The Important Bits

– Bitcoin’s price tends to follow a 4-year cycle in accordance with the halving.

– There’s often a rally leading up to the event, followed by a more dramatic spike upward sometime after.

– While past performance does not always indicate future results, buying Bitcoin before the next halving could be a good bet.

Historically, the price of Bitcoin has followed a 4-year cyclical pattern.

It’s thought that this price action arises (at least in part) from the halving, which reduces the supply of new coins coming online by 50% approximately every 4 years. A reduction in supply means that Bitcoin becomes scarcer, so according to the law of supply and demand, this could lead to an increase in price.

Let’s look at how this scenario has played out in the past and whether or not buying Bitcoin before the halving might be a good idea.

How past halvings have impacted the Bitcoin price

There’s no reliable metric to measure the impact of the halving on prices. However, when looking at the past, a general trend does begin to emerge.

While it’s important to keep in mind that past performance doesn’t always indicate future results, the Bitcoin price tends to peak sometime around 18 months post-halving.

Here’s a brief rundown of how prices have performed after the previous three halving events.

2012 halving

On November 28, 2012, the first Bitcoin halving occurred, reducing the block reward to 25 from 50. For a while, the price didn’t move much. But one year later, Bitcoin reached a new record high at the time above $1,000.

2016 halving

The second halving event occurred on July 9, 2016, and prices quickly soared before correcting just as fast. In early 2017, Bitcoin began reaching new all-time highs over $1,000, and peaked near $19,000 by December of that year.

2020 halving

The third and most recent halving happened on May 11, 2020. This situation was unique as it coincided with a pandemic that impacted financial markets worldwide. Still, during the latter half of the year, a large rally began, culminating in record highs near $69,000 in late 2021.

As you can see, while there isn’t an exact pattern when it comes to Bitcoin prices post-halving, there does tend to be a strong correlation between halving events and prices.

This begs the question, “should I buy Bitcoin before the halving?”.

Should you buy BTC before or after the halving?

It can be difficult to say when the best time to buy Bitcoin might be. It depends on many factors, such as an investor’s risk tolerance, timeframe, and overall portfolio allocation.

That said, in the past there have been periods of accumulation leading up to the halving. During this time, prices tend to trade sideways or drift downwards. Some market observers have noted that the six months prior to the halving has historically been a good buying opportunity. Again, the past doesn’t always predict the future, but it does provide some insight into what could happen.

If this coming cycle were to resemble the previous ones, then market participants could expect a new all-time high for Bitcoin sometime around October of 2025 (18 months after the halving in April 2024).

In other words, anyone who plans on holding for at least 2 years might consider the current market environment to be an attractive buying opportunity.

How BitPay makes it easy and convenient to buy Bitcoin

With BitPay, users have several advantages when buying Bitcoin. In addition to being one of the most convenient places to buy, the platform also offers perks such as:

- Take ownership of your private keys with the BitPay self-custody wallet.

- Choose from over 60 different cryptocurrencies.

- Enjoy flexible payments methods, including credit and debit cards, ACH transfers, Apple Pay, and Google Pay.

- Benefit from low fees, fast delivery, and high limits for purchases.

- Always receive the best rate by selecting our “Best Offer” option at checkout.

Buy Bitcoin with Self-Custody. Fast and Secure.

Buying Crypto In the BitPay app

If knowing more about past halving cycles has convinced you that now is a good time to buy Bitcoin, here’s how to do so using the BitPay mobile app.

Step 1: Get the BitPay Wallet app

Get the app for your iPhone, iPad, or Mac computer. Scan the QR code provided, or visit your app store to download it to your device. (You can skip this part if you already have the BitPay app).

Step 2: Tap “Buy Crypto”

BitPay supports Bitcoin, Ethereum and many of the most popular cryptocurrencies and stablecoins.

