Justin Bieber, the Canadian sensation in the realm of popular music, eagerly explored the domain of Non-Fungible Tokens (NFTs) with fervor, seeking fresh opportunities. However, what commenced as a hopeful journey has now morphed into a tale of caution, as the unpredictable nature of the NFT market has drastically diminished Bieber’s once prosperous collection.

Arkham Intelligence Report

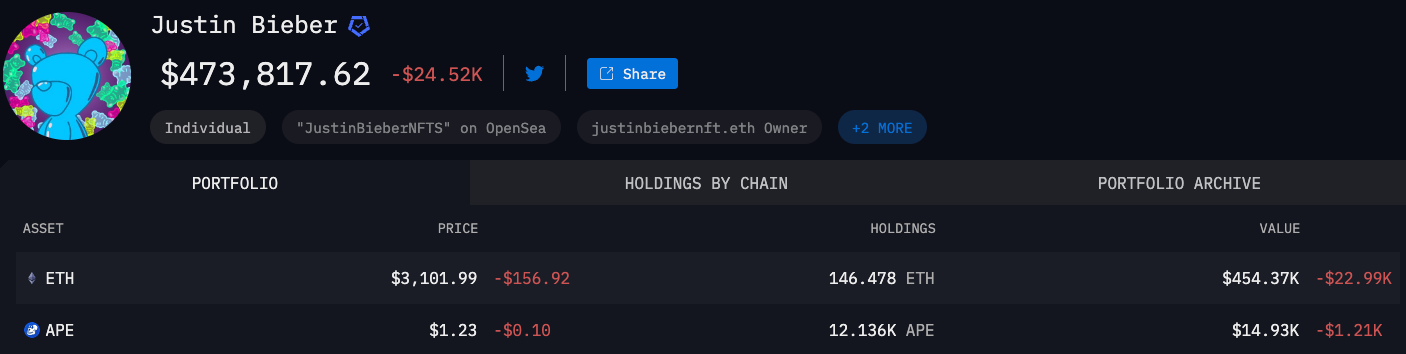

A significant drop in Justin Bieber’s NFT investments was recently revealed by renowned blockchain analytics Arkham Intelligence. The value of the collection used to be priced over $2 million in 2022, Bieber’s NFT collectible dropped to just $100K. With assets assessed at less than $500,000, marking a substantial loss in value over time.

The unique digital assets and its investment possibilities drew the attention of players to the NFT boom in recent years. Joining the NFT market back in 2022, Justin Bieber delved into NFT collections such as Mutant Apes (the ones born after BAYC, World of Women, Otherdeeds, Bored Apes Yacht Club, Metacards, and Doodles. Despite initial promises of potential returns, Bieber’s foray into the NFT market was not invincible to its inherent risks, resulting in a significant drop in value of his investments.

Source: Arkham Intelligence

Source: Arkham Intelligence

A Decline in Portfolio: The Numbers Tell

JB’s NFT portfolio has witnessed a staggering decline of nearly 95% from its peak valuation. The impressive collection, which included multiple MAYCs and BAYCs, has dwindled to a solitary Bored Ape and a Mutant Ape image, both now worth a piece of their last year purchase price. This stark decline serves as a reminder of the unpredictable nature of the NFT market, generally, the whole web3 market and the risks associated with high-profile investments.

Final Thoughts

The decline of Justin Bieber’s NFT portfolio underscores the importance of caution and thorough research when navigating the volatile landscape of digital assets. While the temptation of potential profits may be alluring, retailers/ investors should approach the NFT market with a more concerned attitude and a thoughtful understanding of its risk. His experience reflects a valuable lesson for both celebrities and FOMO investors alike, highlighting the need for careful due diligence and foresight in the high risk/ reward of digital wealth in the Web3 space, at the end, it’s still risky asset.