Bitcoin, Ethereum, and even meme coin prices are not moving as rapidly as they were back in December. Bitcoin is clawing back gains, while Ethereum remains below $3,000.

Solana is under pressure, trading below a multi-month support level, while meme coins have dropped to around $75 billion in cumulative market cap.

Meme Coin Traders Unwinding Their Longs: Time to Sell

Traders are apprehensive, and with the risk of a sharp correction that will likely flush out speculators, Glassnode analysts have noted yet another development.

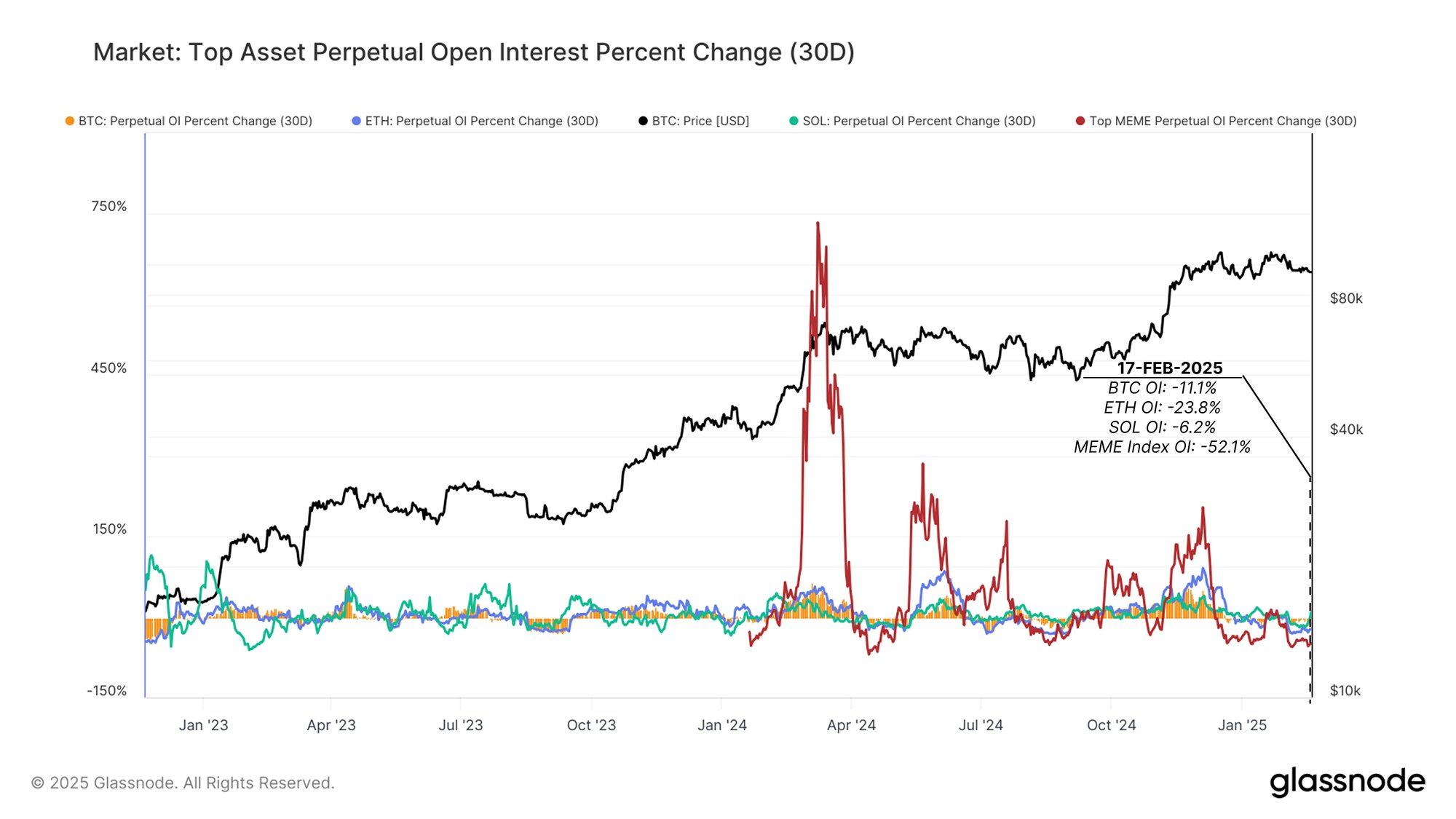

Positions are being unwound on exchanges like Binance, OKX, and Bybit, where traders can place leveraged trades. While this trend is widespread, there is a notable decline in futures open interest among meme coins.

In the last month alone, meme coin open interest has fallen a staggering 52%, and that number could rise further now that Dogecoin, TRUMP, PEPE, and even WIF prices have dropped double digits in the past week alone.

(Source)

The drop in open interest points to a shift in sentiment. Since crypto prices are sensitive to hype, the more traders choose to stay on the sidelines, the faster prices tend to fall. Over 11.1% of leveraged Bitcoin trades have been closed in the last month across multiple exchanges.

Meanwhile, over 23% of leveraged ETH positions have been closed, while meme coin traders are scrambling to exit, with over 52% of positions closed since the TRUMP meme coin launched. Notably, traders are rapidly exiting Pepe, Bonk, and Shiba Inu positions, where open interest has dropped an average of 70%.

Interestingly, only 6.2% of Solana leveraged positions have been closed during this period, though SOL is one of the biggest losers in the past 30 days.

Solana Crypto Prices Under Pressure: What’s Next For SOL

Dropping open interest coincides with price declines. Bitcoin may be holding firm but is trading below $100,000. On the other hand, Ethereum has yet to crack $3,000, while Solana is down over 40% in the last month, falling from $295 to around $175—a key support level.

