[ad_1]

beginner

Imagine a world where you have full control over your money, a place where the transactions you make aren’t tied to a central authority like a bank or government, and the fees for sending money across the world are minuscule. Welcome to the world of Bitcoin.

The first cryptocurrency has provided people with an alternative to fiat currency, becoming a new-age medium of exchange. However, despite its popularity, many people still don’t really understand what it actually is.

In this article, I will talk about Bitcoin, a digital asset that has changed the way many people think about money. I will go through some Bitcoin basics, explain how it works, and where you can buy it.

Definition: What Is Bitcoin?

Bitcoin is a digital form of currency that operates on a decentralized network called a blockchain. Unlike traditional currencies such as the US dollar or the Euro, Bitcoin is not issued or regulated by any central authority like a government or a financial institution. It was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto.

Bitcoin is called a “cryptocurrency” because it uses cryptographic techniques to secure transactions and control the creation of new units. It is also known for its potential to revolutionize the financial industry and has gained significant attention from investors, researchers, and regular users alike.

What does “Bitcoin” mean?

The name Bitcoin comes from the combination of words “bit” and “coin”.

How Does Bitcoin Work?

At its core, Bitcoin is a peer-to-peer electronic cash system. It enables users to send and receive payments directly without the need for intermediaries like banks. The underlying technology that makes this possible is called the blockchain.

The Bitcoin blockchain is a public ledger that contains a record of every transaction ever made with Bitcoin. It is maintained by a network of computers, known as Bitcoin nodes, which participate in the validation and verification of transactions. Each node has a copy of the entire blockchain, ensuring transparency and security.

To use Bitcoin, individuals need a digital wallet that allows them to store, send, and receive the cryptocurrency. Wallets are secured with cryptographic keys, which are essentially long strings of numbers and letters. These keys serve as unique identifiers for users and enable them to access their funds.

When someone wants to send Bitcoin to another person, they create a transaction and sign it with their private key. The transaction is then broadcasted to the Bitcoin network, where it awaits confirmation by miners.

How Does Bitcoin Mining Work?

Bitcoin mining is the process through which new Bitcoins are created and transactions are validated. It plays a crucial role in maintaining the integrity of the Bitcoin network. Miners use powerful computers to solve complex mathematical problems that secure transactions and add them to the blockchain.

Bitcoin mining has little to do with real-world mining.

Mining involves bundling a set of pending transactions into a block and attempting to find a solution to a mathematical puzzle. The first miner to solve the puzzle gets the opportunity to add the block to the blockchain and is rewarded with newly minted Bitcoins as an incentive. This process is known as “proof-of-work.”

To prevent the blockchain from becoming congested with blocks and transactions, the Bitcoin protocol adjusts the difficulty of the mathematical problem based on the total computing power of the network. This ensures that new blocks are added approximately every 10 minutes.

Over time, as more Bitcoins are mined, the reward for mining decreases. The total supply of Bitcoins is limited to 21 million, and it is estimated that the last Bitcoin will be mined around the year 2140. Once all the Bitcoins have been mined, miners will rely on transaction fees as their main source of income.

How to Use Bitcoin

Using Bitcoin starts with acquiring a Bitcoin wallet, a digital tool that allows you to manage and store this virtual currency. A Bitcoin wallet creates a unique address for receiving funds and contains the cryptographic keys necessary to sign and verify transactions. Blockchain technology, which operates as a digital ledger, records every Bitcoin transaction made across a peer network. This ledger consists of a chain of blocks where each block contains transaction data and a reference to the previous block, starting from the genesis block.

But how can Bitcoin be used? With its decentralized nature, Bitcoin has opened up a new world of opportunities. It is primarily used for electronic payment for goods and services, particularly beneficial for international transactions where traditional banking systems and central banks may complicate the process. More businesses are starting to accept Bitcoin as a form of payment due to its growing popularity and the advancement of Bitcoin payment technology.

