With the Canadian cryptocurrency market expected to reach US$941.6 million in 2024, it’s a great time to start trading. However, choosing the right exchange can be tricky. In this guide, we’ll explore the best crypto exchanges in Canada, detailing their unique features, fees, supported coins, and more.

Key Takeaways:

- The best Canadian crypto exchanges include Bitget, Crypto.com, Coinbase, Kraken, Bitbuy, Shakepay, and Uniswap due to their unique features, security, and usability.

- To choose the best crypto exchange in Canada, consider factors like regulation, fees, supported coins, security, CAD funding options, and customer support.

- Canada taxes crypto gains at 50% for capital gains and 100% for business income, making it essential to track and report transactions accurately.

List of Best Crypto Exchanges in Canada: Our Top Picks

We have reviewed over 30 different Canadian crypto asset trading platforms based on security, CAD payment methods, fees, ease of use, and more. Here is our list of the best cryptocurrency exchanges in Canada:

- Bitget: Overall Best Crypto Exchange Canada

- Crypto.com: Best Canadian Bitcoin Exchange for Fiat Deposits

- Coinbase: Regulated Crypto Exchange in Canada

- Kraken: Safest Crypto Exchange in Canada

- Bitbuy: Best for Buying Bitcoin in Canada

- Shakepay: Best Crypto App to Buy Bitcoin and Ethereum

- Uniswap: Best Decentralized Exchange in Canada

Best Canadian Crypto Exchanges – Comparison Table

| Exchange | Supported Coins | Fees | CAD Deposit Supported | FINTRAC Licensed |

| Bitget | 700+ | 0.1% maker/taker | Yes (via credit/debit card) | No |

| Crypto.com | 350+ | 0.25% maker and 0.5% taker | Yes (via Interac, bank transfer) | Yes |

| Coinbase | 200+ | 0.4% maker and 0.6% taker | Yes (via Interac e-Transfer) | Yes |

| Kraken | 200+ | 0.25% maker and 0.4% taker | Yes (via Interac e-Transfer, bank transfer) | Yes |

| Bitbuy | 55+ | 0.5% (Pro Trade) | Yes (via Interac e-Transfer, bank transfer) | Yes |

| Shakepay | 2 (Bitcoin, Ethereum) | 0% | Yes (via Interac e-Transfer, bank transfer) | Yes |

| Uniswap | Thousands of tokens | 0.3% | No | No (DEX platform) |

Best Crypto and Bitcoin Exchanges in Canada – Detailed Review

1. Bitget: Overall Best Crypto Exchange in Canada

Bitget is the #1 crypto exchange for Canadians looking to trade 700+ digital currencies. The platform lets you deposit CAD using credit or debit cards, making it highly convenient. With a flat 0.1% maker and taker fee, Bitget is among the most affordable exchanges for trading. Its native token, BGB, offers even more discounts (up to 20%).

Beginners will find the copy-trading feature helpful, allowing them to replicate the strategies of experienced traders. For advanced users, Bitget excels in 125x futures trading with tools for risk management. The exchange also ensures a secure trading environment, leveraging advanced encryption and compliance standards.

It also provides promotions, such as discounts and $1,000 sign-up bonus opportunities, to engage both new and seasoned traders. The interface is user-friendly, and Bitget is accessible via its mobile app. You can read our detailed Bitget review for more info.

Pros

- Low fees, especially with BGB token discounts

- Copy trading for beginners to follow experienced traders

- Supports CAD deposits and withdrawals

- High-security standards for peace of mind

- Offers both spot and futures trading options

Cons

- No direct crypto-to-bank withdrawal for Canadian users

- Complex features might overwhelm complete beginners

2. Crypto.com: Best Canadian Exchange for Fiat Deposits and Withdrawals

Crypto.com is another popular platform for Canadians looking to trade and manage cryptocurrency. It supports over 350 cryptocurrencies, including Bitcoin, Ethereum, and many altcoins. Canadians can use the Crypto.com app for buying, selling, and staking crypto, which makes it beginner-friendly.

The platform also provides a Visa card, allowing you to spend crypto directly, which is especially handy for everyday transactions. Plus, the app charges 0% fees for deposits and crypto-to-crypto exchanges. However, there are fees for withdrawing crypto, which depend on the currency.

Crypto.com also offers attractive rewards for Canadians through cashback on the Visa card and other promotions. Staking CRO (its native token) can unlock additional perks, including higher cashback rates. Its security features, like two-factor authentication and a user-friendly app, make it trustworthy for Canadian users. Plus, Crypto.com provides tax tools tailored to Canadian regulations.

Pros

- Supports over 350 cryptocurrencies for trading

- Crypto Visa card with cashback rewards

- No fees on deposits and crypto-to-crypto convert

- Canadian tax reporting tools included

- Easy-to-use mobile app

Cons

- Customer support can be slow

- Trading fees are higher compared to global exchanges

3. Coinbase: Regulated Crypto Exchange in Canada

Coinbase is the best crypto exchange in Canada for its regulation-friendly approach. It supports over 200 cryptocurrencies. Canadians can buy crypto easily using debit cards or Interac e-Transfer. Coinbase has strong security features like two-factor authentication and insurance on digital assets held in its system.

For fees, Canadians pay about 1.49% for transactions through bank transfers and around 3.99% when using debit cards. While the fees are higher compared to some other exchanges, Coinbase is loved for its regulatory complaint and safety. It is registered as a Restricted Dealer with the Canadian Securities Administrators (CSA).

Canadians must note that provincial rules can affect their crypto purchase limits on Coinbase. For instance, provinces like Alberta and Quebec don’t have restrictions, while others cap certain crypto purchases at $30,000 annually. Coinbase also complies with Canadian regulations, offering alerts when portfolio values drop significantly, which helps users manage risks better.

Pros

- Buy crypto without fees with Interac e-Transfer

- Sell your crypto and cash out instantly to most Canadian banks

- Trade 200+ digital assets securely

- Earn up to 10% APY on your crypto through the staking program

- Advanced charts powered by TradingView with EMA, MA, MACD, RSI, and Bollinger Bands

Cons

- High transaction fees

- No credit card purchases in Canada

4. Kraken: Safest Crypto Exchange in Canada

Kraken is one of the top Canadian crypto exchanges. It started its Canadian journey in 2016 when it acquired CoinSetter and CaVirtEx, two platforms already popular with early crypto users in the country. Over the years, Kraken has built a strong presence, holding over $2 billion CAD in client assets by 2024. It supports trading in over 200 cryptocurrencies, including popular options like Bitcoin and Ethereum, alongside lesser-known tokens.

Canadian users benefit from features like Interac e-Transfers for easy CAD deposits and withdrawals, with fees as low as 0.25%. Kraken also offers CAD trading pairs, providing more flexibility for local users.

Security is a major focus for Kraken, as it employs advanced measures like two-factor authentication and cold wallet storage to protect user assets. Its 24/7 customer support, including tailored services for Canadians, makes it a reliable choice.

Pros

- Supports over 200 cryptocurrencies

- Interac e-Transfers with low fees

- Excellent security features

- 24/7 customer support tailored to Canadians

- Complies with Canadian regulations

Cons

- Limited advanced trading features for professionals

- Withdrawal fees can be high for certain cryptos

5. Bitbuy: Best for Buying Bitcoin in Canada

Bitbuy is a Canadian crypto exchange that stands out for its focus on security and ease of use. Founded in 2016 and based in Toronto, Bitbuy is one of the most popular crypto platforms in Canada with 900,000+ users. It is registered with FINTRAC and the Ontario Securities Commission, making it a fully regulated marketplace.

Bitbuy supports over 55 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Solana. For beginner traders, it offers “Express Trade”, which is simple and quick. Advanced users can use “Pro Trade”, which provides deeper insights and tools.

The fees are competitive or we can say quite high; for example, trading fees start at 0.5% for Pro accounts. When withdrawing Bitcoin, the minimum fee is 0.0005 BTC. It also supports free deposits via Interac e-Transfer for amounts over $50. It has a staking feature, where users can earn rewards on coins like Ethereum and Solana, with rates varying around 2%-11%.

