The crypto market could be getting ready to enter the highly anticipated altcoin season. As the market rides the bull wave spearheaded by Bitcoin, a crypto analyst has identified the current phase of the market using the Wyckoff Cycle. This analysis suggests that altcoins are preparing for a “parabolic run” that could kickstart the onset of the altcoin season.

Related Reading

Wyckoff Cycle Reveals What Phase The Current Market Has Entered

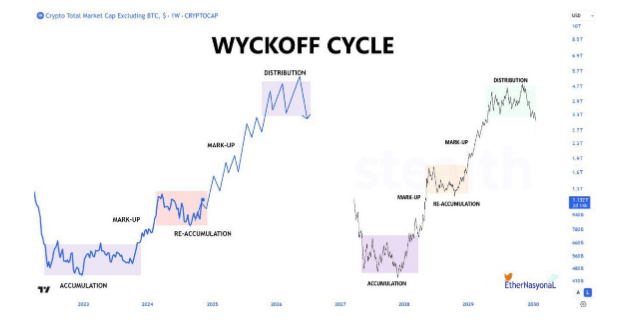

A crypto technical analyst identified as EtherNasyonal has shared a chart of the crypto total market cap, excluding Bitcoin. In this chart, the Wyckoff cycle, a widely used framework for understanding market behavior and trends, can be seen. The chart showed four distinct market phases — Accumulation, Mark up, Distribution, and Mark down.

The accumulation phase is the period when smart money begins buying assets at lower prices, and prices consolidate as selling pressure reduces. Once the accumulation phase completes, the Markup phase begins, where prices break out of the consolidation range and begin an uptrend driven by increased demand.

The next phase, the Distribution stage, is characterized by selling pressure, where smart money begins selling its holdings, leading to price corrections or stabilization. After this stage, the Markdown phase starts, where selling pressure overwhelms demand, triggering a downtrend.

Based on these unique phases, the crypto analyst has revealed that the market is currently in the Mark up phase, highlighted by an increase in the prices of various cryptocurrencies. By 2025, 2026, and 2027, the total market is expected to enter a re-accumulation phase, another mark up phase, and a distribution phase, respectively.

The right side of the chart also shows a continuation of these distinct market phases, with 2027 to 2030 set to witness an accumulation, mark up, and distribution stage.

Here’s When The Altcoin Season Could Begin

Based on EtherNasyonal’s Wyckoff cycle chart, the altcoin season is set to commence, with altcoins already preparing to experience a parabolic run. The altcoin season is a period when cryptocurrencies, excluding Bitcoin, experience significant price increases and often outperform Bitcoin significantly. Based on the past bull market, the altcoins that led the previous altcoin season include Ethereum, Cardano, Solana, and others.

The crypto analyst has revealed that the altcoin season will begin after the reaccumulation phase in the Wyckoff crypto market chart. The reaccumulation phase is set to take place in 2025, following the Mark up phase in 2024.

Related Reading

In this reaccumulation phase, the analyst expects altcoins to experience an epic rise that could lead to a strong and bullish altcoin season. The Bitcoin price performance is also set to influence this anticipated altcoin season, as a Bitcoin bull run has historically preceded past altcoin seasons. Moreover, as the market sees a decrease in Bitcoin’s dominance and increased demand for altcoins, this could signal that the altcoin season may be imminent.

Featured image from Pexels, chart from TradingView