Bitcoin miners, the backbone of the world’s largest cryptocurrency, are experiencing a dramatic shift in their behavior. Data from IntoTheBlock reveals a surprising trend: miner reserves have sunk to their lowest level in 14 years, raising concerns about the future of Bitcoin mining. However, a closer look suggests this might be a case of shrewd adaptation rather than a mass exodus.

Halving Headaches: Balancing Rewards And Risk

The culprit behind this shift is the recent Bitcoin halving event in April 2024. Roughly every four years, the number of Bitcoins awarded to miners for validating transactions is cut in half. This time around, the reward dropped from 6.25 BTC to 3.125 BTC. While this might seem like a minor decrease, it significantly impacts miner profitability.

The halving puts pressure on margins. Miners are now faced with a choice: hold onto Bitcoin and hope for price appreciation, or sell to cover operational costs.

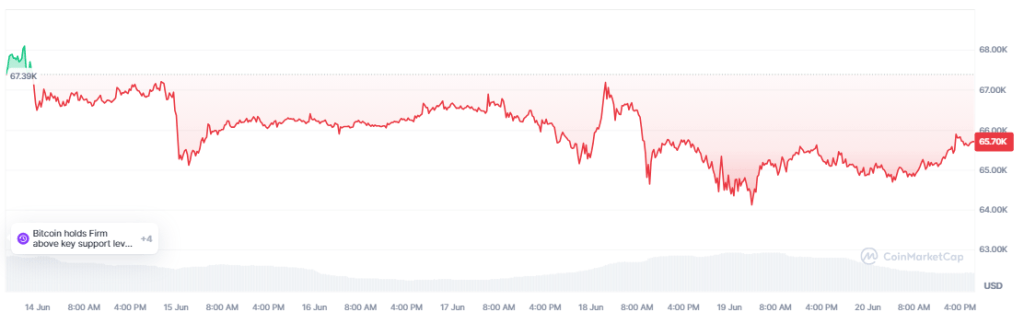

Bitcoin down in the last week. Source: CoinMarketCap

The current market volatility doesn’t make holding onto Bitcoin a particularly attractive option. The recent price dips make long-term bets risky, and miners are prioritizing immediate financial stability. This is a stark contrast to past halving cycles, where miners held onto their Bitcoin reserves in anticipation of future price surges.

Selling Smart: Strategic Swaps Over Hodling

However, there’s a silver lining to this sell-off. While the number of Bitcoins held by miners is decreasing, the total dollar value of their reserves remains near its all-time high of $135 billion. This suggests a strategic shift in mentality.

Since February 2010, miners' Bitcoin holdings have decreased to the lowest point. Source: IntoTheBlock

“Miners seem to have learned from past trends,” says Sascha Grumbach, CEO of Green Mining DAO. “Gone are the days of overleveraging and hodling onto too much Bitcoin.”

The 2018 bear market exposed the dangers of overdependence on Bitcoin price fluctuations. Miners are now prioritizing a diversified portfolio, focusing on short-term gains through strategic sales rather than blind faith in long-term price appreciation.

This newfound prudence might signal a maturing Bitcoin mining industry. Miners are no longer simply chasing the next Bitcoin boom, but are instead treating their operations like any other business – focused on profitability and sustainability.

BTCUSD trading at $65,696 on the daily chart: TradingView.com

Adapting To Changing Landscapes

The immediate impact of this shift in miner behavior is a potential decline in Bitcoin’s hash rate, the combined processing power of the network. Dropping Bitcoin rewards and increased competition make mining less lucrative, potentially discouraging new entrants and causing existing miners to scale back operations.

Miners are adapting to a changing economic landscape, prioritizing short-term stability over risky long bets. This shift might signal a maturing industry, one that prioritizes sustainable operations over chasing the next Bitcoin boom.

Featured image from News18, chart from TradingView