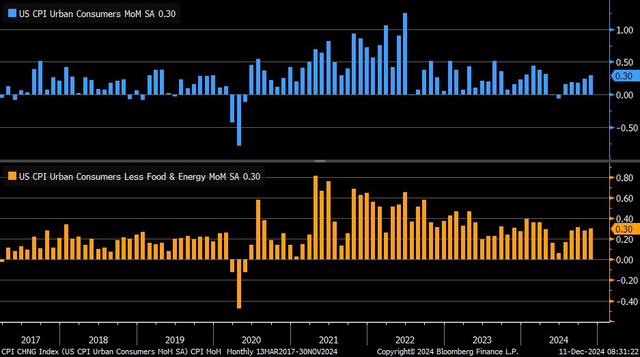

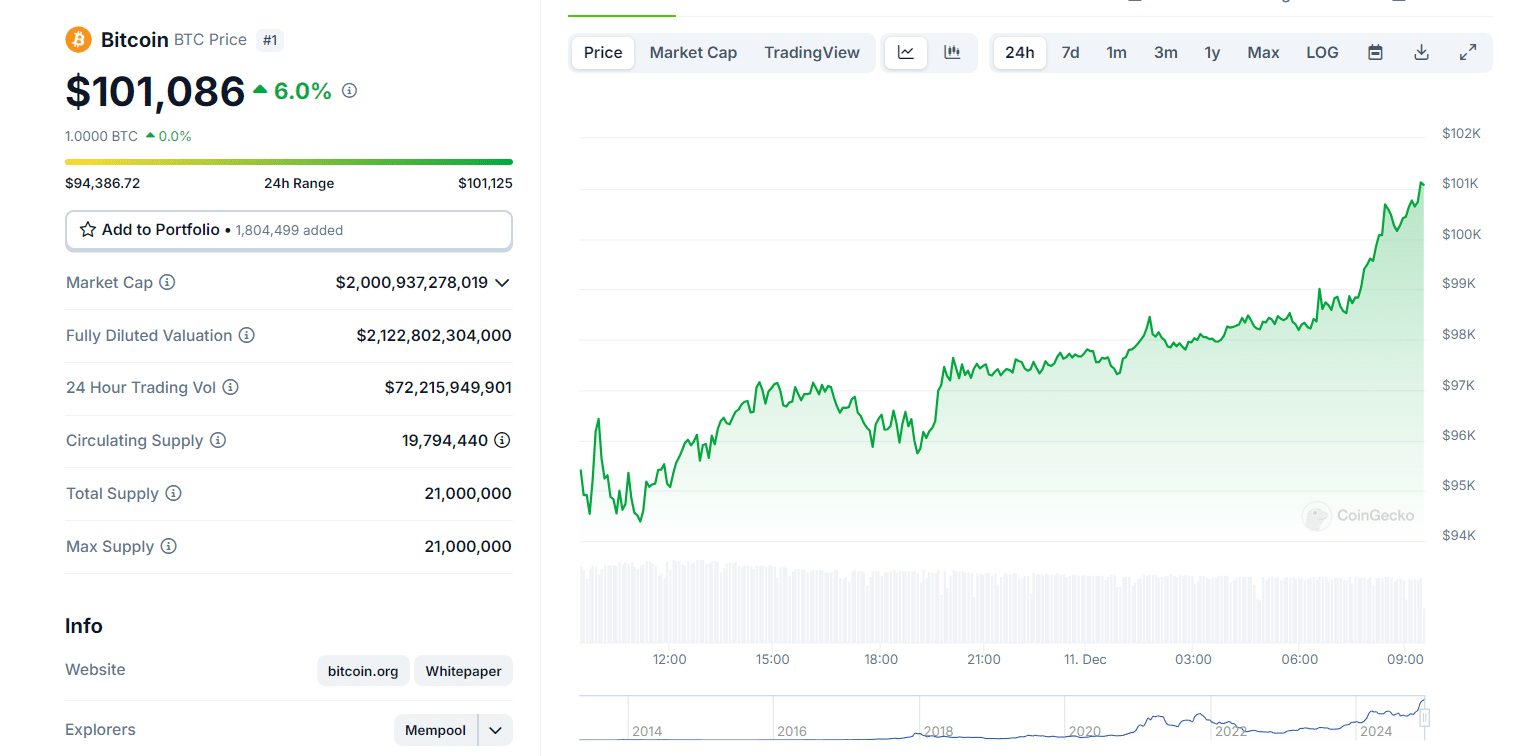

Today’s US Inflation report revealed that the Consumer Price Index (CPI) data landed right on target, showing a 2.7% year-over-year increase and 3.3% for Core CPI, fuelling Bitcoin price back above $100K.

When inflation numbers match expectations, markets generally react favorably—crypto included. Off the news, BTC

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Price

Trading volume in 24h

<!–

?

–>

Last 7d price movement

quickly broke $101,000, and an altcoin rally followed suit.

Inflation Report Today and Bitcoin Price Stability

Bitcoin’s reputation as an inflation hedge keeps it tethered to the ebb and flow of economic data. When prices soar, it becomes the go-to hedge. But when CPI cools, it doesn’t flinch either—lower inflation is often a signal the Fed might ease rates, and that optimism tends to ripple through BTC’s price charts.

For November, CPI rose by 0.2% monthly, matching the October increase. Market forecasts held true, signaling that the Federal Reserve’s efforts to tame inflation might succeed. Bitcoin recovered 6% from the news.

What’s The Federal Reserve’s Next Move?

The timing of the CPI data couldn’t be sharper. With a quarter-point rate cut looking like a lock for the Fed’s next meeting, all eyes are on the numbers. A solid November jobs report—227,000 positions added—has only piled more weight on the scale for looser monetary policy.

Stable inflation numbers reduce the likelihood of unexpected policy changes like aggressive rate hikes, which is generally bullish for risk assets, including Bitcoin. Since tighter monetary policy often restricts liquidity, markets interpret stable rates as a green flag for growth investments like cryptocurrencies.

