The conversation this weekend is all about creator royalties in the NFT space. This topic is profoundly important. I’d like to share my thoughts and try and talk about why I (and others) are talking about it now. Contrary to popular belief, it’s not because of 8liens, or because a bunch of us woke up one day and decided wouldn’t it be fun to stop paying royalties to artists. It’s because there’s a marketplace (sudoswap) which has been rapidly growing in volume, and they do not honour creator royalties. The conversation has come to us, and it’s important that everyone understands the various forces at play. I’ll try my best to explain as much as I can.

Let me preface everything by saying that creator royalties are one of the cornerstones with which our entire space has been built. This is especially true for artists. We must fight to cement the culture that keeps this going. Keyword here is culture. Royalties are not enforceable at the smart-contract level (we’ll get into this soon). In order for creator royalties to be paid, people have to want to pay them.

Let me also say that there is an incredible amount of nuance involved. Not all creators are created equal. I know it becomes an incredible slippery slope once we start discussing these things, but in my opinion we are already on that slope and it’s naive to ignore it at this point. A 1/1 artist is not the same as a team that releases a 10k pfp project with a roadmap with a high mint price which is also not the same as a project that is VC backed. Whether or not these delineations should impact the market’s decision to pay royalties or not is one thing; the reality is, it’s already impacting the market’s decision.

Okay let’s start with the elephant in the room. A VERY common misconception is that creator royalties are hard-coded into smart contracts, and enforced on-chain every time an item sells, forever. This is simply false. I was gobsmacked when I first learned of this (approx Oct 2021 when having the contracts created for ZenAcademy), and most people I know are too.

“Wait, what?? Isn’t that meant to be the point of all of this??”

Yeah, it kinda is. One of the greatest selling points for artists entering the space is the promise of being able to receive royalties on their creations, forever. Our space’s dirty little secret is that this isn’t done on-chain (for the most part). It’s done at the marketplace level. If you sell something on OpenSea, then OS receives the royalty, and will send it out to you. They have to honour the royalty. We are dependent on third-party, often centralized entities to execute the royalty payments.

It’s also largely been dependent on the creators setting up their creator profiles on the MPs and setting their royalty %. If they neglect to set it up, they’re just not gonna receive royalties. Over the last year there have been some big steps forward in this area to try and introduce an on-chain element to all of this (ie EIP-2891), with imo the most notable being what manifold.xyz is doing with the Royalty Registry.

The cliff notes is that rather than requiring creators to go to every individual marketplace and set their royalties, they can include it at the smart contract level and then the marketplaces can then look for that and automatically set + honour it on their end. It introduces a standard that has been adopted by most of the major marketplaces, and is a tremendous step forward.

The crux of the matter though is that the marketplaces still have to agree to honour it. It’s not enforceable if someone decides to OTC (over the counter) trade their token with someone without the use of a marketplace, and it’s also not enforceable if a marketplace were to come along and go “you know what, screw that, let’s just not pay our creator royalties”. The latter is exactly what sudoswap.xyz decided to do.

You’d think they’d face tremendous public backlash and nobody would want to use the MP right? Well yes and no. They have certainly faced backlash, but never underestimate the greed of some, and the aggressiveness with which people will chase profits and hunt down a financial edge. This is exacerbated 100x when you include the ability to transact anonymously.

For comparison, OpenSea, LooksRare and x2y2 did approximately 8,000 ETH, 2,100 ETH and 1,000 ETH respectively over the last 24hrs (wash trading has been excluded):

So sudoswap is still capturing a relatively small amount of the total market volume for NFTs, but the concerning part is the trajectory it appears to be on.

