XRP Ledger, created by Ripple Labs Inc., is an open-source blockchain technology and digital asset. This means that developers can contribute to its development and enhance its functionality. XRP serves as the native cryptocurrency of the XRP Ledger and is the commonly recognized name for it. The XRP Ledger is purposefully designed to enable swift, cost-effective, and secure transactions. It functions as a distributed ledger, where transaction records are stored across a network of validators, which are participating computers, ensuring the integrity of the ledger.

XRP has garnered significant recognition for its ability to facilitate expeditious and streamlined cross-border payments. Its primary objective is to enhance liquidity and establish connections between diverse currencies, enabling seamless value transfers for both financial institutions and individuals across international borders. Ripple, the entity responsible for XRP, has forged partnerships with numerous financial institutions to investigate the potential of XRP in the realms of remittances and international settlements.

It is imperative to emphasize that although XRP is commonly linked with Ripple, the XRP Ledger functions autonomously, separate from the company. XRP can be exchanged on different cryptocurrency platforms and stored in digital wallets that are compatible with the XRP Ledger.

Additionally, there is a diverse range of cryptocurrency exchanges that support the XRP Ledger (XRP) for individuals interested in buying, selling, or trading XRP. Some notable examples include Binance, Coinbase, Kraken, BitStamp, Huobi, and more.

Founders Of XRP Ledger (XRP)

In early 2011, developers David Schwartz, Jed McCaleb, and Arthur Britto were intrigued by Bitcoin but concerned about its energy consumption and scalability issues. They aimed to create a more sustainable system for value transfer. Their predictions about Bitcoin’s energy usage were proven right when estimates revealed that Bitcoin mining consumed more energy than Portugal in 2019. They also foresaw the risks of one miner or collusion of miners gaining over 50% of the mining power, which remains a concern today as mining power concentrates in China.

Undeterred, the developers continued their work and created a distributed ledger called Ripple, with a digital asset initially called “ripples” (later referred to as XRP). The name Ripple encompassed the open-source project, the unique consensus ledger (Ripple Consensus Ledger), the transaction protocol (Ripple Transaction Protocol or RTXP), the network, and the digital asset.

To eliminate confusion, the community started referring to the digital asset as “XRP.” By June 2012, Schwartz, McCaleb, and Britto completed the code development and finalized the Ledger.

How XRP Ledger (XRP) Works

The XRP Ledger represents a pioneering blockchain technology that places a strong emphasis on scalability and interoperability. This focus enables the ledger to offer a wide array of possibilities for diverse applications that surpass the realms of traditional financial systems.

By demonstrating the capacity to handle substantial transaction volumes and foster seamless connectivity among different assets, the XRP Ledger stands poised to bring about a revolution across multiple industries and ignite innovation. Its scalable and interoperable nature creates opportunities for novel use cases and transformative solutions within the blockchain ecosystem.

Prominent Features Of XRP Ledger

Consensus Ledger

Functioning as a distributed and decentralized ledger, the XRP Ledger stores the transaction history across an independent network of validators. Every validator preserves a copy of the ledger, and transactions undergo validation and agreement via the consensus algorithm. This approach ensures that the ledger’s transaction history is securely stored and that transactions are verified and approved through a collaborative process among validators. By employing this distributed and decentralized framework, the XRP Ledger establishes a reliable and transparent system for recording and validating transactions.

Gateways and Interoperability

The XRP Ledger enables the establishment of gateways, which are entities responsible for issuing and redeeming assets on the ledger. These gateways play a crucial role in bridging various currencies and assets, fostering seamless interoperability across different financial systems.

By facilitating the transfer and exchange of diverse assets, the gateways enhance the connectivity and compatibility between different forms of value representation. This feature of the XRP Ledger promotes greater efficiency and accessibility in cross-border transactions and opens up opportunities for enhanced liquidity and streamlined financial operations.

Transaction Speed and Scalability

Engineered with scalability and rapid transaction settlement in mind, the XRP Ledger (XRP) is adept at processing a substantial number of transactions per second. With the capability to settle transactions within a matter of seconds, the ledger is well-suited for a wide range of use cases that demand swift and efficient transaction execution.