Pros

- Approved by the Ontario Securities Commission and the Canadian Securities Administrators

- 90% of your crypto is kept secure in cold storage

- Earn up to 11.23% in rewards by staking some of your favorite coins

- Excellent customer support tailored for Canadians

Cons

- Higher staking commission with up to 25%

- A limited number of supported coins

- Lacks advanced trading features compared to global platforms like Binance and OKX

6. Shakepay: Best crypto app Canada to buy Bitcoin and Ethereum

Shakepay is a Canadian cryptocurrency app that makes buying and selling Bitcoin and Ethereum super easy for Canadians. Based in Montreal, it started in 2015 and now has over 1.3 million users across the country.

Shakepay focuses on making crypto accessible while charging no commission fees on trades, which is a big plus for beginners. Instead, they earn through small spreads on buying and selling prices. The platform only supports Bitcoin and Ethereum, so it’s simple but not ideal if you’re looking for a wide variety of coins.

You can also use Shakepay for everyday money needs, like paying bills, sending e-transfers, and even direct deposits. They even have a prepaid Visa card that offers up to 1% Bitcoin cashback on purchases, which makes it stand out. You can earn extra Bitcoin through features like “ShakingSats”, where you get free Bitcoin daily just by logging into the app. Shakepay is heavily regulated in Canada, making it safe and trustworthy for users here.

