Bitcoin has definitely performed on the bullish side for the past three weeks. Many investors are now convinced of the full return of bullish price actions, and various technical indicators support this surge in optimism. One such indicator is the hash ribbon, which highlights a positive price momentum for Bitcoin.

Related Reading

The hash ribbon provides a compelling view of on-chain activity by tracking the behavior of miners, who are known to have a direct influence on the cryptocurrency’s price.

Price Momentum Flips Positive

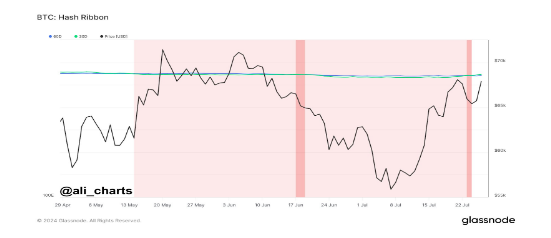

Crypto analyst Ali Martinez highlighted an intriguing phenomenon with the hash ribbon indicator on social media platform X. As noted by the analyst, the hash ribbon is signaling the end of miner capitulation, which suggests that the BTC price momentum has shifted from negative to positive.

The hash ribbon indicator analyzes Bitcoin’s hash rate using the 30-day and 60-day moving averages to gauge miner activity and network health. When the 30-day moving average drops below the 60-day, it indicates miner capitulation; when it crosses back above, it signals recovery and potential bullish price action.

As shown by the price chart below, the last miner capitulation began on June 17 after the 30-day moving average crossed below the 60-day moving average. Recent market dynamics have seen the 30-day moving average crossing back up, suggesting that miners are now at a bullish outlook.

Bitcoin miners have faced challenges since the April 2024 halving, which reduced their daily revenue from an average of $70 million pre-halving to $30 million post-halving. This revenue drop forced many miners to sell their BTC holdings to cover operational costs. However, recent data indicates that miner capitulation may be nearing its end, as increased activity on the Bitcoin network pushed daily miner revenue back above $40 million.

Positive Bitcoin Comments Reach Highest Level In 16 Months

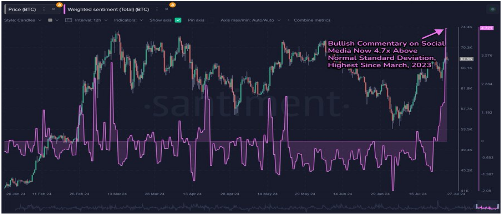

Still in the spirit of bullishness, crypto on-chain intelligence platform Santiment noted Bitcoin’s bullishness among market participants is now at its peak. Santiment’s data reveals that the ratio of positive versus negative comments about BTC on social media has surged to its highest level since March 2023 as investors become increasingly optimistic about a new all-time high.

This surge in positive sentiment can be attributed mainly to the favorable mentions of Bitcoin at the recently concluded Bitcoin conference. During the conference, Republican presidential candidate Robert F. Kennedy Jr. reiterated his bullish stance on Bitcoin.

Related Reading

Additionally, former president and current Republican nominee Donald Trump altered his previous stance on Bitcoin and expressed support for the cryptocurrency. Trump also promised to fire SEC Chairman Gary Gensler, who is known for his very strict approach towards Bitcoin and other cryptocurrencies, if elected president.

The combination of political support and positive sentiment on social media has fueled mentions of Bitcoin reaching a new all-time high in August. At the time of writing, Bitcoin is trading at $67,500.

Featured image from Vecteezy, chart from TradingView