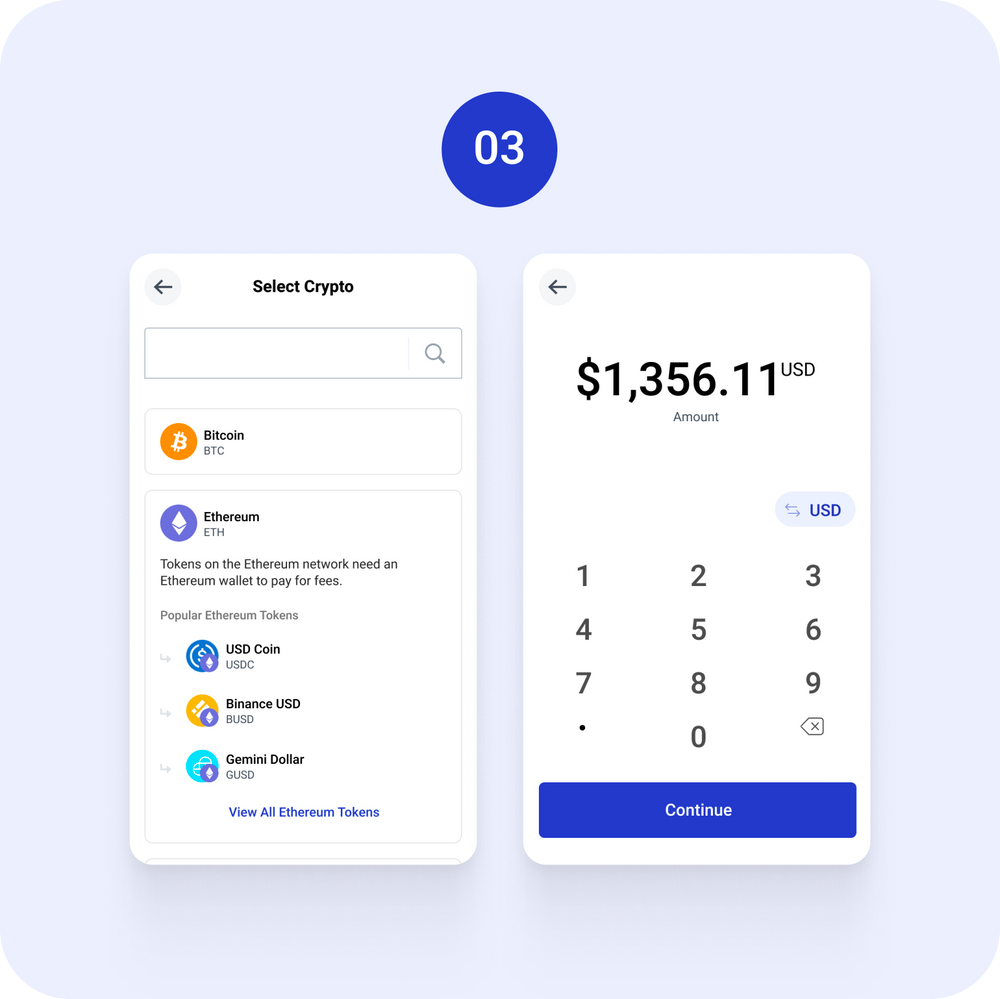

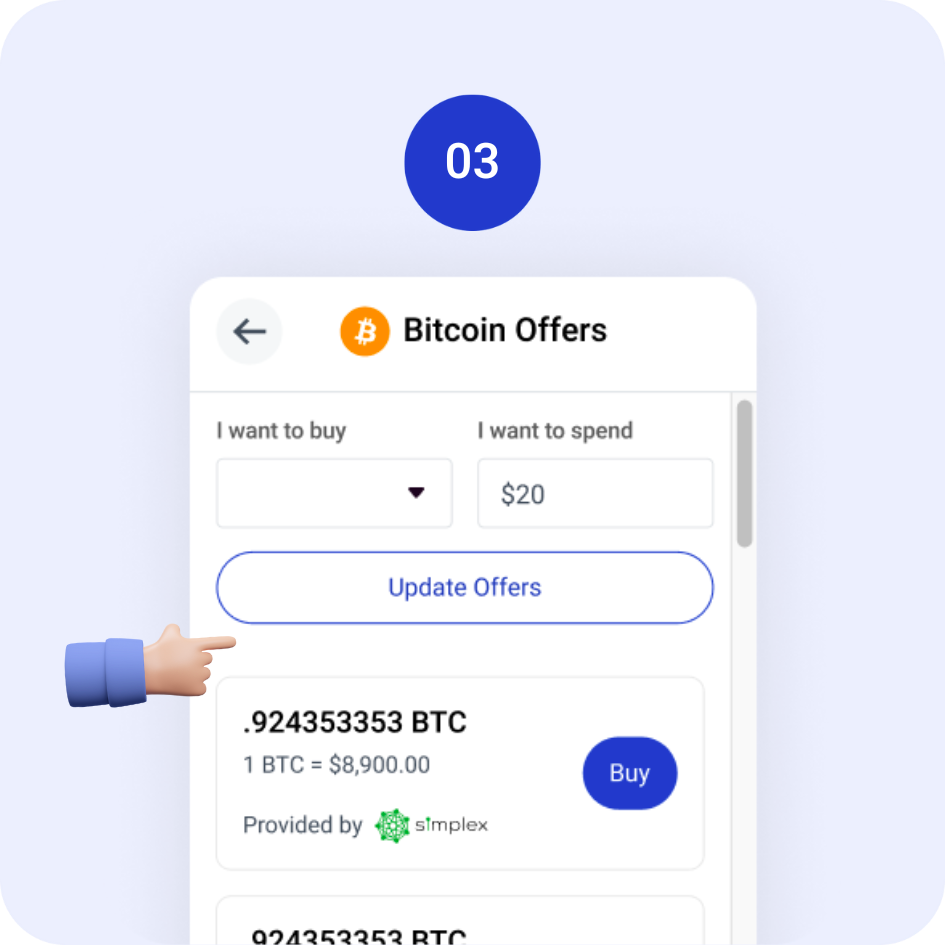

Step 3: Choose your amount and your crypto of choice.

Enter how much you’d like to convert to cryptocurrency. BitPay supports over 40 fiat currencies including USD, EUR, GBP, AUD and many others.

Step 4: Choose your preferred payment method.

With BitPay you can buy Bitcoin with a debit card, credit card, Apple Pay, Google Pay, ACH bank transfers, and other local bank transfers methods (options may vary by location).