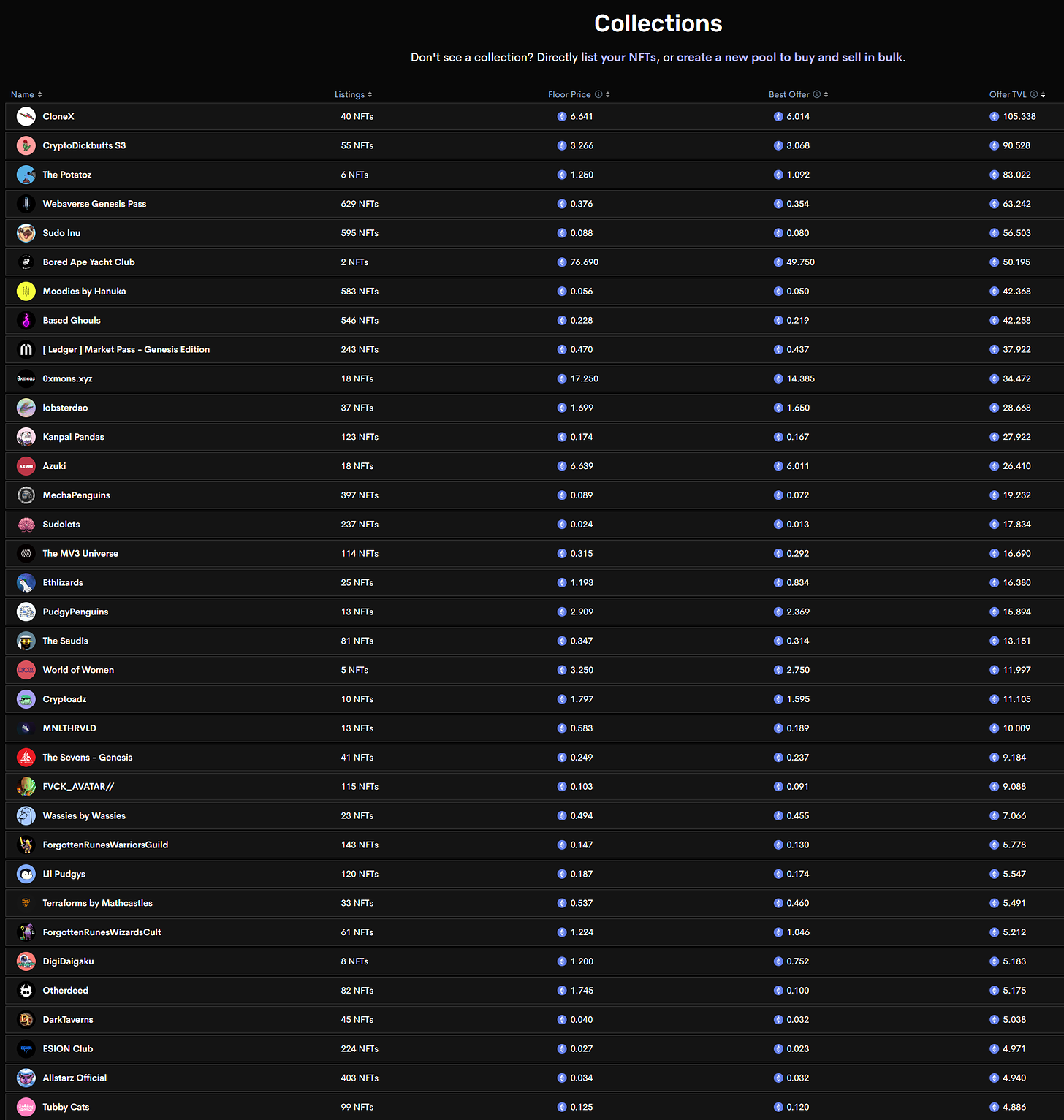

Let’s take a look at the types of collections people are trading on sudoswap:

Remember at the beginning when I spoke about the difference between 1/1 art and larger collections? Basically all of the trading activity (so far) appears to be done on large collections, either PFP projects and/or membership projects. It of course is an incredibly murky area because, for the most part, you had artists who worked to create the artwork for these collections. Some of which are 1/1 artists in their own right (Gremplin with Cryptoadz and FVCKRENDER with FVCK_AVATAR// particularly stand out).

Why are these the collections people are trading on sudoswap? It’s hard to say exactly but one thing I am confident of is that there is a correlation between the size of the collection, and the likelihood of finding traders willing to circumvent creator royalties. I’ll give an example shortly, but this brings up another important point:

The difference between collectors and traders/investors. Yes many people are both, but many also would consider themselves to be purely here to make money and trade NFTs and have zero interest in collecting or supporting artists/creators. It kinda sucks, but it’s the truth. Ignoring it won’t make this reality go away. These people exist, and they are part of the market, and they make up a significant amount of the trading volume for larger collections.