Apart from serving as an electronic payment system, Bitcoin has emerged as a digital asset and a potential store of value. Some individuals buy and hold Bitcoin, treating it like an investment in gold or other financial products. In some countries, particularly those experiencing economic instability and high inflation, Bitcoin is used as a hedge against the local economy.

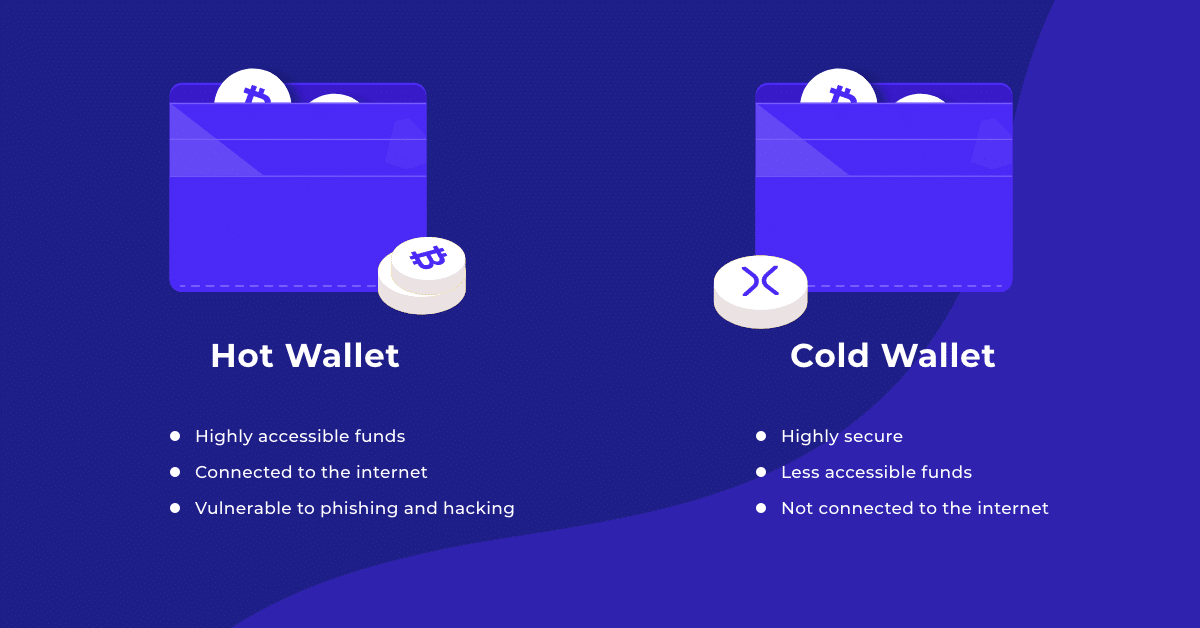

Storing Bitcoin: Hot vs. Cold Wallets

Storing Bitcoin securely is crucial for any user of the digital currency. Just like physical wallets store your cash and cards, Bitcoin wallets store your BTC coins. But instead of anything physical, these wallets keep your key pair – a public key, which is like an email address other people use to send you Bitcoins, and a private key, which you use to authorize transactions.

The choice between a hot and cold wallet depends on how you use your Bitcoins. If you perform regular cryptocurrency transactions, a hot wallet offers more convenience. But if you’re a Bitcoin miner or an investor holding large amounts of BTC, the security of a cold wallet is more suitable. It’s also worth noting that you can use both types simultaneously – a hot wallet for daily transactions and a cold wallet for long-term storage. Some wallets even offer integrations with other wallet types, like Ledger.

Remember, the key to successful crypto management is securely managing your private keys and choosing the right wallet for your needs.

If you want to see more examples or a more thorough guide on Bitcoin wallets, check out this article.

Hot Wallets

A hot wallet is a Bitcoin software wallet that is always connected to the Internet. This connection makes hot wallets convenient for completing Bitcoin transactions quickly, but also increases security risks. Crypto exchanges like Coinbase and Binance provide users with hot wallets when they create accounts.