Pros

- Zero fees platform for buying or selling crypto

- Simple and beginner-friendly user interface

- Bitcoin cashback rewards on Visa card spend

- Trusted by over 1.3 million Canadians

- Regulated across all provinces

Cons

- Only supports BTC and ETH for crypto purchases

- No advanced trading tools

- Higher spreads can be frustrating sometimes

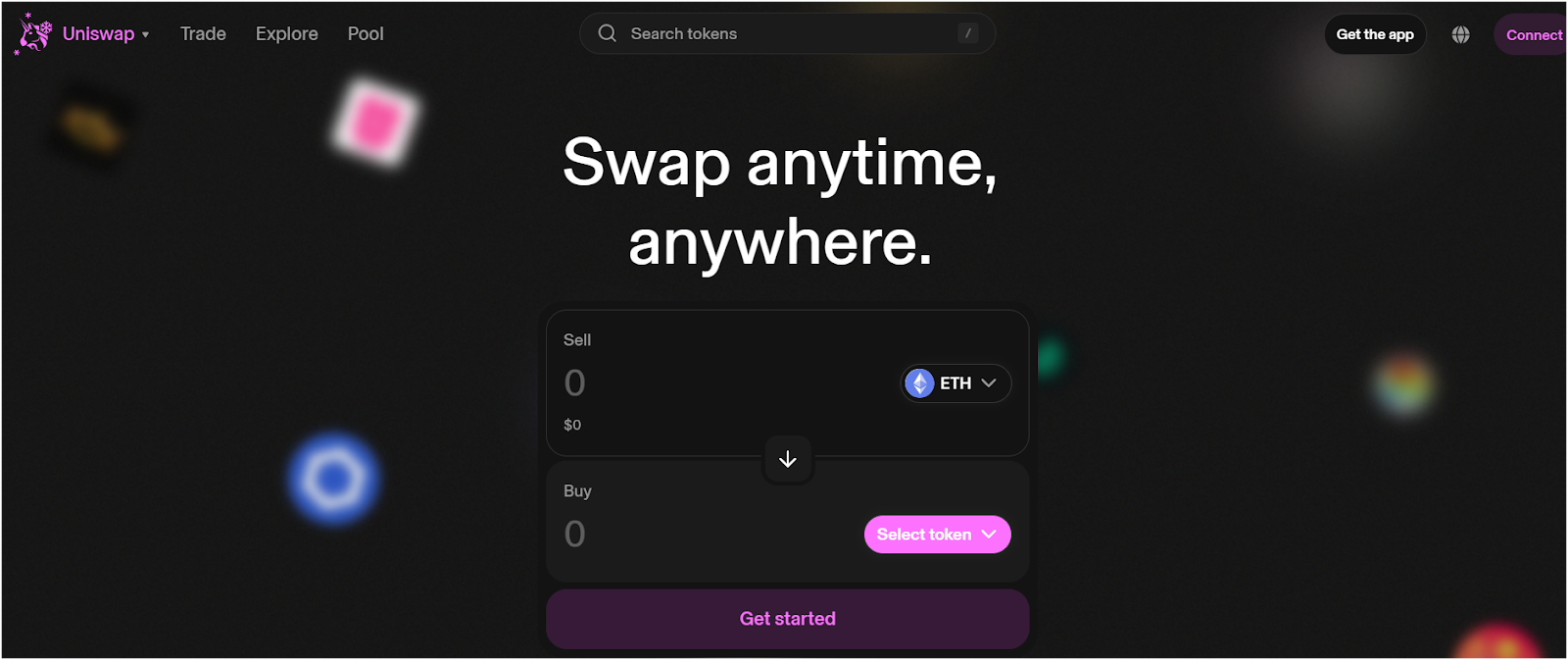

7. Uniswap: Best decentralized exchange in Canada

Uniswap is a popular decentralized exchange (DEX) that operates on the Ethereum blockchain. Now, it supports 11+ blockchains. It is widely used in Canada for trading without needing an account or centralized authority.

It is popular as a no-KYC crypto exchange in Canada. Instead, you connect your crypto wallet, like MetaMask, to trade directly with others. Uniswap is known for its automated market maker (AMM) system, which uses liquidity pools to match trades rather than an order book.

In Canada, Uniswap appeals to users who want privacy and control since it doesn’t require personal details or a KYC. The platform charges a trading fee of 0.3%, but transactions might cost more due to Ethereum’s gas fees, which vary depending on network traffic.

Liquidity providers on Uniswap earn a share of the trading fees, making it attractive for earning passive income. However, there’s no customer support or insurance, so any mistakes or hacks mean you could lose funds. For Canadian users, Uniswap is a solid choice for those who value decentralization and access to a wide variety of tokens, including many not listed on centralized exchanges.

Pros

- Trade thousands of low-cap tokens without account or registration

- Earn passive income by providing liquidity for pools

- No KYC ensures privacy and decentralized transactions

- Competitive 0.3% trading fee for all token swaps

- Simple interface great for beginners and casual users

Cons

- Gas fees are high during Ethereum network congestion

- No insurance protection for lost or hacked funds

- Limited guidance or support for new crypto traders

- Slower transactions compared to non-Ethereum blockchains

Best Bitcoin and Crypto Wallets in Canada

Crypto wallets are important for storing BTC or other crypto assets in Canada. For software wallets, Trust Wallet is a popular free option that works with over a million cryptocurrencies. It’s user-friendly and ideal for beginners.

Another great online wallet is MetaMask, perfect for Ethereum-based tokens and NFTs, with features like token swaps and DeFi access. ZenGo Wallet is another MPC-based wallet that offers an easy-to-use experience and advanced biometric security, great for those who don’t want to manage private keys.

For hardware wallets, Ledger Nano X and Ledger Nano S Plus are highly secure and support thousands of coins. The Nano X, which costs around $209 CAD, is Bluetooth-enabled for mobile use, while the Nano S is more budget-friendly.

Trezor Model T is another top cold wallet, known for its touchscreen and excellent Bitcoin support. If you want something ultra-portable, SafePal S1 Pro is as small as a credit card and supports unlimited cryptocurrencies. For maximum offline security, you can also consider a paper wallet.

Best Crypto Trading Charting Platforms in Canada

For charting and trading, TradingView is a top recommendation. It offers advanced tools to analyze crypto markets and helps you create custom strategies. It’s perfect for beginners and pros, with a free tier and subscription options.

Exchanges like Coinbase and Bitget also provide excellent charting features. Coinbase includes advanced graphs, indicators, and drawing tools. Similarly, Bitget offers professional-grade charts with easy customization and access to futures trading.

How to Choose the Best Cryptocurrency Exchange in Canada?

- Regulated and Licensed: Not all cryptocurrency exchanges work well for Canadians. Some, like Binance, have even left the Canadian market recently. Look for exchanges registered with Canadian regulators like FINTRAC. Exchanges like Bitbuy, Coinbase, and Kraken are good examples of platforms built for Canadians. They let you deposit Canadian dollars easily through methods like Interac e-Transfer or bank transfers.

- Trading Fees: Every time you buy or sell crypto, fees eat into your profits. In Canada, fees vary widely. For example, Bitbuy charges a flat 0.5% per trade, while platforms like Coinbase may add spreads on top of trading fees. Lower fees are better, especially if you plan to trade often.

- Supported Coins: Some exchanges only let you trade Bitcoin and Ethereum, while others offer hundreds of coins. Kraken and Bitget let you trade over 200+ coins, while smaller platforms like ShakePay focus on major ones like BTC and ETH. Pick one that matches your needs – whether you want to stick to popular coins or explore altcoins.

- Security Measures: Crypto is risky, so security should be a top priority. Many Canadian crypto trading exchanges store most of their crypto in offline cold storage. Bitbuy and Coinbase, for instance, hold over 90% of their crypto offline, protecting them from hacks. Some platforms even have insurance, like Coinbase, which covers up to $250,000 in cash.

- Ease of Use: Choose an exchange with a simple interface like Coinbase or Bitbuy. They’re easy to navigate and perfect for first-timers. For advanced traders, platforms like Kraken Pro or Bitget offer tools like live order books, charting, and automated trading bots.

- Funding Options: Depositing and withdrawing money should be straightforward. Interac e-Transfer is one of the most common methods in Canada and is offered by platforms like Bitbuy. Avoid exchanges that charge high deposit or withdrawal fees. Some, like Crypto.com, even offer zero-fee bank transfers for Canadians.

- Customer Support: If something goes wrong, you’ll need quick help. Look for exchanges with 24/7 support. NDAX and Kraken are known for reliable service, while some platforms might only respond during office hours.

Different Types of Crypto Exchanges in Canada

1. Centralized Exchanges (CEXs)

These are the most popular types of crypto exchanges. Platforms like Bitbuy, Bitget, and Kraken fall into this category. Centralized exchanges are run by companies, and they act as middlemen between buyers and sellers. For Canadians, these exchanges are great because they are easy to use, even for beginners.

You can deposit Canadian dollars using Interac e-Transfer or bank transfers. One downside is that you don’t fully control your crypto on these platforms. They hold your coins in wallets, which means if the exchange is hacked, your funds could be at risk.

2. Decentralized Exchanges (DEXs)

Decentralized exchanges are the opposite of CEXs. They don’t have a central authority or middleman. Instead, they let you trade directly with others using blockchain technology. Examples include Uniswap and PancakeSwap, but these are mostly for advanced Canadian users.

For Canadians, DEXs can be harder to use because you need to set up a wallet and manage your private keys. There’s also no support for Canadian dollars, so you need to convert CAD to crypto first.

3. Peer-to-Peer (P2P) Exchanges

Peer-to-peer exchanges connect buyers and sellers directly. For Canadians, platforms like LocalBitcoins or Paxful are examples of P2P exchanges. These platforms let you negotiate prices and payment methods, including PayPal, bank transfers, or even cash.

P2P exchanges are great if you want to avoid trading fees or if you can’t find certain payment options on regular exchanges.

Canada Crypto Tax Explained

In Canada, cryptocurrency is treated as a type of digital asset rather than actual currency. The Canada Revenue Agency (CRA) requires you to report any crypto transactions because they often lead to either taxable capital gains or business income.

When you sell, trade, or even use cryptocurrency to pay for something, the profit or loss from that activity becomes subject to taxes. For example, if you buy Bitcoin for $10,000 and later sell it for $15,000, the $5,000 gain must be declared.

If this is considered a capital gain, only 50% of it is taxable, meaning $2,500 will be added to your taxable income. On the other hand, if the CRA considers your crypto activity as business income – say, you are mining or trading frequently – then the entire $5,000 profit is taxable. Cryptocurrency day trading also comes under business income.

Earning cryptocurrency through mining, staking, or even getting paid in crypto is treated differently. These activities are typically seen as business income, which means 100% of the value is taxable.

The CRA values crypto income based on the Canadian dollar (CAD) value at the time it was received. Even using crypto to buy something like a laptop or a car counts as a taxable event. The CRA calculates the tax based on how much the crypto was worth in CAD when it was spent.

