The Ethereum market has been a whirlwind of activity in recent days. After a brutal price correction last week, the world’s second-largest cryptocurrency by market capitalization has staged a mini-rebound, leaving investors wondering if this is the start of a sustained bull run or a fleeting flicker before another dip.

Related Reading

Ethereum Rallies, But Questions Linger

Ethereum (ETH) surged 3.7% in the last 24 hours, buoyed by a general uptick in the crypto market. This positive movement comes after a significant price drop that saw ETH fall to $2,850. The recent rise has sparked optimism among some analysts, with popular crypto figure Ali calling for a potential “one to four candlestick rebound” based on a buy signal he identified on ETH’s chart.

The TD Sequential presents a buy signal on the #Ethereum daily chart! It anticipates that $ETH could see a rebound of one to four candlesticks. pic.twitter.com/Vg7FTl9X2a

— Ali (@ali_charts) May 15, 2024

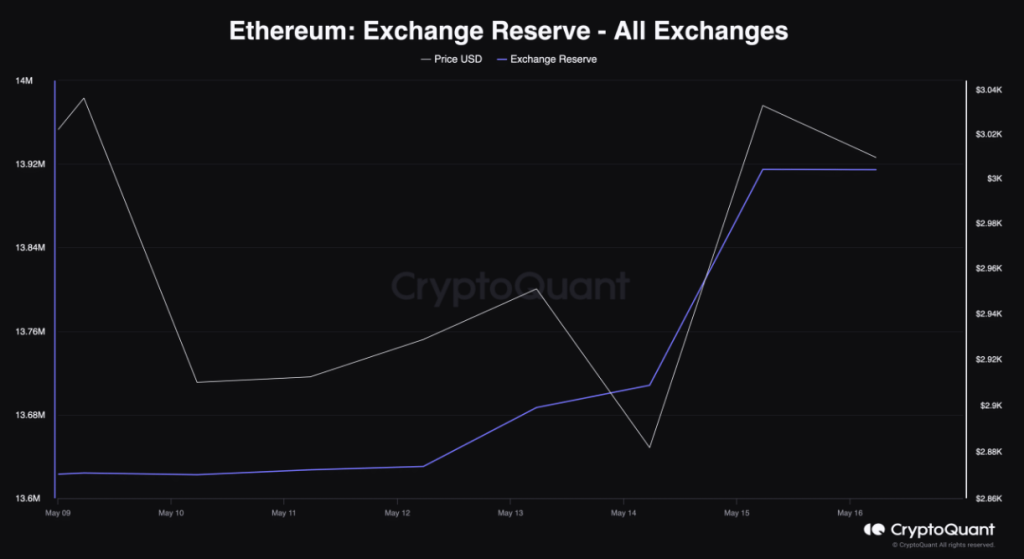

However, not everyone is convinced. A closer look at on-chain data reveals some conflicting signals. CryptoQuant’s data shows a sharp rise in ETH’s exchange reserves over the past few days, suggesting that investors might be offloading their holdings rather than accumulating.

This is further supported by Santiment’s data, which indicates an increase in ETH’s supply on exchanges over the past week.

The behavior of large investors, often referred to as “whales,” also paints an unclear picture. While Ethereum’s supply held by top addresses remained flat, suggesting whales haven’t made any significant moves, this could be interpreted in two ways.

Some believe it indicates a wait-and-see approach from whales, anticipating a potential market top before re-entering.

Undervaluation Hints At Potential Growth

Despite the mixed signals, some metrics point towards a potential price increase for ETH. The token’s Network To Value (NVT) ratio, as analyzed by Glassnode, has declined significantly over the past week.

Market Sentiment, Technical Indicators Send Conflicting Messages

Meanwhile, adding another layer of complexity to the prediction puzzle is the current market sentiment surrounding ETH. While some analysts are turning bullish, evidenced by the rise in ETH’s weighted sentiment on social media platforms, technical indicators paint a less clear picture.

Related Reading

The Relative Strength Index (RSI) and Money Flow Index (MFI) have both dipped recently, potentially suggesting a loss of momentum in the recent upswing. The Moving Average Convergence Divergence (MACD) indicator, however, has presented a bullish crossover, hinting at a potential continuation of the uptrend.

A Potential Bull Run For Ether

While the recent price increase and some on-chain metrics suggest a potential bull run for Ethereum, the conflicting signals from exchange reserves, whale behavior, and technical indicators make it difficult to predict with certainty.

Featured image from Popular Mechanics, chart from TradingView