For these people, they will go where the fees are lowest. They will trade high frequency, look for arbitrage opportunities, and enter/exit projects and positions to maximize profit. This gives sudoswap a competitive edge over other marketplaces who honour royalties. We as a community can boycott sudoswap, we can say we hate it, we can refuse to transact there — but, it only takes a few people to buck the trend and all of a sudden there’s a market on there for a collection. When you have a collection size of 10,000 with several thousand unique owners, many of whom, when we’re being honest, are just trying to make money, it’s not hard to see this happening.

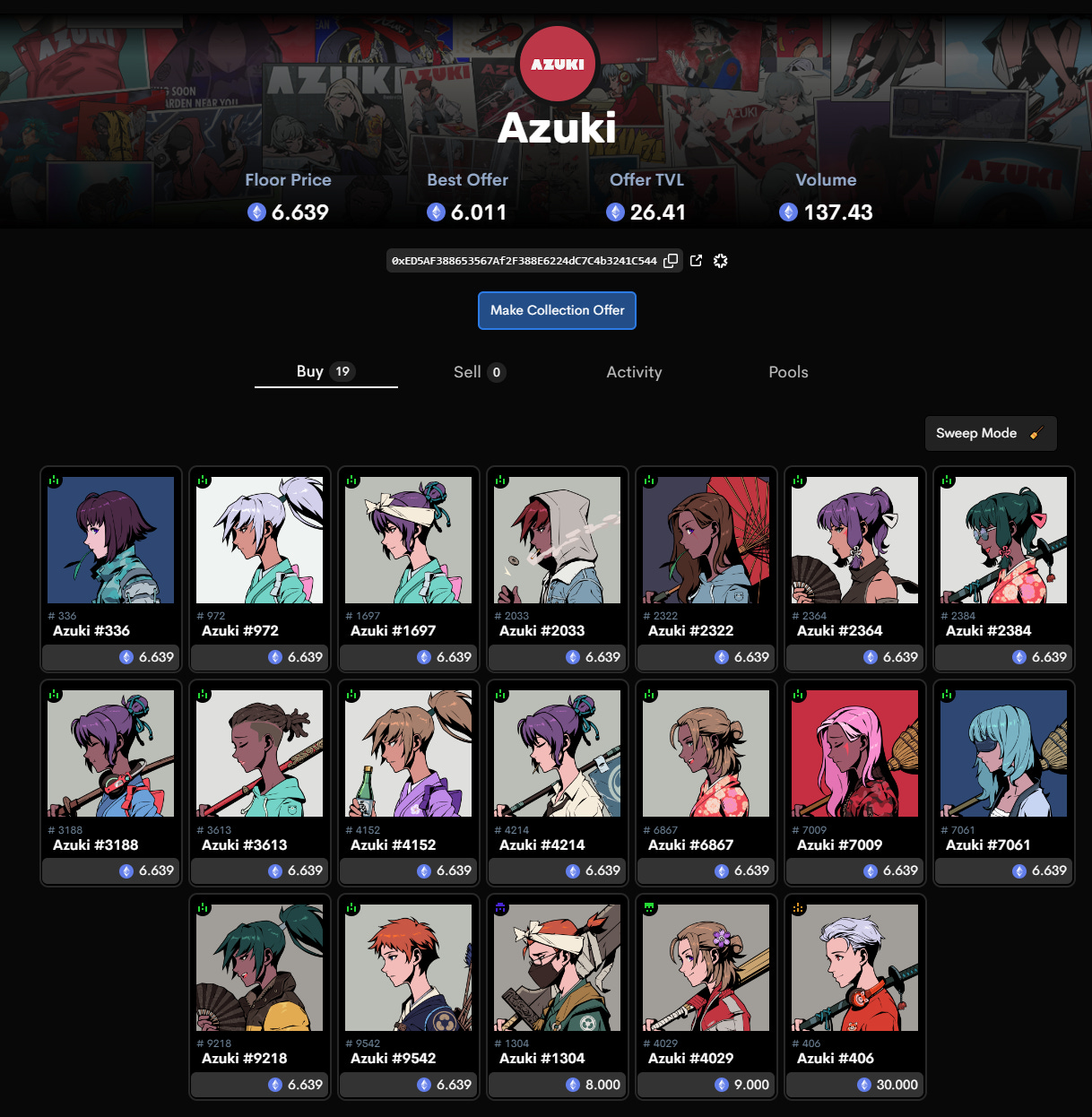

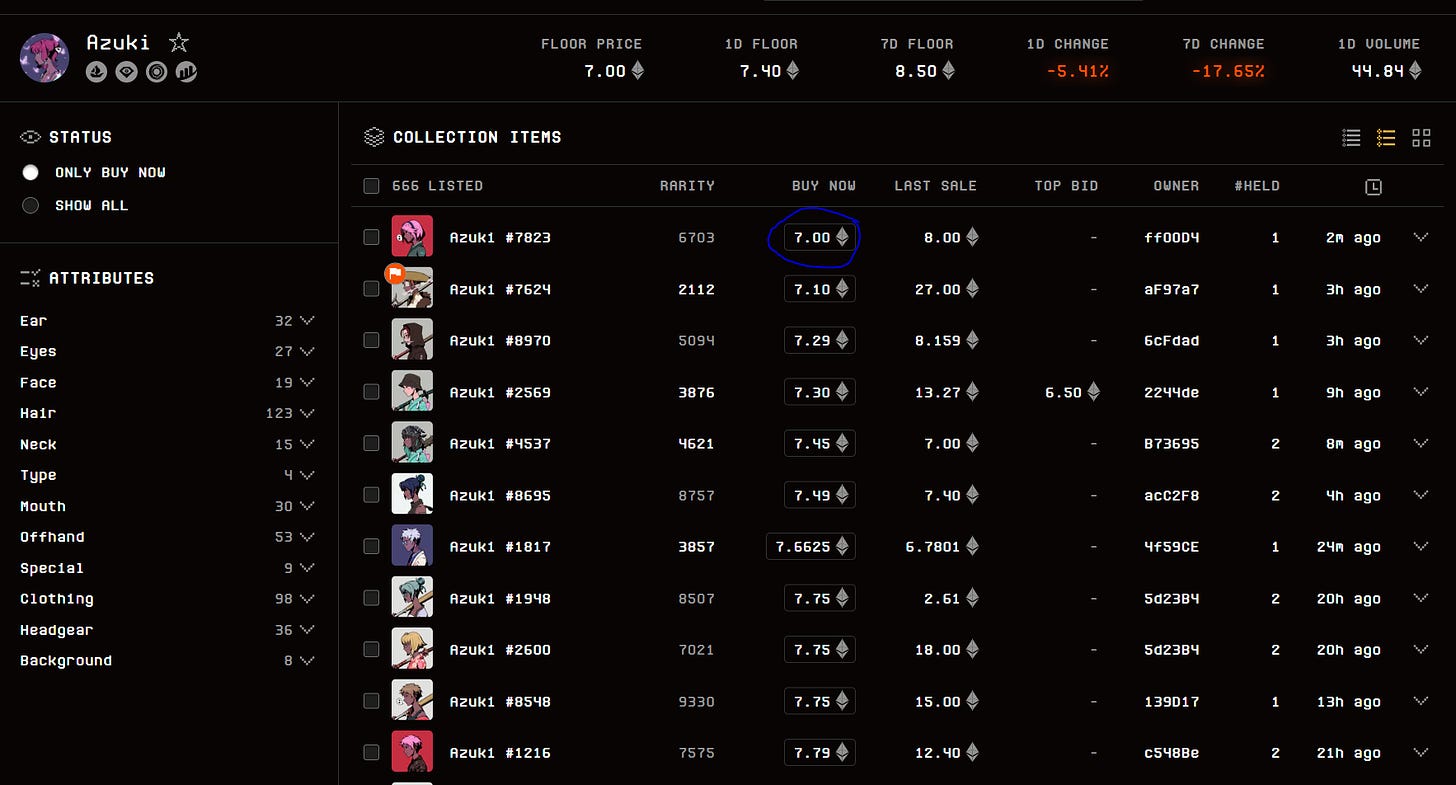

Here’s an example. Right now, if I wanted to buy an Azuki, the lowest price across OpenSea, LooksRare and x2y2 is 7 ETH, and there is exactly one choice at that price.

Or, I could go to sudoswap, and choose between 16 different Azukis and pay 6.639 ETH for it, or a 5.16% discount. As a buyer, who only cares about profit, this seems like a no brainer, right?

What about for the seller? In this instance, they listed on OpenSea. They’re going to pay 7.5% in fees (2.5% OS + 5% creator), so for selling their Azuki at 7 ETH they’re going to take home 7 – 0.525 = 6.475 ETH.

Compare this to selling on sudoswap which has a 0.5% fee total, where they’re taking home 6.639 – .0332 = 6.606 ETH.

The seller gets to list at a significantly lower price, and still earns more.

Had they listed for 7 ETH on x2y2, it works out to being slightly beneficial for the seller; but that’s without considering the incentive for a buyer being much more likely to buy at the lower price point.

All of this should highlight that there is a significant spread involved and when you can eliminate the creator royalty of 2.5-10%, the financial incentive for a trader to transact on a marketplace without the fee becomes tremendous.

We can yell till we’re blue in the face and plead with “the market” to please not use sudoswap, but, there’s already significant activity on there and I truly don’t think this is going to slow down. Traders are ruthless. Anonymous traders, and bots, are even more cut throat.

There is another enormous issue here with respect to the transferring of stolen assets. I don’t actually know if or how sudoswap deals with items that have been reported stolen, but it’s something to be mindful of an a reason to be especially careful if buying on there.

This is where the difference between collector and trader comes into play, as well as the difference in collection size. Beeple summed it up pretty succinctly earlier today:

By and large, we as a community, have decided that we WANT to honour royalties for creators. I believe this is especially true for 1/1 artists, but also generative artists and individual creators not part of a massive team. Most collectors buying NFT art are beyond willing to support the artist and pay royalties. We WANT to. There have been countless number of OTC trades of high-value assets that occur where even though the deal happens without the use of a marketplace, the seller will reach out to the artist and send them their royalty payment. Happens all the time with art blocks, for instance.

This is a cultural thing. This is a social contract. We, the collectors of NFTs, choose to pay our royalties. We choose to use marketplaces that support them. We must continue to advocate for creator royalties, and to pay artists, or we’re failing at one of the most beautiful things about web3.

I believe we can keep this ethos and culture from now until the end of time. I really do. It’s so strongly ingrained in our community that it’s basically a non-starter for people to even consider not honouring royalties for artists. I read a wonderful analogy on Twitter today drawing a parallel between royalties and tipping culture in the US:

Tipping is not mandatory, it is not enforceable by law. It is however, a social law. The vast majority of people will tip at least a nominal/standard amount (I think 15-20% is the norm these days). Yes, there will always be a small minority that opt out and for the most part they are socially shunned, and it always remains a small minority.

We need to continue to uphold the culture of paying royalties to artists in web3. I think it’s doable when it comes to art, and collectors, and small(er) collections. I’m not convinced it is when it comes to these large 10k roadmap collections being run as for-profit businesses.

I’m using “10k” to mean generally large collections, could be 4k, 8k, 15k, 50k, 250k. They’re different because, at least today, the vast majority of people buying, holding, selling, and trading these collections, are doing so for monetary gain and not to collect or support the creator(s).

Whether or not that should be the case is a little beside the point for now, and whether it’ll be the case in the future is also a separate issue. The reality is, right now, when a 10k collection mints out, a significant percentage of those minting are looking to flip and trade in the short-medium term and maximize profit.

Of that significant percentage, a non-insignificant amount of people won’t care to honour the social contract and culture of royalties. This means there will always be some level of demand within these collections to transact on marketplaces that do not honour creator royalties.

Again, it kinda sucks, but let’s not stick our heads in the sand and pretend reality is a rosy utopia and that by asking nicely we’ll get the cut-throat anon traders of the world to pay their dues.

This whole thing also highlights a massive issue with the entire model of creator royalties for these larger collections, especially those with roadmaps. It is in their best financial interest to increase secondary market activity. High volume = more profits. The incentive alignments are bonkers tbh.

Why do you think all these projects have “delayed reveal” periods? Occasionally it’s to get the artwork in order, or for a non-nefarious reason. Most of the time it’s to build hype and generate secondary market activity. People speculate and there’s a lot of trading while the market discovers a “pre-reveal” price. Then the reveal happens, and there’s a flurry of further activity as the price (usually) tanks and the market discovers a “post-reveal” price. Collectors collect, traders trade, speculators speculate, gamblers gamble, all the while the collection loves it and takes a cut on every trade.

It’s also good for a project if they announce any sort of news to impact their floor price. It matters less whether it goes up or down, and more that there’s activity. Even better is if they can announce something to tank their floor price, then announce something a couple of weeks later to boost it back up. I’m not saying all, or most, or many projects are actively and intentionally doing this — but there is certainly a financial incentive (in the short term) for this to happen.