(SOLUSDT)

If Bitcoin prices recover, lifting altcoins in the process, traders may flock back, looking to capitalize on a possible resumption of the Q4 2024 uptrend. However, after the plunge in February and the general apprehension—coupled with the realization that meme coins funneled capital away from top altcoins—traders will likely remain cautious.

If, conversely, prices drop further, with Solana losing $150 and Bitcoin falling below $90,000, widespread panic selling could ensue, leading to the unwinding of billions worth of leveraged trades.

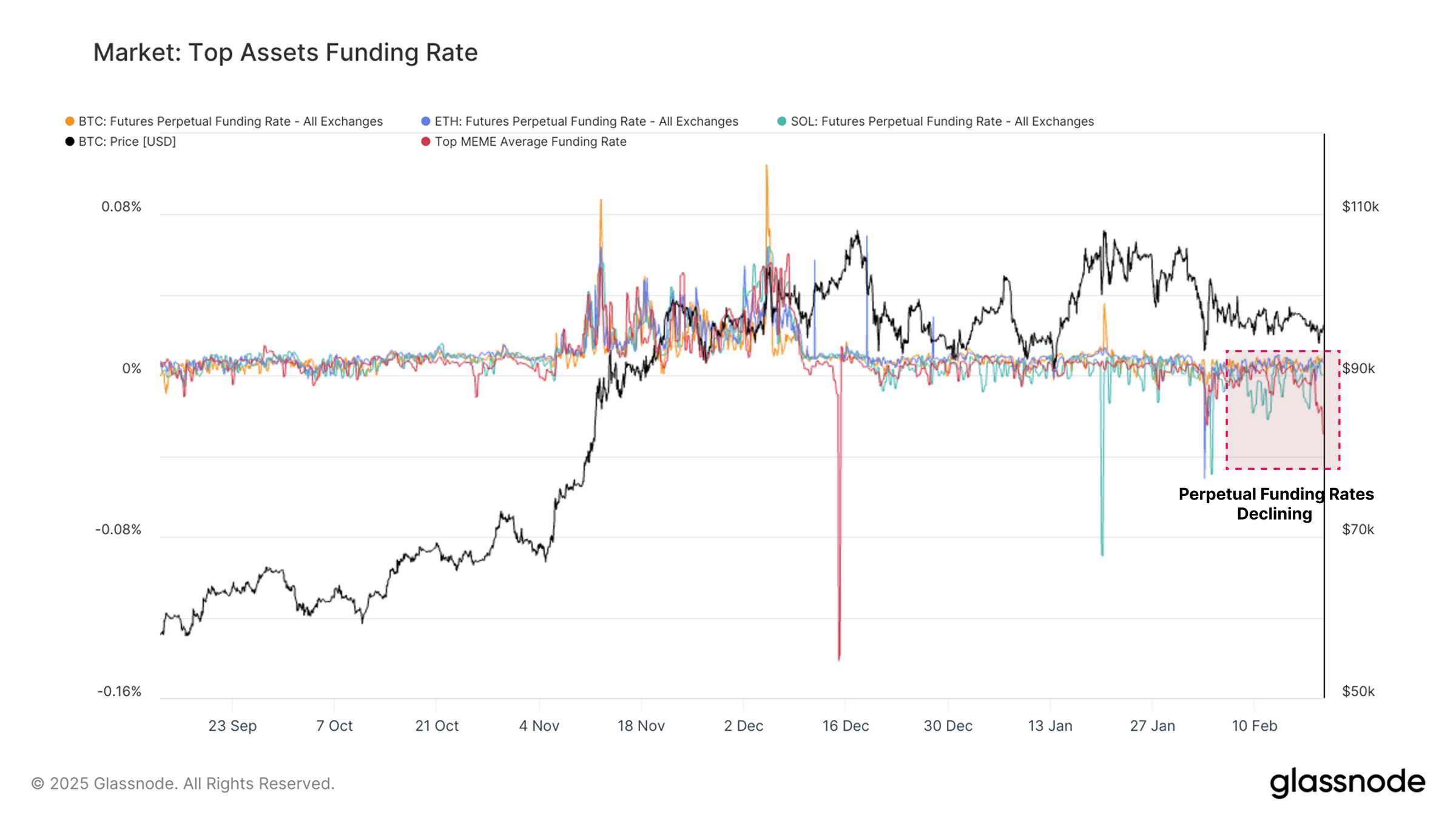

Reflecting this trend is the drop in funding rates. Glassnode analysts observe that while Ethereum and Bitcoin funding rates are slightly negative, leveraged traders taking long positions on Solana are being paid, as its funding rate is also negative.

(Source)

The shift from positive to negative over the last month indicates more traders are exiting and unwinding their long positions. Since exiting longs means selling, this sell-off has been exacerbated, creating a domino effect.

It remains to be seen how open interest will evolve in the next few days. As of this writing, most traders are neutral (42), according to the CoinMarketCap Fear and Greed Index.

(Source)

However, over the past month, traders have been mostly fearful, with fear and anxiety gripping the market since early February.

EXPLORE: 15 New & Upcoming Coinbase Listings to Watch in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Meme Coin open interest falls by over 52%

- Crypto momentum fading, Bitcoin, altcoins, and meme coins retracing

- Meme coin open interest fall by 52% in one month

- Funding rates also turn negative on leading crypto perpetual exchanges

The post Retailers Backing Off From Leveraged Crypto Trades: Meme Coin Open Interest Plunges 52% appeared first on 99Bitcoins.