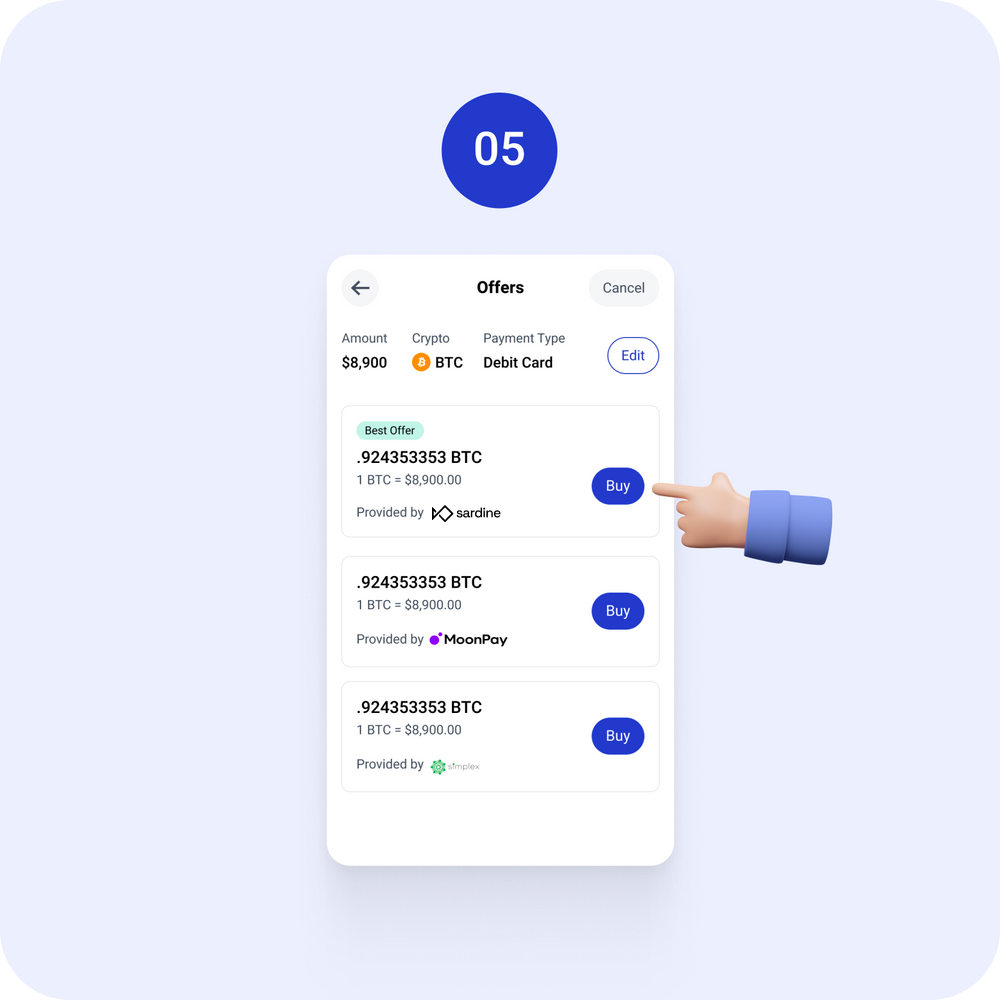

Step 5: Choose your “Best Offer.”

We work with a network of partners to ensure you always get the best possible price. We also take the guesswork out of buying crypto by highlighting the best rate for each purchase you make (just look for the “Best Offer” flag). Once you’ve chosen your offer, you’ll be taken to one of our partner sites to complete the transaction.

