Cardano (ADA), the smart contracts platform aiming to dethrone Ethereum, is facing a balancing act. While the token has seen a recent price increase, a potential exodus by major investors casts a shadow of doubt.

Related Reading

Will Whales Drag ADA Down?

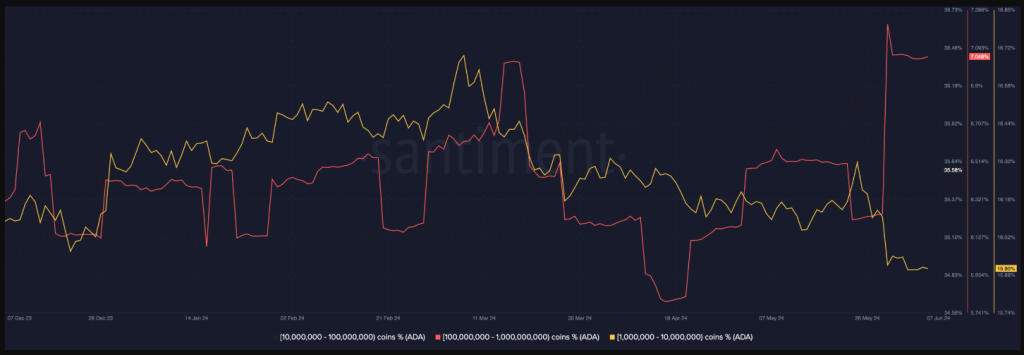

On-chain data reveals a cause for concern for Cardano bulls. Addresses holding a significant amount of ADA (between 1 million and 1 billion tokens) have been selling their holdings. This behavior by “whales,” as these large investors are known, can be a bearish indicator, suggesting a loss of confidence in the project’s future. Historically, such selloffs have often preceded price dips.

While some might view low volatility as a sign of stability, in ADA’s case, it might be hindering growth. The token’s current low volatility acts like a force field, keeping price swings in check. This can be positive, preventing sharp drops. However, it also restricts upward momentum and makes significant price increases less likely.

Consolidation Or Correction?

Two potential scenarios for ADA’s price have been observed. If selling pressure by whales intensifies, ADA could fall back to its previous support level between $0.42 and $0.44. This consolidation phase would represent a pause in the token’s upward trajectory.

However, a more concerning possibility exists. A significant increase in selling could trigger a correction, pushing the price down to $0.42 or even lower. This scenario would be a setback for ADA bulls, potentially erasing recent gains.

Cardano Bulls Look For A Lifeline

Despite the bearish undercurrents, there are reasons for cautious optimism. First, ADA has defied the selling pressure from whales with a nearly 5% price increase in the last week. This resilience suggests there might still be enough buying pressure to offset the selling.

Second, some Cardano price predictions remain bullish. Sources anticipate a rise to $0.46 by July 8th. Whether this prediction materializes depends on market forces, but it offers a potential silver lining for investors.

Related Reading

The Fear & Greed Index

Adding another layer to the complex situation is the current market sentiment. The Fear & Greed Index, a measure of investor sentiment across the cryptocurrency market, currently sits at 72, indicating “Greed.”

This overall bullish sentiment could potentially provide some support for ADA, but it’s important to remember that the index reflects the broader market, not just Cardano specifically.

Featured image from Pngtree, chart from TradingView