Pros:

- They are convenient and user-friendly, making them ideal for beginners.

- Instantly accessible from anywhere with an Internet connection.

- Suitable for handling small amounts of Bitcoin and regular transactions.

Cons:

- As they are always online, they are more susceptible to cyber threats.

- If the platform your wallet belongs to is compromised, your Bitcoins could be stolen.

Best for: Casual Bitcoin users, small-scale traders, and those who spend Bitcoin regularly.

Examples: Coinbase wallet, Binance wallet, and other exchange-based wallets. Standalone software wallets like Electrum and Exodus also fall into this category. Please note that exchange wallets are generally less safe than other types of software wallets.

Cold Wallets

Cold wallets are the type of a Bitcoin wallet that stores your private keys offline. They usually come in the form of a small USB drive or card, and sometimes have little screens. These wallets are more secure because they are less susceptible to hacking.

Pros:

- Provides the highest level of security for your Bitcoins.

- Ideal for storing large amounts of Bitcoin.

- Immune to online hacking attempts.

Cons:

- Less convenient for regular transactions.

- If you lose the device or forget the password, recovering your Bitcoins can be difficult or even impossible.

Best for: Long-term holders, large-scale investors, and those mining Bitcoins who need secure storage for large amounts.

Examples: Trezor and Ledger (hardware wallets), paper wallets (a physical copy or printout of your public and private keys).