Buying Crypto on BitPay.com

The BitPay widget offers a seamless experience when buying crypto online, allowing you to buy the cryptocurrency of your choice and have it sent to a self-custody wallet address.

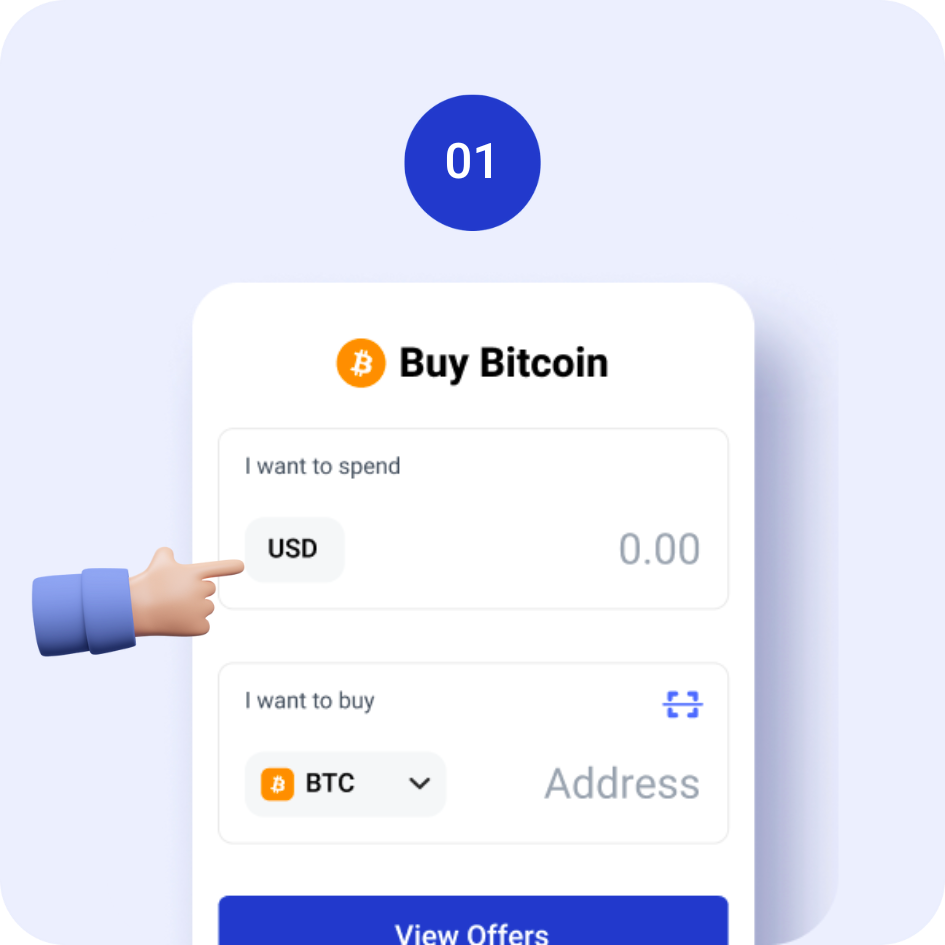

Step 1: Enter the amount of Bitcoin you want to buy

Choose your crypto of choice and input the amount of local fiat currency you wish to convert.

