A recent report by digital assets research firm 10x Research highlights that the US Federal Reserve’s (Fed) stance on interest rate cuts remains the most significant hurdle that could dampen the current Bitcoin (BTC) rally.

Bitcoin’s Trump-Fuelled Rally At Risk Ahead Of FOMC Meeting

Since pro-crypto Republican candidate Donald Trump secured victory in the November presidential election, Bitcoin has climbed an impressive 47%, rising from approximately $67,500 on November 4 to around $99,700 as of January 6.

Related Reading

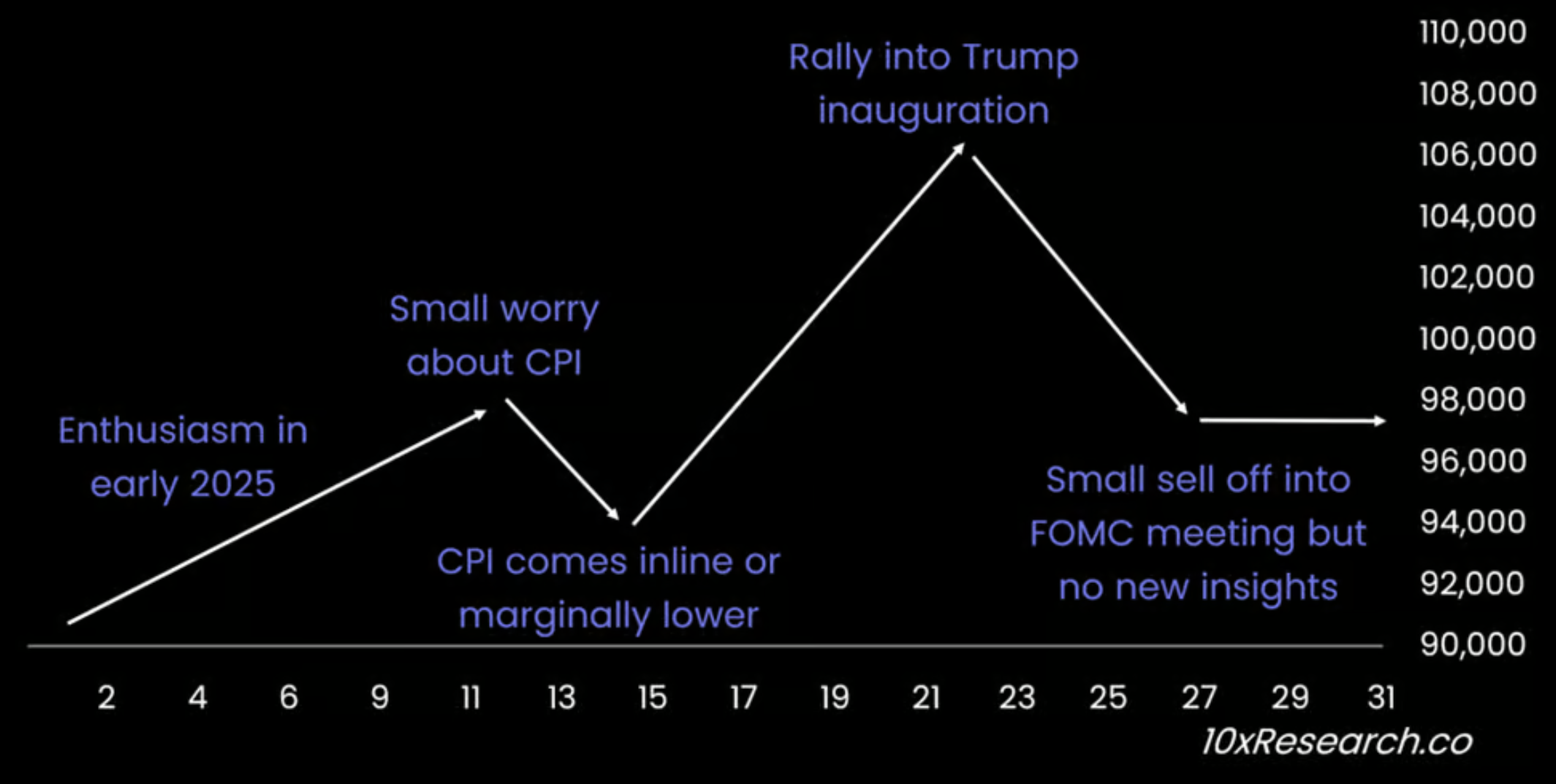

While further gains are anticipated during the so-called “Trump rally” leading up to the January 20 inauguration, the momentum might stall ahead of the Federal Open Market Committee (FOMC) meeting later in January, says 10x Research’s Markus Thielen.

Thielen predicts a “positive start” to January for BTC, followed by a slight dip before the Consumer Price Index (CPI) inflation data release on January 15. A favorable CPI report could reignite optimism, potentially fueling another rally before Trump’s inauguration. However, Thielen cautions that bullish momentum may wane ahead of the FOMC meeting on January 29.

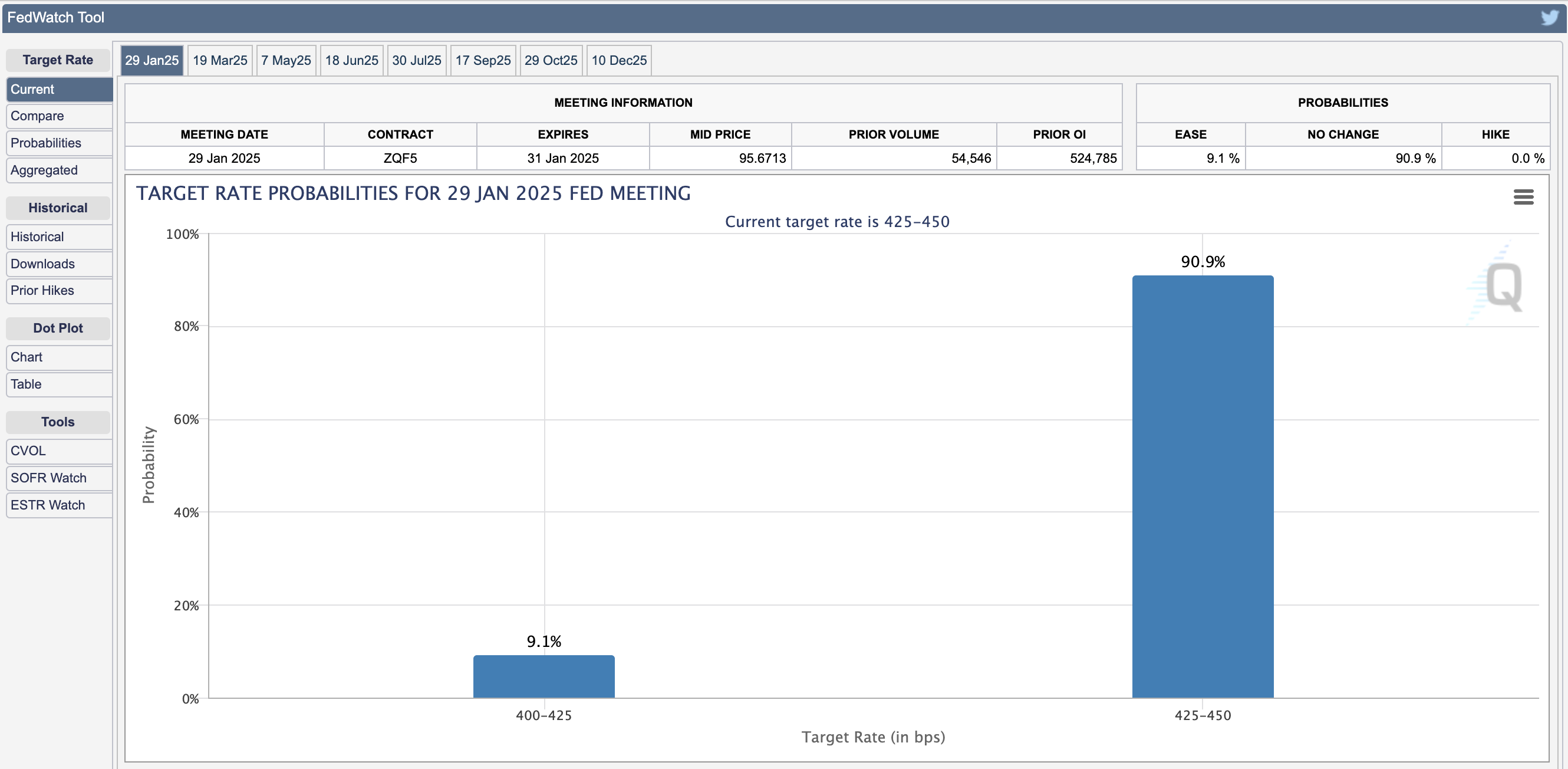

Latest data from CME Group’s FedWatch tool shows that interest rates are likely to remain unchanged following the upcoming FOMC meeting. The tool currently predicts a 90.9% chance of interest rates remaining 425 and 450 basis points (BPS).

Bitcoin’s decline of approximately 15% to $92,900 following the December 18 FOMC meeting underscores the Fed’s significant influence. This drop came after the Fed signaled only two rate cuts for 2025 instead of five, reinforcing Thielen’s view that the Fed’s decisions are the “primary risk” to BTC’s current bullish trajectory. Thielen stated:

We anticipate lower inflation this year, though it may take some time for the Federal Reserve to recognize and respond to this shift formally.

Thielen also cited institutional participation as a key factor influencing Bitcoin’s short-term price action, with metrics like stablecoin minting rates and crypto exchange-traded fund (ETF) inflows serving as indicators of institutional interest.

Institutional Interest In Bitcoin Continues To Rise

Although US spot Bitcoin ETFs faced significant outflows at the end of December, fresh inflows have sparked optimism about rising institutional interest in the premier cryptocurrency. Data from SoSoValue notes that spot Bitcoin ETFs saw $908 million in inflows on January 3.

Related Reading

In addition, several major BTC mining firms such as MARA and Hut 8 are bolstering their BTC reserves. Technology firms such as Canada-based video-sharing platform Rumble also recently unveiled a $20 million BTC treasury strategy.

A separate report by cryptocurrency exchange Bitfinex predicts Bitcoin could surge to $200,000 by mid-2025, despite minor price pullbacks. At press time, BTC trades at $101,555, up 3.7% in the last 24 hours.

Featured image from Unsplash, charts from 10x Research, CME FedWatch and Tradingview.com