The United States election was one of the most defining events in the crypto space in 2024. Specifically, the reelection of Donald Trump revived Bitcoin and the entire crypto market after an uninspiring second and third quarter.

One of the promises made by President-elect Trump in the run-up to the polls was the institution of a strategic Bitcoin reserve. Unsurprisingly, most of the recent crypto conversations has been around the BTC reserve and its potential impact on the US economy and the crypto landscape.

Why Should The US Establish Strategic Bitcoin Reserves?

CryptoQuant CEO and founder Ki Young Ju is the latest to weigh in on the issue of strategic Bitcoin reserves in the United States. In a post on the X platform, the crypto expert said that using the world’s largest cryptocurrency to offset the United States debt is a feasible approach.

The CryptoQuant CEO mentioned:

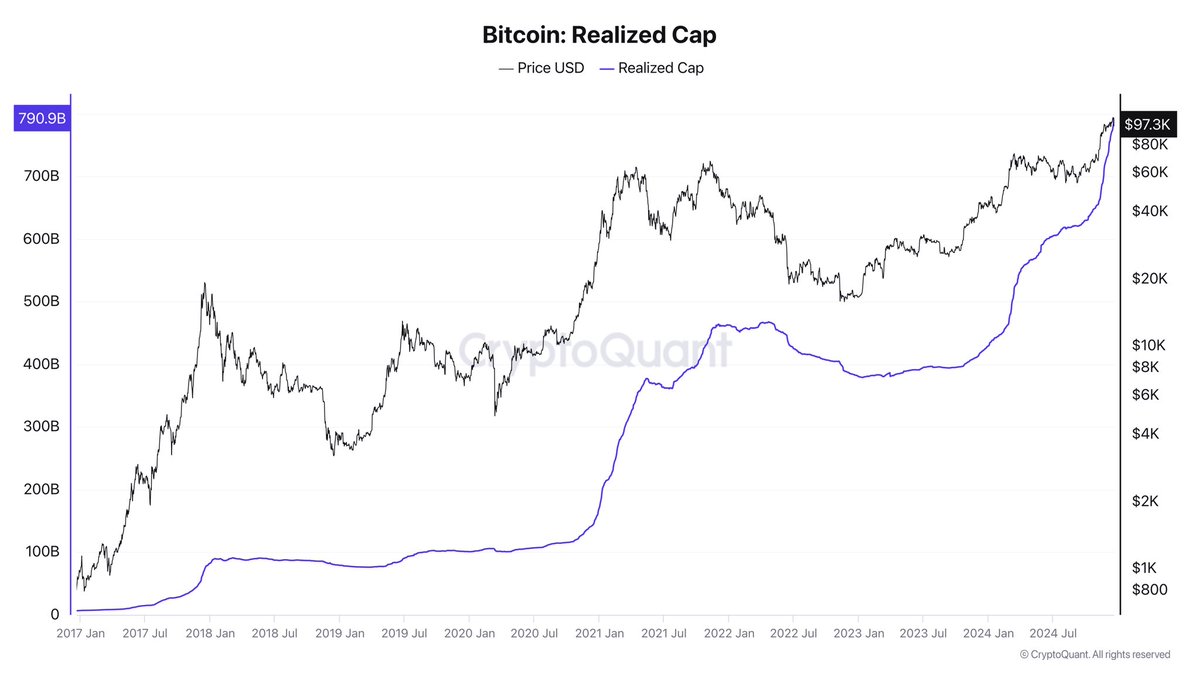

Over the past 15 years, $790 billion in realized capital inflows have propelled Bitcoin’s market cap to $2 trillion. This year alone, $352 billion in inflows have added $1 trillion to its market cap.

Young Ju then disclosed that the United States could trim their domestic debt (70% of the total) by 36% if the government acquires 1 million BTC by 2050 and designates the premier cryptocurrency as a strategic asset. “While the remaining 30% of debt held by foreign entities may resist this approach, the plan does not rely on settling all debt with Bitcoin, making the strategy practical,” the CryptoQuant founder added.

A chart showing BTC's realized cap | Source: Ki_young_ju/X

Young Ju believes that using a “pumpable asset” like BTC to compensate for dollar-denominated debt could face the challenge of creditors’ acceptance. However, the US instituting a strategic Bitcoin reserve could serve as a “symbolic first step” toward bringing global, nationwide legitimacy to the flagship cryptocurrency — as seen with assets like gold.

In the post on X, the CryptoQuant CEO identified old whales dumping their BTC to spite the US government as a risk that could come with establishing a strategic Bitcoin reserve. “However, if governments continue accumulating Bitcoin until 2050 and its price keeps rising, I doubt they would actually dump it,” Young Ju concluded.

BTC Price At A Glance

As of this writing, the price of BTC is hovering around the $97,000 mark, reflecting a 0.4% decline in the past 24 hours. According to data from CoinGecko, the premier cryptocurrency is down by 3.6% in the last seven days.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView