The Sushi Price and DAO continue to make headlines with a forward-thinking proposal to reshape its treasury strategy. The plan, shared with the community last Friday, suggests diversifying its holdings beyond its native SUSHI tokens.

SushiSwap (SUSHI)

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

is up 65% over the last week on the announcement.

The Sushi team plans to steady the turbulence, pump up liquidity, and lay down a path for sustainable growth while keeping innovation alive on SushiSwap. Whether it works or not hinges on execution and, as always, the nod of an unpredictable community vote.

What Sushi’s Treasury Diversification Proposal Means

Sushi DAO’s treasury leans hard on SUSHI tokens, leaving it vulnerable to price swings and choking its flexibility. The new plan is to shift gears with a three-part fix.

- Liquidity Boost: 70% of the treasury will move into stablecoins like USDT and USDC, locking in steady liquidity and slashing market risk.

- Blue-Chip Crypto Investments: Another 20% would be allocated toward top-tier cryptocurrencies such as Bitcoin and Ethereum. These assets offer both diversification and growth opportunities.

- DeFi Tokens: The remaining 10% would focus on promising DeFi tokens like AAVE, selected after evaluating their risk-reward potential.

$SUSHI is breaking through the major sell wall.

If it breaks through that sell wall, there are no other sell walls until $2.5. pic.twitter.com/2RVs1eAEnH

— CW (@CW8900) December 8, 2024

Sushi DAO plans to implement this diversification through a dollar-cost averaging (DCA) approach to ensure a seamless transition. This gradual shift minimizes market disruption while effectively reallocating assets.

DISCOVER: The Best Altcoins to Stack Ahead of Mega 2025

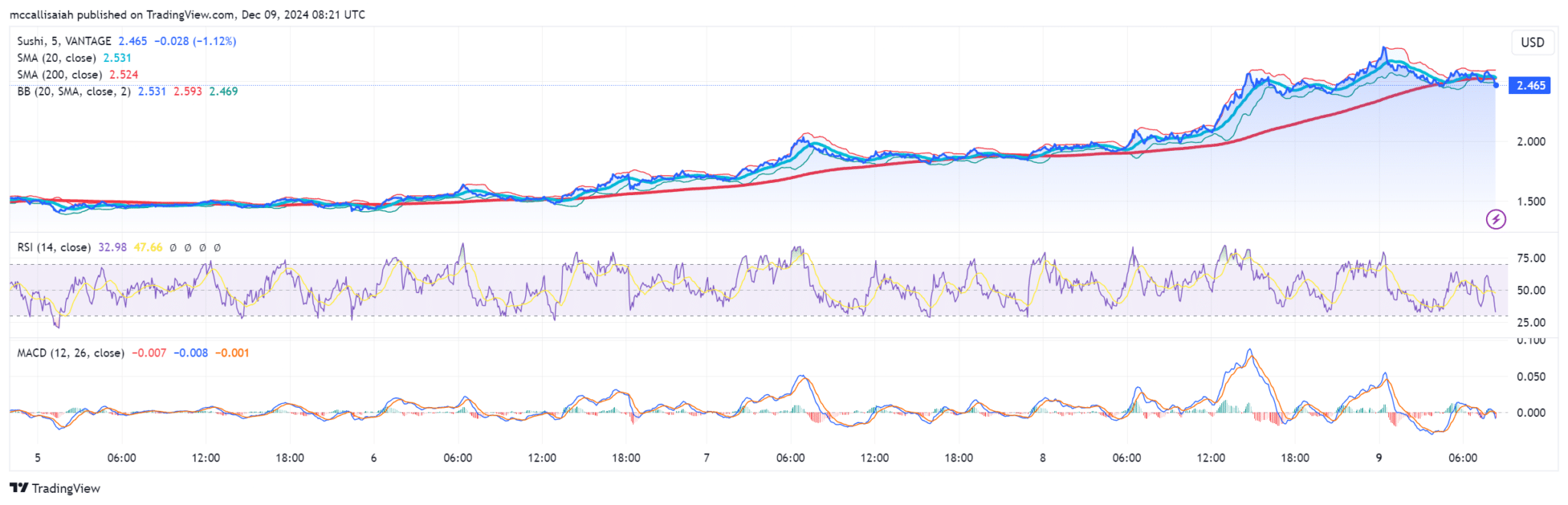

SUSHI Price Technical Analysis Shows Consolidation

After spiking nearly 20% on the news, SUSHI has entered what looks like a consolidation phase.

$2.45 is a key support level, aligning with the lower Bollinger Band. A dip below this could signal further downside. Meanwhile, $2.53, near the 20-day Simple Moving Average (SMA), is an immediate resistance. A breakout above this level could confirm bullish momentum.

Key Indicators to Watch

- Bollinger Bands: The narrowing bands for Sushi indicate reduced volatility, often a prelude to a significant price move.

- Moving Averages: While no golden cross or death cross is present, the proximity of the 20-day and 200-day SMAs suggests a critical decision point ahead.

- RSI: The Relative Strength Index at 33 nears oversold territory, which could hint at a reversal if buying pressure increases.

Governance Vote Could Shape the Future

The treasury diversification strategy must pass a governance vote before being implemented. Sushi DAO plans to present a detailed proposal for community scrutiny to ensure alignment with its decentralized ethos.

Approval could shift the protocol’s trajectory entirely, breaking its dependence on a single asset and opening doors for lasting innovation. Orchestrated by SushiSwap’s Head Chef, Jared Grey, the strategy’s proactive approach to treasury management has already turned heads.

“Phantom Wallet is selective about which chains they support, and we are proud to be now included among this notable group,” Grey shared. “This treasury diversification strategy reflects our commitment to long-term stability, liquidity, and community alignment.”

DON’T MISS: 100X Cryptocurrency Opportunities in the 2025 Bull Run

The Road Ahead for Sushi DAO

The treasury diversification proposal comes as Sushi DAO seeks more financial resilience. Whether the plan garners enough support during the governance vote remains to be seen, but the potential benefits make it a compelling case.

With tighter Bollinger Bands, consolidating price action, and a governance vote on the horizon, SUSHI traders have plenty to watch in the coming weeks. A breakout could redefine the token’s trajectory—and the strategy’s implementation could position Sushi DAO as a model for adaptive treasury management in the decentralized world.

EXPLORE: Another Day, Another Celeb Meme Coin Rugpull: Hawk Tuah Girl Rugs Her HAWK Token In Less Than 1 Hour

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Sushi Price Pumps +95% in a Week Amid SushiSwap Treasury Move appeared first on 99Bitcoins.