Go radio silent and keep your community guessing and speculating. Some will give up faith and sell/leave, others will buy in hoping for a big announcement to move the floor price up. The more vague and abstract you can be with your promises, the better. Great for the project, less ideal for the collector/consumer/token holder(s).

Why are projects incentivized to churn their holder base? Shouldn’t incentives be aligned so that holding for the long term is the best outcome for all involved?

I understand there is something nice about a project receiving ongoing royalties to pay for upkeep and to allow them to build things for the benefit of the whole community. I don’t think this is something that should just “go away”, but I just think there’s something kinda flawed in the whole system.

It’s kind of a kick in the guts also for people who are selling out of a project they’ve lost faith, and money in, only to have to pay more royalties. I’m not advocating that anyone should bypass royalties just because they’re taking a loss on a trade, but I would say that people are more likely to be inclined to do so.

When incentives are so out of whack, and when people no longer want to pay royalties… well that’s where we end up with activity on sudoswap. Note again that basically all the activity on there so far is for these larger collections, and not for 1/1 art. The reality is, people want to support artists and pay their royalties. That collective desire is less apparent with respect to these larger collections.

Beeple is worth quoting twice.

It’s impractical to build a collector base from a 10k collection where everyone WANTS to honour the royalties. It just is. I’m sorry. There’ll always be those that will want to circumvent them and ‘cheat the system’. As the collection size increases, the odds increase that there’ll be a cohort of such people.

A great barometer we can follow for this might be XCOPY. I would imagine all of his 1/1 collectors will bend over backwards to honour the royalties on any sale they might make. I feel far less confident that all 4,178 holders of his MAX PAIN AND FRENS collection of which there are 7,469 items would all honour the royalties.

There’s a tremendous amount to think about and unpack, still. I think every existing and future project founder and collection owner needs to be proactively thinking about this. There are a myriad of different ‘solutions’ and ways to better align incentives and I hope we see more exploration and experimentation to see what works and what doesn’t.

The “LarvaLabs Model” is an interesting one. They withheld 10% of the supply (1,000 NFTs) and launched with 0 royalties as a feature of the collection. Over time they sold about 500 of them, and then when they got acquired by Yuga Labs, the remaining 500 were sold as part of that deal. More recently, 8liens adopted the same model. It’s an interesting one.

It does mean that in order to realize capital, you have to sell the tokens in the future. The most common reaction to this is “oh, won’t the team dumping the tokens tank the floor price?” and sure if they go out and list 100 at floor that’s bound to happen. There are much smarter ways to do it though — sell off much more slowly; sell via auction; sell at a 15% discount to floor to people who would add value to your project/ecosystem.

There are still plenty of problems though — what if the price never goes up enough to sell? Well then you might not realize much/any profit. That’s where you might want to consider a higher initial mint price. That’s a problem too though because then we’re misaligning incentives again and giving founders all this up-front money in the hopes they deliver value later… so then what about free mints? Well sure that can work, but now all of a sudden VCs and those with deep pockets have a huge edge b/c they can afford to launch and support a phenomenal project and take no mint proceeds or secondary revenue in lieu of future profits.

It’s a tricky nut to crack.

Another option being floated around is the idea of subscription-based NFTs. Sell tokens that give “access” or “utility” for a month, a year, 3 years. These work a bit better for SAAS projects and membership clubs, they’re not as clean for PFPs that are going down the IP route.

Vitalik seems to think Harberger taxes are good:

of course the gigabrain was thinking about this a year+ ago and posted about it on reddit. The tl;dr of Harberger taxes is that similar to property tax, you pay a monthly/yearly “fee” to keep your token. If you don’t pay, you lose it. It has it’s own host of problems and issues and seems entirely unfeasible for a lot of type of projects.

It’s yet another potential tool in the toolkit for founders though.

