Data shows the Bitcoin Open Interest has shot up by $1.8 billion as the cryptocurrency’s price has broken the $27,000 level.

Bitcoin Open Interest Has Exploded During The Past Day

The “Open Interest” indicator keeps track of the total amount of Bitcoin futures contracts currently open on all derivative exchange platforms.

When the value of this metric rises, it means that the investors are opening up new positions on the market right now. Generally, the cryptocurrency becomes more likely to display volatility when this happens, as new contracts usually imply an increase in the total leverage in the sector (“leverage” naturally being the loan amount holders can opt to take against their positions).

On the other hand, the indicator going down implies that a net amount of contracts are either closing up or getting liquidated. The asset may become more calmer following such a trend.

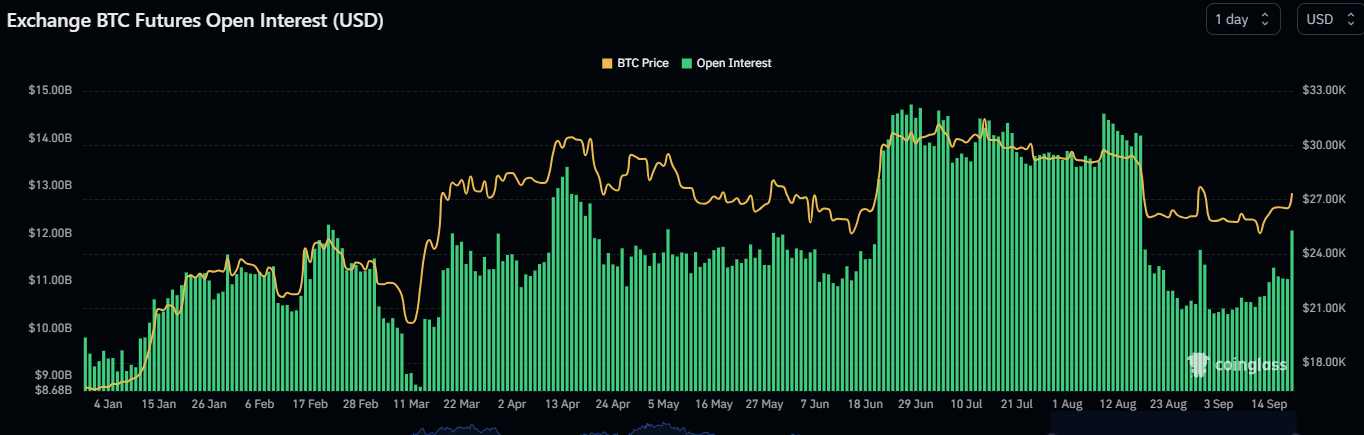

Now, here is a chart from CoinGlass that shows the trend in the Bitcoin Open Interest over the year 2023 so far:

Looks like the value of the metric has shot up over the past day | Source: CoinGlass

The above graph shows that the Bitcoin Open Interest has registered a rather sharp surge today. The main instigator behind this futures rush appears to be the surge in the cryptocurrency’s mark beyond the $27,000 level.

Before this rise, the indicator had a value of $11.04 billion, but now it has hit the $12.81 billion mark, suggesting an increase of a whopping $1.77 billion (about 16%).

This rapid growth in the Open Interest can naturally lead to the asset becoming more volatile, although it’s hard to say in what direction this volatility might appear.

If this rise has come from shorts jumping in to bet against the asset, a further rise would result in their liquidation, thus fueling the price increase even further. If, however, the contracts being opened are long, then it may not end very well for the rally.

The chart shows that the Open Interest had a similar spike back during the Grayscale rally last month, but the longs that had opened then had ended up finding liquidation, as the price had returned to lower levels.

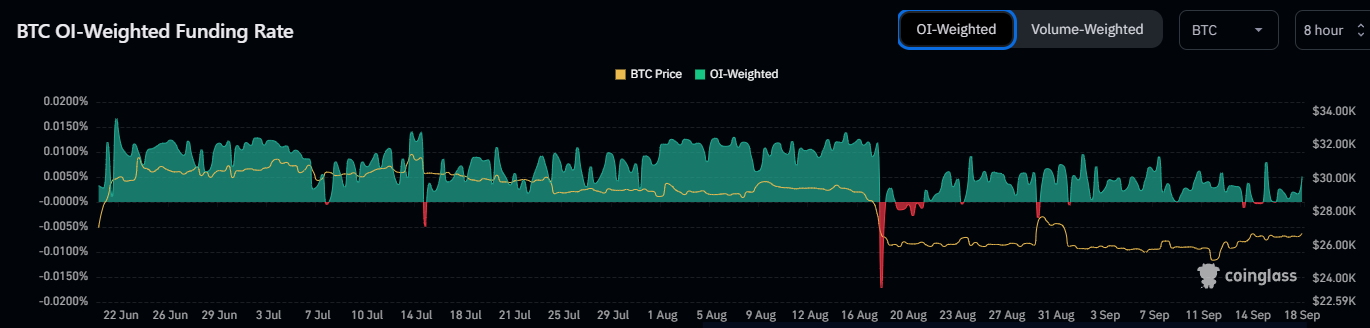

The funding rate, which measures the periodic fee that futures traders pay each other, may provide hints about whether the new positions are shorts or longs.

The value of the metric seems to have been green in recent days | Source: CoinGlass

As is visible in the graph, the Bitcoin funding rate is positive currently, but it hasn’t changed much with the Open Interest rise, implying that long and short positions are spread more evenly in this increase.

It remains to be seen where the cryptocurrency goes in the coming few days and if the Open Interest surge will play any role.

BTC Price

Bitcoin had surged to $27,400 earlier in the day but has since retraced back to $27,200.

BTC has surged during the past day | Source: BTCUSD on TradingView

Featured image from Dmytro Demidko on Unsplash.com, charts from TradingView.com, CoinGlass.com