Its high scalability and speedy transaction settlement empower businesses and individuals alike to conduct seamless and timely transactions, fostering enhanced productivity and responsiveness in various applications and industries.

Consensus Algorithm

Within the XRP Ledger, a distinctive consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA) is employed. Diverging from conventional proof-of-work (PoW) or proof-of-stake (PoS) algorithms, RPCA relies on a group of trusted validators to authenticate and validate transactions. These validators assume the crucial role of collectively establishing consensus regarding the sequence and legitimacy of transactions on the network. By leveraging this innovative consensus mechanism, the XRP Ledger ensures the integrity and reliability of its transaction validation process, providing a secure and efficient environment for conducting business.

Native Cryptocurrency (XRP)

XRP operates as the inherent digital currency of the XRP Ledger, serving multiple purposes, such as facilitating transactions, offering liquidity, and bridging diverse currencies. As a medium of value exchange, XRP can be transferred between various entities on the XRP Ledger, enabling seamless transactions and facilitating the exchange of value. This versatile cryptocurrency plays a vital role in supporting the functionality and efficiency of the XRP Ledger ecosystem.

The Impact Of XRP On The Financial Industry

Undoubtedly, the XRP Ledger, along with its native currency XRP, has made a notable impact on the financial industry, bringing forth a range of positive innovations across various important aspects such as:

Decentralized Finance (DeFi)

The XRP Ledger’s utilization of smart contracts and tokenization creates possibilities for decentralized finance (DeFi) applications, paving the way for the development of groundbreaking financial services like lending, borrowing, and decentralized exchanges. With its rapid and scalable nature, the XRP Ledger provides an ideal foundation for constructing DeFi applications, potentially extending financial services to underserved communities and diminishing dependence on conventional intermediaries.

Asset Tokenization

The capacity of the XRP Ledger to tokenize tangible assets like real estate, art, and commodities has the potential to unleash liquidity for assets that have historically lacked it. Through the representation of these assets as digital tokens on the ledger, fractional ownership becomes feasible, enabling enhanced accessibility and transferability. This breakthrough can introduce fresh investment prospects and enhance market efficiency.

Cross-Border Payments

The swift transaction settlement and economical fees offered by the XRP Ledger make it an attractive choice for cross-border payments. Its efficient currency-bridging capabilities simplify and expedite international transactions, potentially reducing expenses and enhancing liquidity for financial institutions. This can result in expedited and cost-effective remittances, benefiting both businesses and individuals.

Liquidity and Market Efficiency

The XRP Ledger’s utilization of XRP as a bridge currency and liquidity tool has the potential to bolster market efficiency and enhance liquidity for diverse assets. By enabling seamless value exchange across different currencies, the XRP Ledger contributes to improved market liquidity, simplifying the process of buying, selling, and trading assets for users. This heightened liquidity has the capacity to foster more efficient markets and enhance the process of price discovery.

XRP Distribution And Price Dynamics

The distribution of XRP tokens by Ripple Labs is a nuanced process that goes beyond a simple monthly release schedule. Currently, the majority of XRP is held in 16 escrow contracts, and their release is influenced by multiple factors, such as market conditions and ecosystem adoption. The original 55-month distribution projection was an estimate, and Ripple has the ability to adjust the pace based on their assessment.

Certainly, this distribution strategy impacts the price of XRP. A significant influx of XRP could potentially exert downward pressure on its value. However, attributing price fluctuations solely to this factor would be narrow-minded. The overall market sentiment towards cryptocurrencies, demand from financial institutions, regulatory developments, and news related to Ripple all contribute significantly. To truly understand the price action of XRP, a comprehensive analysis of these intertwined factors is necessary, recognizing the intricate interplay between Ripple’s distribution strategy and the dynamic cryptocurrency landscape.

Tokenomics Of XRP Supply

XRP has a fixed supply of 100 billion tokens, making it a pre-mined cryptocurrency with no possibility of additional token creation. Only a fraction of the tokens are actively traded, while 20 billion went to the founders. The distribution involves 55 smart contracts that release 1 billion tokens monthly over 55 months, resulting in a monthly increment of 1 billion tokens. The circulating supply is around 53.7 billion tokens, with the remaining held in escrow.

