to the Newsletter. Hopefully you find the content valuable enough to share and help a friend learn about Ordinals too 🙏

Since referrals is a new thing – I put the rewards together last minute, so there’s still a bit to be figured out. Nonetheless, please know that if you do refer people – I will find an appropriate way to reward and thank you for helping spread the word.

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. I’m not a financial adviser. These are only my own opinions and ideas. You should always consult with a professional/licensed financial adviser before trading or investing in any cryptocurrency related product.