Bitcoin has shown remarkable resilience following its dip below $94,000 earlier this month.

This sentiment is pivotal in December, a historically volatile month. A combination of favorable CPI data, a likely rate cut, and steady economic growth suggests BTC could maintain its upward trajectory through the end of the year.

BREAKING:

*FED FUNDS FUTURES 25BPS DECEMBER RATE CUT ODDS RISE TO 97% AFTER CPI REPORT$SPY $QQQ

pic.twitter.com/PBrPHvoDg4

— Investing.com (@Investingcom) December 11, 2024

EXPLORE: 20 New Crypto Coins to Invest in 2024

Broader Market Implications From The Inflation Report Today

After the CPI results were announced, financial markets rebounded, with the S&P 500, Dow Jones, and Nasdaq all rebounding. High corporate earnings from certain sectors, like technology, explained pockets of growth, while rising Treasury yields created some drag.

For cryptocurrencies, however, the story has an even greater impact. Stable inflation rates and potential monetary policy easing preserve the liquidity environment necessary for risk-on assets to thrive. Bitcoin and the rest of the crypto market could see a continued lift from current macro trends.

All eyes are on the Fed’s December 17-18 meeting, the next key moment that could shift the playing field for investors. A confirmed rate cut could further solidify Bitcoin’s standing by making risk assets more attractive relative to bonds or cash.

Meanwhile, investors should continue tracking monthly CPI updates as they remain a key influence on overall market sentiment.

EXPLORE: Crypto to Hollywood: ‘Crypto Man’ and Streaming Giants HBO and Netflix Are Embracing Crypto Culture

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post US Inflation Data Hits 2.7%: Triggers Violent Bitcoin Price Pump Back Above $100K appeared first on 99Bitcoins.