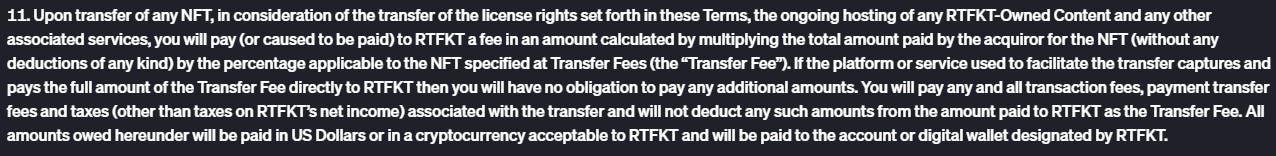

There’s the web2 corporate RTFKT model where they state in their T&Cs that you must pay royalties:

It got a lot of backlash at the time. Now, though, I wonder if sentiment has shifted and people are thinking “hmm maybe it’s not so bad to have people legally agree to pay royalties?”

IIRC Murakami had something baked in their T&Cs that said under certain circumstances, they could “brick” the artwork and make the token point to a blank page or something. Not very decentralized, but there are centralized options for sure where you can try and implement a registry to track royalty payments and “cancel” tokens that don’t adhere to them. Extremely impractical and unfeasible though IMO.

We’re seeing more and more projects pop up with their own marketplaces. If you can create a marketplace that offers a better service and experience than a standard MP or aggregator, that’s one way to have people using it. Perhaps there are incentive structures you can bake in.

Another interesting idea is royalties that change over time. How about a royalty % that reduces the longer someone holds an asset? Or reduces the higher the floor price goes up? There’s so much room for experimentation.

At the end of the day, there’s no one-size-fits-all.

The absolute, very best thing you can do as a creator, when it comes to royalties, is to make people want to pay royalties.

Why might people want to pay royalties? To support creators. To support founders and their vision and roadmap. To keep up the culture and ethos of finding a new and better model than the traditional web2, web1, web0 models of the past.

Tell your friends to pay their royalties. Tell your friends to support artists and creators. Whether individual artist, or 10k collection, we should encourage honouring royalties.

As a project founder, please, please, please, think about alternative revenue models for your business. It just seems extremely irresponsible to me at this point to rely solely on secondary market royalties forever. Even if you can ensure that 100% of token sales take place in a way that royalties are sent back to you, there are still going to be long NFT winters and bear markets where volume will be terribly low for a terribly long amount of time and things will get terribly stressful if your only revenue source is secondary market sales (or hoping to drop another collection).

I mean, I am not a dev, but if this was possible, it would probably have been done by now. The reality is that you simply cannot, without other significant drawbacks, hard-code a royalty into a smart contract. I hope people way smarter than me come up with a really creative and innovative solution to solve this issue at the smart contract level, but I am pretty sure it hasn’t been figured out yet, aside from the hamburger tax version.

Hopefully someone Cunningham’s Laws me here, though i’m not optimistic.

I have barely scratched the surface on this topic. Mostly I shared some facts and raised a bunch of topics and points without any real solutions. I hope that anyone reading this will think more deeply about the space and relationship we have between creators, royalties, collectors, traders, speculators, and teams.

It’s also worth thinking about different royalty and incentive structures for 1/1 artists. I went through the entire post with the presumption that the status quo is the best we can do. It’s great, but perhaps there’s room for even more innovation. Are artists currently best incentivized and rewarded for creating? Should royalties be paid in perpetuity, or is 100 years more reasonable? Is the “standard” of 10% for artists “good enough”, or the best for all? Would 20% be better?

Should it make a difference if an artist releases 1 piece a year vs 1500 a year?

Food for thought.

This topic for debate is one that will be on-going for a long time. I hope we continue to move forward, not backwards. We have the tools to create a better world. It’ll never be perfect, but let’s at least make sure it’s better than everything else that has come before.

This Artwork Is Always On Sale (an example of the Harberger tax)

EIP-2891: NFT Royalty Standard

Great video by Giancarlo on Sudoswap + Royalties

An interesting thread on NFT market liquidity

Old Reddit Post by Vitalik on the topic

Minimum 10% Royalties – Letter to Platforms

Thank you for reading — If you enjoy my writing, please consider subscribing below.

This is an entirely free Newsletter. If you’d like to support me or join my community of like minded individuals focused on learning and building in this space, you can buy a ZenAcademy NFT and join us in Discord. If you can’t afford or justify the expense, anyone can join for free too and get a slightly limited level of access. We welcome all 🙂

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. I’m not a financial adviser. These are only my own opinions and ideas. You should always consult with a professional/licensed financial adviser before trading or investing in any cryptocurrency related product.