Swapping one crypto for another, such as trading Bitcoin for Ethereum, is also taxable because it’s considered a disposition, just like selling crypto for fiat currency.

How to Buy Cryptocurrency In Canada?

Here is a step-by-step guide on how to buy Bitcoin or altcoin in Canada using CAD:

- Choose a crypto exchange: Start by picking a trusted cryptocurrency exchange like Bitget, Bitbuy, Coinbase, or Kraken. These platforms support Canadian dollars (CAD) and are legal in Canada. Make sure to check fees, features, and reviews to find the one that works best for you.

- Create an account and complete KYC: Sign up on the exchange by providing your name, email, and other personal details. Complete the KYC process by uploading your ID, like a driver’s license, to verify your identity. This step is necessary for security and follows Canadian rules.

- Deposit CAD: Add Canadian dollars to your exchange account. You can use Interac e-Transfer, bank transfers, or sometimes debit cards. Check if there are any deposit fees, as some platforms charge small amounts while others are free.

- Buy crypto and transfer to a wallet: Choose the cryptocurrency you want to buy, like Bitcoin or Ethereum, and place your order. Once purchased, transfer your crypto to a private wallet for better security and control over your funds.

Conclusion

In a nutshell, finding the best crypto exchange in Canada depends on your trading goals, experience, and preferred features. For beginners, platforms like Crypto.com and Shakepay provide simple interfaces, while advanced traders can explore Bitget’s futures trading or Uniswap’s decentralized options.

Security and compliance are paramount; exchanges like Kraken and Bitbuy excel in these areas, making them reliable choices. Remember, crypto in Canada is taxable, so track transactions and understand whether your earnings fall under capital gains (50% taxable) or business income (100% taxable). Choose a platform that balances features, costs, and convenience for a seamless trading experience.

FAQs

Is Crypto legal in Canada?

Yes, cryptocurrency is legal in Canada. The Canadian government recognizes cryptocurrencies like Bitcoin and Ethereum as digital assets, but they are not considered legal tender.

You can buy, sell, and trade crypto through exchanges that comply with Canadian laws, such as those registered with FINTRAC (Financial Transactions and Reports Analysis Centre of Canada). However, crypto activities, including trading, mining, and using it for purchases, are subject to taxation.

Which crypto exchange is best in Canada?

Bitget and Crypto.com are both the best crypto exchanges in Canada. Bitget is popular for its advanced trading features, especially futures trading, making it ideal for experienced traders. It offers competitive fees and supports many cryptocurrencies.

On the other hand, Crypto.com is more beginner-friendly and offers additional features like crypto debit cards and staking options. It supports CAD deposits through Interac e-Transfer and has a user-friendly mobile app.

Is Coinbase or Wealthsimple better for crypto?

Coinbase and Wealthsimple serve different types of users. Coinbase is a global crypto exchange with a wide variety of coins and advanced features like staking and earning rewards. It is better for someone who wants access to many cryptocurrencies and tools.

Wealthsimple is a Canadian platform that focuses on simplicity and supports CAD transactions. It’s best for beginners or those who want to invest small amounts in major cryptocurrencies like Bitcoin or Ethereum.

Is Coinbase legit in Canada?

Coinbase is legit in Canada. It is a well-known cryptocurrency exchange with a strong global presence and complies with regulations in every country where it operates, including Canada.

Is Bitbuy Canada legit?

Bitbuy is a legitimate and trusted crypto trading platform in Canada. It is one of the few platforms fully registered with FINTRAC and the Ontario Securities Commission (OSC), ensuring compliance with Canadian regulations. Bitbuy supports CAD deposits and withdrawals, making it easy for Canadian crypto investors to use.

Which international crypto exchanges are leaving Canada?

Several international crypto exchanges, including Binance, Bybit, and OKX, have announced their exit from Canada. These decisions came after Canada introduced stricter crypto regulations, including the Pre-Registration Undertaking (PRU) process.

This framework requires crypto platforms to comply with rules like limiting leverage, banning specific derivatives, and ensuring more rigorous KYC procedures.