How to Buy Bitcoin

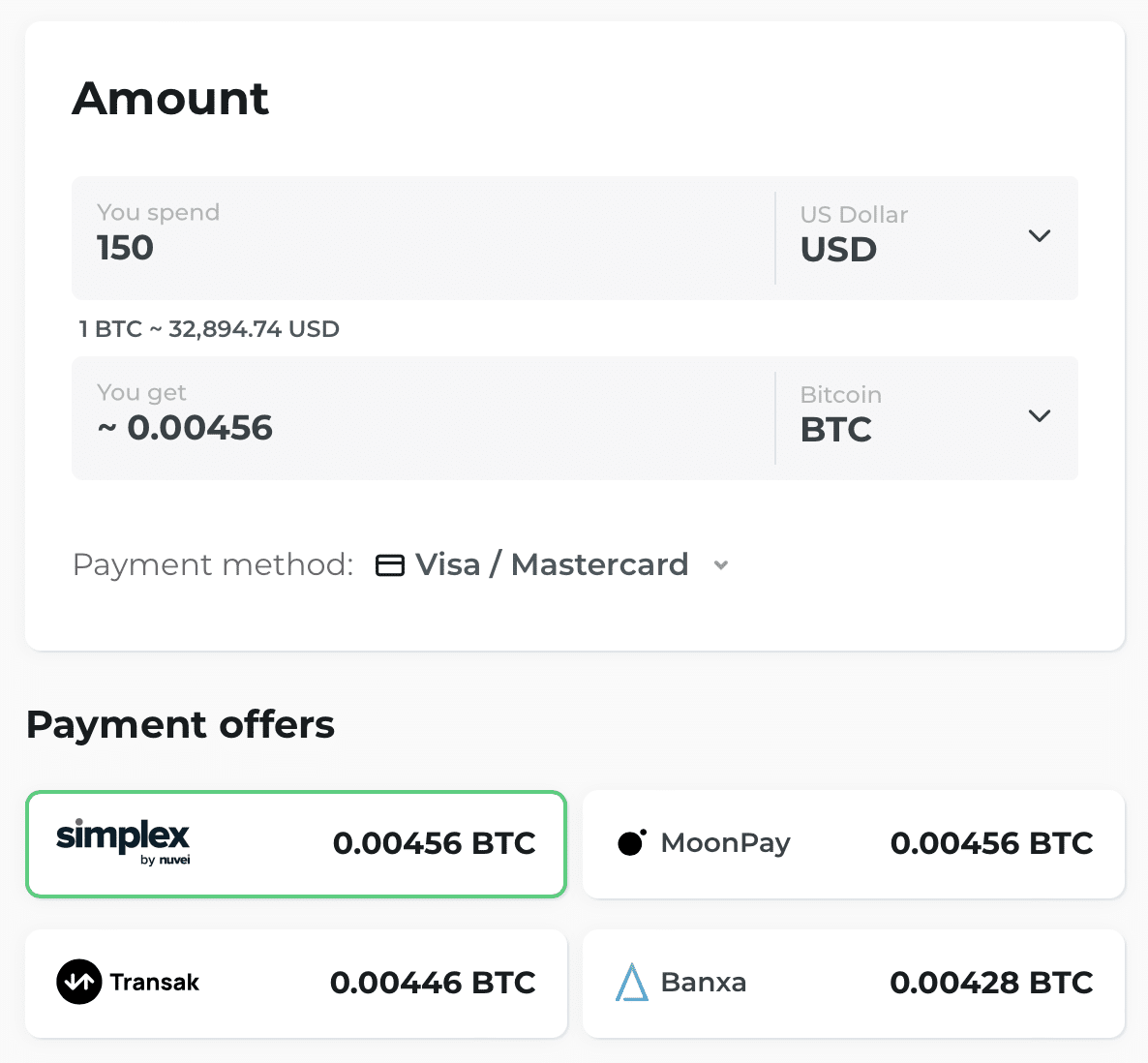

Buying Bitcoin involves transacting on cryptocurrency exchanges, online platforms where individuals can exchange traditional fiat currency like US dollars or Euros for Bitcoin or other virtual currencies. Most major Bitcoin exchanges also provide a platform for trading Bitcoin for other cryptocurrencies.

The process of buying Bitcoin generally involves the following steps: create an account on a cryptocurrency exchange, undergo a verification process, deposit fiat currency into the account, and then use those funds to buy Bitcoin. Bitcoin transactions are then recorded on the blockchain ledger, and Bitcoin miners validate transactions and add them to an existing chain of blocks.

As Bitcoin is the most popular cryptocurrency, there are also many alternative ways to get it. For example, you can use a Bitcoin ATM, or buy BTC on a peer-to-peer platform directly from other users. Additionally, these days, many crypto wallets offer built-in widgets that enable Bitcoin purchases.

Should You Buy Bitcoin?

Deciding whether to buy Bitcoin is a personal decision and depends largely on your financial situation, risk tolerance, and understanding of Bitcoin and blockchain technology. It’s essential to consider the following:

- Bitcoin’s price is known for its volatility. While significant increases in value can result in substantial gains for investors, the price can also drop quickly. Therefore, potential investors should be prepared for this volatility and avoid investing money they cannot afford to lose.

- Bitcoin’s decentralized nature also means that there’s no central authority guaranteeing its value. Unlike traditional fiat currencies issued by central banks, Bitcoin’s value is purely determined by supply and demand dynamics in the market.

- Given its relative novelty and complex nature, it’s essential for potential investors to thoroughly research and consider their decision before buying Bitcoin. Many resources are available online, including courses, forums, and articles that can help individuals learn more about this virtual currency.

Despite the risks, many believe in Bitcoin’s potential to disrupt traditional financial systems and view it as the future of money. For these individuals, buying and holding Bitcoin is not just an investment but a belief in a technological revolution. Whether you decide to buy Bitcoin or not, there’s no doubt that it has sparked a significant conversation about the future of money and finance.

FAQ

Is Bitcoin an actual coin?

No, Bitcoin doesn’t have a physical form. It is a fully digital currency.

What blockchain does Bitcoin use?

Bitcoin uses its own blockchain, called the Bitcoin blockchain.

What are Bitcoins made of?

Well, technically, Bitcoins are made of… nothing. After all, they only exist in a digital form.

How long do Bitcoin transactions take?

Transactions on the Bitcoin network typically take anywhere from 10 to 20 minutes.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

[ad_2]

Source link