On-chain data shows the Bitcoin transfer volume of retail investors has seen a sharp decline recently, a sign that this group may be losing interest.

Bitcoin Volume For Retail-Sized Transactions Has Plunged Recently

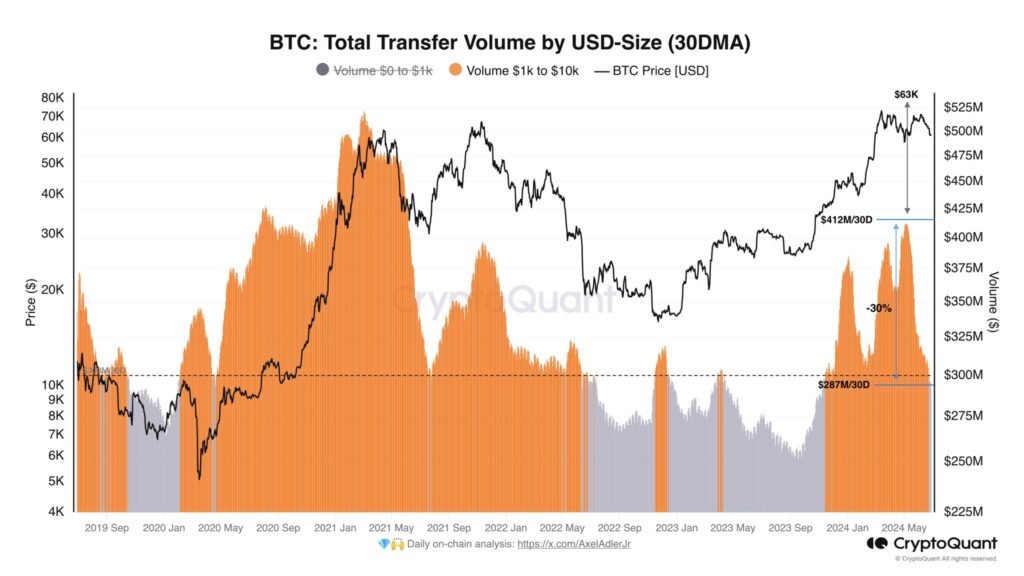

As explained by CrypoQuant author Axel Adler Jr in a new post on X, the total BTC transfer volume for transactions valued between $1,000 and $10,000 has gone down recently.

The “transfer volume” here refers to the total amount of Bitcoin (in USD) that addresses on the network are moving around daily. This metric isn’t confused with the “trading volume,” which typically keeps track of only the volume involved in trades on spot exchanges.

Related Reading

When the value of the transfer volume is high, it means the users are moving around large amounts on the blockchain right now. Such a trend implies that investors are actively interested in trading the asset.

On the other hand, the low metric suggests that holders may not pay attention to the cryptocurrency as they aren’t participating in much activity on the network.

Now, here is a chart that shows the trend in the 30-day moving average (MA) Bitcoin transfer volume specifically for the transactions involving the movement of coins worth at least $1,000 and at most $10,000:

As displayed in the above graph, the Bitcoin transfer volume for transactions of this size spiked to relatively high levels during the rally earlier in the year.

The $1,000 to $10,000-sized transfers are considered relatively small, so their volume would reflect the level of activity of the smallest of investors in the market: retail.

The increase in this metric from earlier in the year would suggest the price surge ignited interest in the asset from these investors. The chart shows that a similar trend was also observed during the previous bull run.

Sharp price action is generally exciting to retail investors, so it’s not surprising that they tend to become more active during rallies. This increased interest is what makes any surge sustainable for extended periods. As such, only rallies that can attract retail interest can hope to last.

As the chart shows, the Bitcoin transfer volume for retail-sized moves peaked in May and has since seen a sharp drawdown of 30%. This would mean that the bearish price action has made these investors disappear.

Interestingly, the downtrend in the indicator persisted even when Bitcoin had made a recovery back above $70,000 a few weeks ago, which could have been a potential foreshadowing that this rally would never stay.

Related Reading

With the 30-day retail transfer volume floating at the same lows as during the bearish period in July 2021, any new recovery runs could also be set up for failure unless the indicator shows a revival.

BTC Price

At the time of writing, Bitcoin is trading at around $62,200, down over 4% in the past week.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com