Source: Messari on X

Over 60% of the total supply is concentrated in the top 100 wallets, raising decentralization concerns. Ripple owns 6.5 billion XRP, adjusting the circulating supply to approximately 47 billion tokens.

XRP exhibits a mild deflationary trend from burning fees, reducing the total supply to about 99,988,221,902 XRP.

Buying XRP Coins

Purchasing XRP coins can be a relatively straightforward procedure; however, the available choices cater to diverse levels of experience and comfort. Here is a breakdown of different approaches tailored to meet your specific requirements:

Beginner-Friendly Exchanges

Coinbase and Binance are user-friendly platforms suitable for newcomers. They provide intuitive interfaces, clear instructions, and customer support to assist users throughout the process.

Peer-to-Peer (P2P) Exchanges

Platforms like Paxful are P2P exchanges that enable direct XRP purchases from other individuals. This decentralized approach offers privacy and flexibility but requires caution when evaluating counterparties and following safety measures.

Decentralized Exchanges (DEX)

Uniswap is an example of a DEX platform that operates on blockchains. They facilitate direct peer-to-peer trading without intermediaries, providing enhanced security and control over funds. However, using DEX platforms will require compatible wallets.

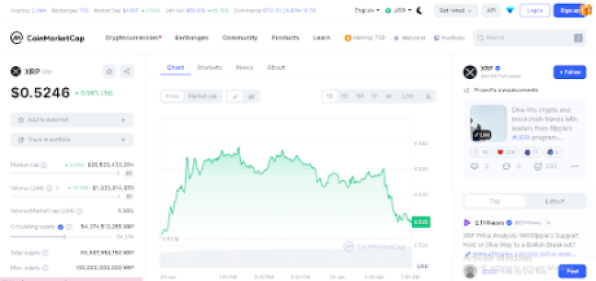

Tracking Prices of XRP Ledger (XRP)

To effectively track the prices of XRP Ledger (XRP), the digital asset native to the XRP Ledger, and stay up to date with its market movements and fluctuations, there are several reliable methods and platforms that you can utilize, such as widely recognized cryptocurrency tracking platforms like CoinMarketCap

CoinMarketCap is a highly regarded platform for monitoring cryptocurrencies, offering extensive data on a diverse range of digital assets, such as XRP Ledger (XRP). Users can explore the XRP page on CoinMarketCap to access up-to-the-minute price updates, historical data, market trends, and other pertinent information relating to XRP. CoinMarketCap serves as a trusted resource for individuals seeking to track and analyze the performance of XRP Ledger within the global cryptocurrency market.

Ripple Lawsuit With Securities And Exchange Commission (SEC)

The Ripple vs. SEC legal dispute, which began in December 2020, has a profound impact on XRP. The SEC accuses Ripple of conducting an unregistered securities offering through XRP sales, while Ripple argues that XRP is a utility token for cross-border payments and not a security. This ongoing battle has caused turbulence for XRP, resulting in price volatility and adoption uncertainty. The outcome of the case will have significant implications for XRP and the broader cryptocurrency industry.

The lawsuit has led to a hesitant market as businesses and individuals are cautious about embracing XRP due to the uncertainty surrounding its classification. The resolution will determine whether XRP’s utility as a token will prevail or if the SEC’s classification as a security will cast a long shadow over its future. As the market awaits a definitive answer, the trajectory of Ripple’s digital creation remains uncertain.

Conclusion

XRP Ledger (XRP) boasts an established name, a decentralized network, and lightning-fast, low-cost transactions. This has cemented its role as a preferred bridge currency for cross-border payments.

Despite facing legal challenges, XRP has an impressive track record as one of the pioneering cryptocurrencies, gaining widespread adoption among major financial institutions through RippleNet. The community’s dedication and the project’s foundational strengths provide a solid basis for potential success. However, the outcome of the SEC lawsuit will be a crucial determinant in shaping the future of XRP, whether it will be positive or negative.

Nevertheless, navigating the world of XRP necessitates careful consideration. While some may prioritize user-friendly platforms for entry, experienced traders might seek advanced features offered by decentralized exchanges (DEXs).

Regardless of your experience level, remember that cryptocurrencies remain volatile, and responsible investing practices are paramount. Consider these factors, research, and choose the path that aligns with your personal financial goals and risk tolerance.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.