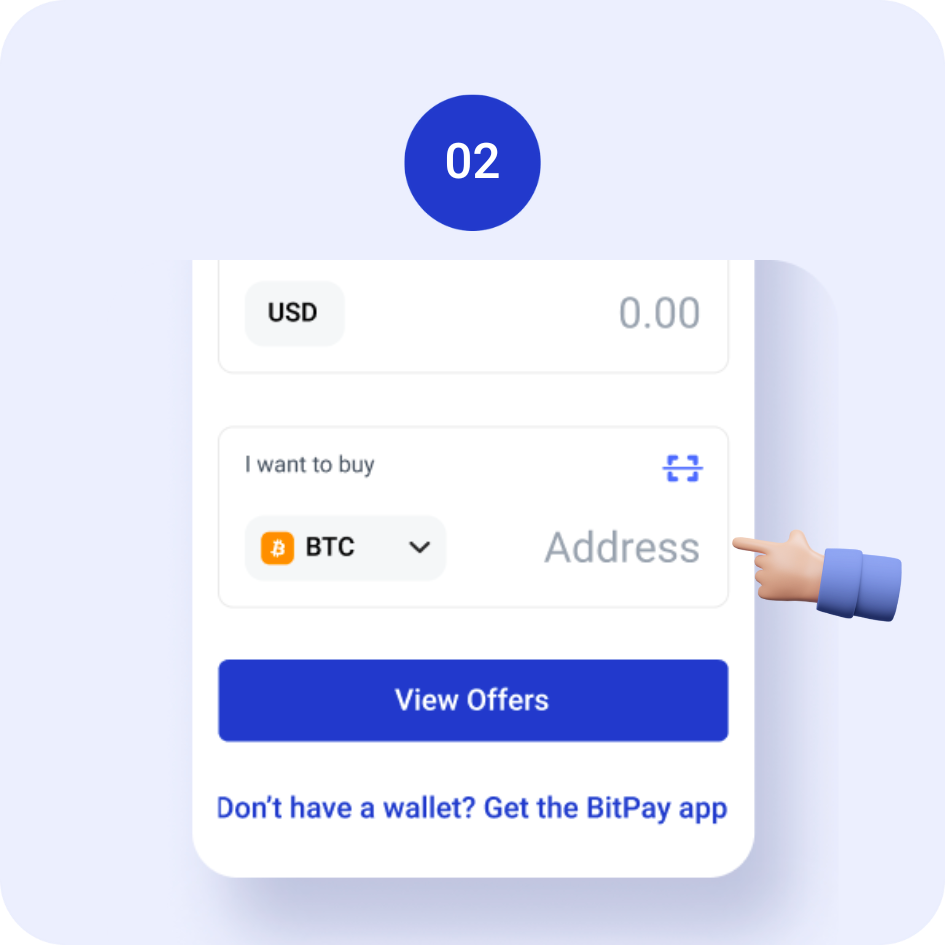

Step 2: Enter your wallet address

You can send crypto to any wallet, simply enter the address where you’d like to receive it. Need a wallet? BitPay’s self-custody wallet is easy to use and offers maximum peace of mind your funds will always be secure.

Step 3: Choose the “Best Offer” rate

BitPay does the work for you, aggregating offers from our multiple partners and surfacing those with the lowest fees and best exchange rate. Just look for the “Best Offer” flag and choose the offer that works best for you. Then you’ll be brought to one of our partner websites to complete the transaction.

Note: All information in this article is for educational purposes only, and shouldn’t be interpreted as investment advice. BitPay is not liable for any errors, omissions or inaccuracies. The opinions expressed are solely those of the author, and do not reflect views of BitPay or its management. For investment or financial guidance, a professional should be consulted.